Bloomberg's Clarice Couto reported this past Friday that "a surprising tax change in agriculture powerhouse Brazil has the potential to make soy grown in the world’s largest bean exporter less…

China Trade, Export Focus as Commodity Prices Pressured

China Trade Policy Shift?

Shawn Donnan and Sam Fleming reported last week at The Financial Times Online that, “Robert Lighthizer, the lawyer [President-elect Donald Trump] picked for US trade representative, has for years likened free-trade advocates to political naifs. He will join Peter Navarro, another outspoken China hawk set to lead a new National Trade Council, and Wilbur Ross, the billionaire investor and the president-elect’s pick for commerce secretary, in a triumvirate chosen to deliver on Mr Trump’s campaign promise of an ‘America First’ trade policy.”

The FT article added that, “In 2010 testimony to a congressional commission Mr Lighthizer called for the US to adopt a ‘significantly more aggressive approach [to China] than we have followed thus far.’ Among his suggestions was a vigorous challenge to China’s alleged currency manipulation, something Mr Trump has repeatedly griped about.”

In last week’s article, Donna and Fleming also pointed out that, “But Mr Lighthizer’s views are echoed by Mr Navarro, the economist and author of Death by China, named to head Mr Trump’s new National Trade Council.

And that is why many fear that Mr Trump could set off a trade war with China. ‘I think the biggest risk is conflict with China that spins out of control,’ says [Robert Zoellick, the former World Bank president and US trade representative].

Agricultural Groups Stress Importance of Trade

DTN Ag Policy Editor Chris Clayton reported on Friday at the DTN Ag Policy Blog that, “Sixteen major farm groups sent a letter Friday to President-elect Donald Trump and Vice President-elect Mike Pence stressing the importance of agricultural trade to farmers.

“The farm groups seemed to be flashing a little light toward agricultural priorities as the president-elect has yet to choose an Agriculture secretary and Trump’s incoming trade team is loaded with people emphasizing trade battles with China.”

Mr. Clayton noted that the ag groups stated that:

The importance of trade to America’s farmers and ranchers cannot be overstated.

And the DTN update added that, “USDA data on exports released Friday showed ag exports for fiscal-year 2016 (Oct. 1, 2015-Sept. 30, 2016) accounted for $129.7 billion in exports with imports pegged at $113.1 billion and a positive trade balance of $16.6 billion.”

Interesting look at the change in the trade balance for U.S. agriculture over the last couple of years, @USDA_ERS pic.twitter.com/PbBGPbYwXK

— Farm Policy (@FarmPolicy) January 7, 2017

China and U.S. Agricultural Exports- Lower Commodity Prices Heighten Concern

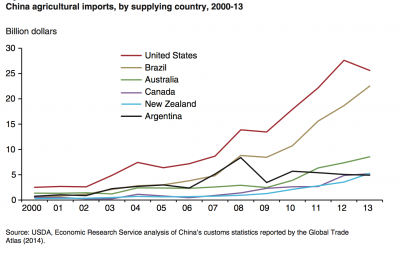

A recent report from the U.S. Department of Agriculture’s Economic Research Service (ERS) explained that, “China’s agricultural imports have risen dramatically in recent years, and the United States has become the leading supplier of these imports.”

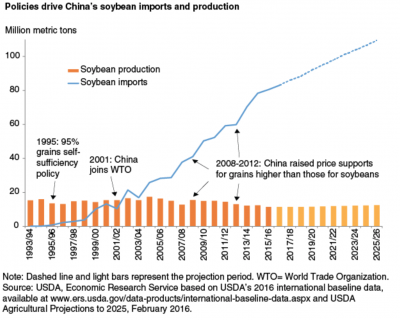

And an Amber Waves (USDA-ERS) article from May pointed out that, “As China’s policies favoring grain production remain and its feed and livestock industries develop further, the countrie’s high soybean demand is projected to continue. Although China’s soybean import growth rate will be slower than it was 10 years ago, it is projected to remain strong in absolute terms over the next decade by increasing from 83 million tons in 2016/17 to 109.5 million tons in 2025/26. Its global soybean import market share is projected to expand from 63 to 68 percent over the same period.”

As robust U.S. agricultural production for corn and soybeans over the past three years has driven commodity prices and farm income lower, farmers are uneasy about policy variables that could potentially limit exports, particularly to China.

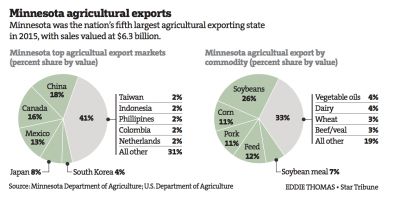

Tom Meersman reported on the front page of the business section in the January 1st edition of the Minneapolis Star Tribune that, “Keith Schrader, who grows corn and soybeans near Northfield [Minn.], said demand is coming from Asian countries with a growing middle class that is eating more meat. The grain is purchased mainly for animal feed, he said, especially for poultry and pork.

“‘Our biggest problem is we’ve had three really good crops in a row nationwide, so we’ve just had this huge increase in supply,’ said Schrader, who also chairs the Minnesota Soybean Research & Promotion Council. On the negative side, that has kept prices low, he said. But plentiful grain at bargain prices has also fueled export sales.”

The Star Tribune article indicated that, “Schrader said farm credit will be an upcoming issue for many farmers in 2017, and he expects some of them will need to restructure their debt. He’s also concerned by President-elect Donald Trump’s campaign promises to do away with trade deals or renegotiate trade agreements.”

The New Year’s Day article also pointed out that, “Ed Usset, grain marketing specialist at the University of Minnesota Extension, said there’s reason to be concerned.

“‘We have a lot at stake in the world of trade,’ he said.

‘If we want to get in a trade war over politics or whatever, the American farmer is going to learn quickly that they’re at the front lines of this battle, and they’ll take the first hit.’

The Star Tribune article added that, “Mike Steenhoek, executive director of the Soy Transportation Coalition, said that the Asian markets for U.S. grain, especially soybean meal for poultry and pork production, will only grow larger and stronger in the future.”