As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

U.S. Contests China Ag Trade Policies at W.T.O.

Background

Recall that back in September, Reuters writers David Lawder and Nathaniel Taplin reported that, “The United States on [September 13th] launched a challenge to China’s price supports for domestic wheat, corn and rice at the World Trade Organization, charging that these far exceed limits that China committed to when it joined the WTO in 2001.”

The Reuters article explained that, “The first step in its formal WTO complaint is to seek formal consultations with Chinese officials to try to resolve the dispute without litigation.”

Bloomberg writer Jeff Wilson reported at the time that:

China’s Ministry of Commerce responded by expressing regret at the U.S. action, saying on its website that it complied with WTO rules and would handle the complaint in accordance with established procedures.

And Christopher Doering noted at The Des Moines Register Online on September 13th that, “Agriculture Secretary Tom Vilsack said U.S. agricultural exports to China now exceed $20 billion a year, but the total could be more if American grains could compete ‘on a level playing field.’ China is expected to be the largest market for U.S. agricultural exports in fiscal year 2017, he said.”

Tom Vilsack: China Is Our Number One Customer - Bloomberg https://t.co/2XiZpze3ms

— Farm Policy (@FarmPolicy) September 17, 2016

Wheat Farmers Most to Gain- Chinese Corn Reform Began in March

Also in September, Reuters writers Karl Plume and Tom Polansek pointed out that, “U.S. wheat farmers, struggling to make money as prices sink and global supplies swell, could be the main beneficiaries if Washington wins a case it brought last week against China over an estimated $100 billion in domestic grain market supports.”

Plume and Polansek explained that:

While the U.S. allegations cover corn and rice as well as wheat, China has already reformed its corn policy and rice exports were never a major part of U.S. agricultural income.

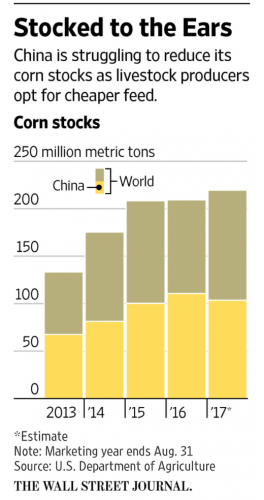

In addition, Wall Street Journal writer Lucy Craymer reported on October 6th that, “The government this spring scrapped a minimum-price support program for corn started in 2007-08. That program, in which the government bought corn to keep prices above a certain level, had proved so popular that farmers grew more. The stockpile soared, doubling in size between 2009 and now.”

Also on October 6th, The Wall Street Journal editorial board noted that, “Beijing got smart in March and switched to a policy of ‘market-oriented purchase and subsidy.’ The market will set the price of corn, and farmers will receive cash payments based on acreage. The price of corn could fall another 30% to the global level.”

The opinion item added that, “The best way to make Chinese agriculture efficient is to expose it to international competition. Next on the chopping block should be wheat and rice support prices that the U.S. claims cost nearly $100 billion more than World Trade Organization rules allow.”

Julie Ingwersen provided this brief perspective on U.S. wheat variables in a Reuters article on September 19th that, “U.S. farmers are poised to plant winter wheat on the smallest area in over a century this autumn, as tumbling global prices and fierce competition push the world’s former top supplier into retreat.”

The Reuters article noted that, “Farmers in Oklahoma, the No. 2 winter wheat producing state, face potential losses of roughly $55 an acre for wheat in 2017, according to Kim Anderson, an agricultural economist at Oklahoma State University.”

Current Developments- New W.T.O. Case Against China

With this background in mind, Wall Street Journal writer William Mauldin reported on December 15th that, “The Obama administration announced a new challenge over Beijing’s barriers to American rice, wheat and corn, attacking a policy that U.S. officials say prevented as much of $3.5 billion in agriculture shipments to China.

“U.S. trade lawyers accused China Thursday of improperly administering a program designed to put limits on grain imports to the country, violating international agreements.”

The Journal article indicated that, “In the new case, the U.S. says Beijing appears to be operating its complicated import barriers known as tariff-rate quotas, or TRQs, in ways that disadvantage U.S. growers through lack of transparency and unreasonable implementation.”

Mr. Mauldin pointed out that, “U.S. exports of wheat, rice and corn to China last year fell to $381 million, compared with $2.3 billion in 2013, according to the Census Bureau. By comparison, soybean exports to China, used to fatten Chinese hogs, were worth $10.5 billion last year.”

And DTN Ag Policy Editor Chris Clayton explained on December 15th that, “As with any actions with the World Trade Organization, both disputes with China will be turned over to the incoming presidential administration to defend and argue at the WTO.”

Associated Press writer Kevin Freking provided this context of the action on December 15th:

The complaint comes at a sensitive time in U.S.-China relations. President-elect Donald Trump, a critic of China’s trade practices, angered Chinese leaders when he spoke by phone to Taiwan’s president and later suggested he may reconsider U.S. policy maintaining only unofficial relations with the island, which broke from China in 1949.”

Rod Bain of USDA Radio provided a one-minute recap of both WTO cases on December 15th.