As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Dallas Fed Ag Credit Survey, “Concern” Noted

Earlier this week, the Federal Reserve Bank of Dallas released the results of its 2016 Fourth Quarter Agricultural Credit Survey.

The report noted that:

Bankers responding to the fourth-quarter survey continued to report concern for producers’ financial positions and profitability due to low commodity prices.

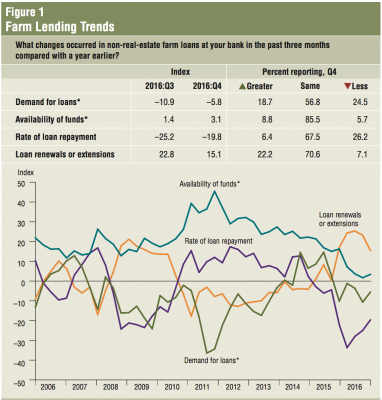

More specifically, the Fed report stated that, “Loan renewals and extensions continued to increase, albeit at a slower pace, as loan repayment rates declined for the second year in a row. Overall, the volume of non-real-estate farm loans was lower than a year ago. Operating loan volume increased year over year, while all other loan categories’ volumes fell (Figure 1).”

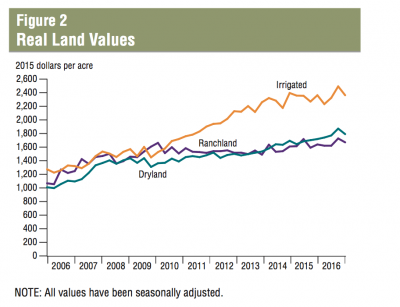

With respect to land values, the Dallas Fed pointed out that, “Real district land values decreased this quarter (Figure 2). Real irrigated land values fell 5.2 percent from last quarter. Real dryland values declined 4.3 percent, while real ranchland values were down 3.3 percent.”

Last week’s Fed report added that, “The anticipated trend in farmland values index was negative for a sixth consecutive quarter, suggesting respondents expect farmland values to trend down in the coming months.”

Selected comments in the credit survey from agricultural bankers in the Dallas Federal Reserve District included the following:

- “Farmers are still feeling the effects of low commodity prices, which are hurting loan repayment.”

- “2017 is anticipated to be another challenging year as most crop and livestock budgets are prepared with anticipation of negative cash flows.”

- “Cattle prices are killing our farmers.”