As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Lower Food Prices Benefit Consumers, Complicate Farmer’s Ledger

Los Angeles Times writer Geoffrey Mohan reported on the front page of the business section on Friday, December 30th that, “For food shoppers, 2016 was a back-to-the-future experience, with retail prices deflating for the first time since Lyndon Johnson was president.

“The year is expected to end with an annual drop of between 0.5% and 1.5% in the retail price of food prepared at home, according to the U.S. Department of Agriculture’s Economic Research Service.”

But Mr. Hohan added that:

That might be reason enough for consumers to cheer, but deflation after several years of flat price growth has complicated the ledgers of growers and grocers alike.

The article explained that, “The annual value of U.S. agricultural sector production is expected to fall 5.9%, to $403.7 billion in 2016, almost entirely due to declines in the value of animals and animal products, according to the U.S. Department of Agriculture [Click here for complete details].

“Net farm income, meanwhile, should post an annual decline of 17.2% from 2015, after a nearly 13% decline from 2014, according to the USDA.

“Analysts mostly blame a strong U.S. dollar, which dampened exports and made imported goods cheaper. U.S. agricultural exports are expected to decline by $1 billion to about $139 billion, while imports are projected to post a $7-billion gain to a record $123 billion, according to the USDA.”

The article noted that, “Depressed exports proved to be a double whammy — more U.S. products wound up in the domestic market, which was flooded at the same time with cheaper imports, said Annemarie Kuhns, an economist with the USDA’s Economic Research Service.”

Meanwhile, Purdue University agricultural economist Ken Foster indicated recently (“Purdue Agricultural Economics Report, 2017 Agricultural Outlook“) that, “It was less than a decade ago that many were expressing dire food security concerns as food prices rose strongly on demand from biofuel production and food demand in other parts of the world. Farmers and other participants in the food and agricultural industry responded with increased supply and now, after several good grain harvests in the U.S, agricultural commodity prices have fallen dramatically. Thus, the most important reason for lower grocery store prices this year are lower farm prices. Abundant harvests over the past three years have reduced the prices farmers receive.

In addition, lower prices for feed items like corn and soybean meal have increased animal production and lowered animal product prices from beef to milk.

In the same Purdue University outlook report, agricultural economist and farmdoc team member Chris Hurt pointed out that, “In the last three years, U.S. production has outpaced usage for corn, soybeans, and wheat. This means that end of year inventory levels have steadily increased. In fact, the stocks-to-use percentage for wheat is expected to be at the highest level in 30 years. Corn and soybean stocks- to-use percentages are the highest in a decade.

“Abundant inventories of grains and soybeans mean low prices. Wheat prices for the 2016 crop are expected to be at $3.70 per bushel, the lowest level since the 2005 crop. Corn and soybean prices for the 2016 crop are expected to be at the lowest level since the 2006 crops. All three are reflecting decade-low prices. Unfortunately, costs of production have not nearly dropped back to the levels they were a decade ago, so margins for the 2016 crops will be narrow or even negative for many producers.”

farmdoc team member Chris Hurt from @PurdueAgEcon provides a brief overview for 2017 grain prices https://t.co/kh3kAlbYUZ

— Farm Policy (@FarmPolicy) January 4, 2017

And the lower prices are having a negative impact on the balance sheet and financial condition of some farm operations.

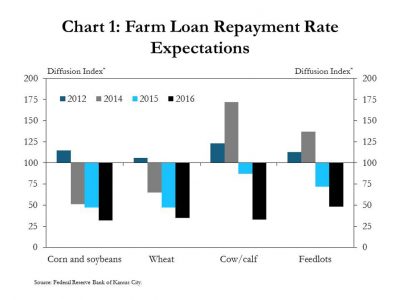

A report late last month from the Federal Reserve Bank of Kansas City stated that, “Declining repayment rates and lower farmland values have contributed to a weak financial outlook in the farm sector. In the Tenth District, the overall rate of loan repayment has declined since mid-2013. Furthermore, repayment rates on farm loans have declined in each major industry in the District’s agricultural economy.”

A fundamental goal of U.S. farm policy is affordable, abundant food for our citizens. As the Farm Bill debate unfolds, lawmakers will have to consider how to achieve success in this goal while maintaining the financial well being of America’s farmers and ranchers.