Farm Progress' Joshua Baethge reported at the end of last week that "it’s hard to find anyone optimistic about passing a new farm bill this year. While the two political…

2018 Farm Bill

Background: Spending Allocation Reminder- Nutrition (SNAP) Dominates

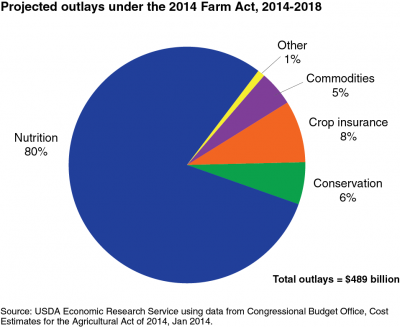

The U.S. Department of Agriculture’s Economic Research Service (ERS) has noted that, “The Agricultural Act of 2014 (2014 Farm Bill) is made up of 12 titles governing a wide range of food- and agriculture-related policy areas. The Congressional Budget Office (CBO) projected that the total cost of the new Farm Bill would be $489 billion over 5 years (2014-2018). Nutrition programs account for about 80 percent of this total, with projected outlays for crop insurance, conservation, and commodities representing another 19 percent.”

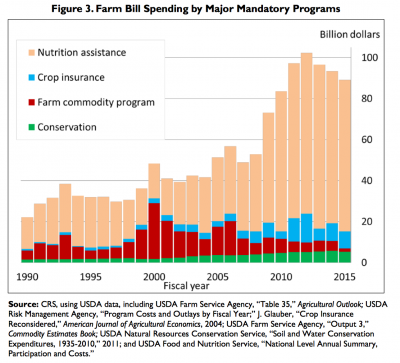

And a recent Congressional Research Report (CRS) (“What is the Farm Bill?“) pointed out that the rate of growth for nutrition and crop insurance has been on the rise, while the rate of commodity program spending has decreased:

Projected five-year SNAP outlays rose at an annualized rate of 13% per year from enactment of the 2008 farm bill to the 2014 farm bill…[P]rojected five-year crop insurance outlays rose at an annualized rate of 11% per year from 2008 to 2014—nearly the same rate as SNAP, though smaller in dollars…[P]rojected five-year farm commodity program outlays fell at an annualized rate of 9.1% per year between the 2008 and 2014 farm bills.

Meanwhile, a House Ag Committee news release from December 7th stated that, “Today, House Agriculture Committee Chairman K. Michael Conaway (R-TX) unveiled a new report summarizing the committee’s two-year review of the Supplemental Nutrition Assistance Program (SNAP). Committee members heard from 60 witnesses in 16 hearings over the course of the review known as the Past, Present, and Future of SNAP. The report can be viewed here.”

The report noted that, “Even now, with a 4.6 percent unemployment rate (compared to a 9.6 percent unemployment rate for 2010), there were still 43.4 million SNAP participants as of July 2016. Because of the magnitude of the program, the House Committee on Agriculture devoted significant time and effort to educating Members on how SNAP works, who it serves, and what can be done to make it more effective.”

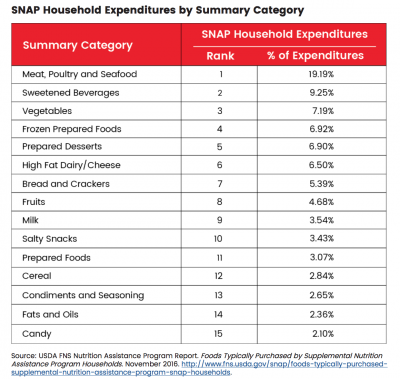

The report also included this chart depicting SNAP household expenditures:

Annie Gasparro provided some context on the House SNAP report in an article posted at The Wall Street Journal Online on December 7th, where she explained that: “The House committee’s 60-page report this week is designed to guide conversation of the sweeping 2018 Farm Bill that will oversee policy and spending in the agricultural and food sectors.”

AP writer Mary Clare Jalonick reported on December 7th that, “Food stamp policy is included in a wide-ranging farm bill every five years; the next one is due in 2018. It also could be part of a larger effort headed by House Speaker Paul Ryan, R-Wis., to tackle a welfare or entitlement overhaul, if that should happen in the next Congress.”

The AP article pointed out that, “On [SNAP] block grants, Conaway said it’s not off the table, but not a priority.”

In a statement on the House Ag Committee SNAP report on December 8th, Agriculture Secretary Tom Vilsack noted that, “Proposals to convert SNAP into a block grant are misguided and would mean the program could no longer respond to economic conditions and serve all eligible Americans without drastically reducing benefits.”

Chairman Conaway also tweeted about the SNAP report on December 7th:

#SNAP serves a wide-ranging demographic, and the program must be adaptable enough to meet the needs of each unique recipient.

— House Ag Committee (@HouseAgNews) December 7, 2016

It is essential all policy options promote better access to food and do not make it harder for people to feed their families. #SNAP

— House Ag Committee (@HouseAgNews) December 7, 2016

Farm Bill: farmdoc Analysis, SNAP

A farmdoc daily update from November 11th by Jonathan Coppess, Gary Schnitkey, Nick Paulson, and Carl Zulauf (“Early Thoughts: 2016 Election Results and the Next Farm Bill“) explained that, “Farm bills did not play any notable role in the presidential campaign discussions, so there is little from that process to inform the discussion. There were two indicators on farm bill matters but they directly conflict. The Republican Party platform explicitly focused on the Supplemental Nutrition Assistance Program (SNAP), stating that its policy would be to restore work requirements to the program and ‘to correct a mistake made when the Food Stamp program was first created in 1964, separate the administration of SNAP from the Department of Agriculture.’ A representative of President-elect Trump’s campaign, however, indicated in a forum held by the Farm Foundation that SNAP should remain a part of the farm bill.

“The position of the Republican Congress indicates stronger alignment with the Republican platform but a possible divide between the House and the Senate. For example, Speaker Paul Ryan repeatedly argued for a specific policy agenda throughout the campaign and it also emphasized work requirements for SNAP. During the previous effort, moreover, the House was the scene of a very bitter partisan debate over SNAP that resulted in the farm bill’s initial defeat on the House floor. Much of that controversy involved work requirements and splitting SNAP from the rest of the bill.”

The farmdoc update added that, “The 2014 Farm Bill debate in the Senate did not feature a similarly disruptive fight over SNAP, but it was also controlled by Democrats at the time. Institutionally, the Senate tends to be far more consensus driven and Senators typically answer to a broader constituent base. Senior Republican Senators such as Chairman Pat Roberts and Thad Cochran have a long history with the farm program-food stamp/SNAP coalition, as well as its importance in their states and for the farm bill itself. Much of their position and influence, however, may be determined by the process for the farm bill. Specifically, whether it is considered through regular order or is included in a budget reconciliation effort.”

Farm Bill: Beyond SNAP- Commodities, Cotton, Dairy, Grains

Jerry Lackey reported at the San Angelo (Tex.) Standard-Times Online back on September 12 that, “Mary Kay Thatcher, senior director of congressional relations with AFBF, said some changes need to be made in the 2018 farm bill compared to the 2014 bill.

“‘We’ve heard from our cotton producers and our dairy folks, that they don’t think the new programs that were put into effect are working for them,’ she said. ‘There is fairly low participation in both programs and most folks feeling again like they just don’t provide an adequate safety net.’

“‘The cotton part of the 2014 farm bill hasn’t worked and will require an overhaul when the House Agriculture Committee begins writing a new farm bill for 2018,’ said congressman Mike Conaway of Midland, who represents San Angelo, parts of the Big Country and the South Plains.”

The article added that, “‘Cotton will have to be dramatically different because it just didn’t work,’ [Conaway] said. ‘The STAX program without a reference price — it just didn’t work — and cotton is in a world of hurt.'”

More specifically on dairy provisions in the Farm Bill, House Ag Committee Ranking Member Collin Peterson (D., Minn.) indicated in his E-newsletter on December 2nd that, “I met Thursday with Jim Mullhern, CEO of the National Milk Producers Federation (NMPF) to discuss necessary changes to the farm bill’s dairy Margin Protection Program. NMPF is working through their economic policy committee to explore changes and improvements to the current program. They are hopeful, as am I, that we can move forward with the Farm Bill next year to help dairy producers around the county. I look forward to hearing what ideas come out of their committee work early next year.”

Meanwhile, in their policy recommendations for 2017, both the Wisconsin Farm Bureau and the Michigan Farm Bureau suggested changes to the dairy Margin Protection Program.

And with respect to grain producers, Bradley D. Lubben, of the University of Nebraska, indicated in the November 30th edition of “Cornhusker Economics” that, “While total farm program payments in Nebraska exceeded $600 million per year for the 2014 and 2015 crops and are expected to still be large for the 2016 crop, they are also projected to fall to less than $200 million for the 2018 crop as ARC payments all but disappear.”

Farm Bill: Ag Economy, Sour

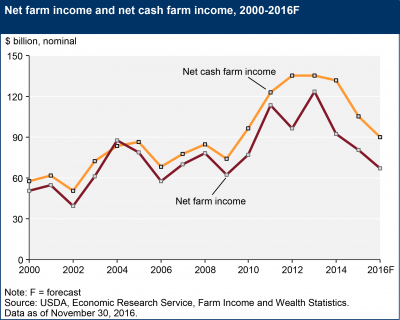

Regarding the state of the U.S. agricultural economy, and the general tone and environment of the financial conditions that will undergird the Farm Bill debate in Congress, Jane Wells provided this succinct recap in a report on December 5th at CNBC Online:

“Farming usually moves in boom and bust cycles, but everything right now is close to busting. The USDA predicts farm incomes will fall 17 percent this year. Corn prices are below break-even levels, while soybeans are doing better. ‘Wheat is terrible, there’s no profit in it,’ said [farmer and grain futures trader Jerry Gulke of The Gulke Group].”

Additional Resources: Farm Bill

An eight minute overview of the Budget Issues for the upcoming Farm Bill debate; a video featuring Mary Kay Thatcher of the American Farm Bureau Federation.

Ms. Thatcher explained that crop insurance represents about 42% of the budget for programs impacting farmers and ranchers- a fact that makes crop insurance a high priority for cuts for Farm Bill critics.