Bloomberg's Clarice Couto reported this past Friday that "a surprising tax change in agriculture powerhouse Brazil has the potential to make soy grown in the world’s largest bean exporter less…

Trump Talks NAFTA Renegotiation; Tariff Issues a Separate Concern- China, North America Key to U.S. Ag Trade

Executive Branch Perspective and Action

Bloomberg writer Shannon Pettypiece reported late last week that, “President-elect Donald Trump won’t wait for Congress to confirm trade officials to act on his promises to withdraw from the Trans-Pacific Partnership trade deal and give notice he will renegotiate NAFTA, press secretary Sean Spicer said.”

Movement on this pledge appeared to be confirmed on Friday shortly after Trump was sworn into office. This updated White House webpage stated that, “With tough and fair agreements, international trade can be used to grow our economy, return millions of jobs to America’s shores, and revitalize our nation’s suffering communities.

“This strategy starts by withdrawing from the Trans-Pacific Partnership and making certain that any new trade deals are in the interests of American workers. President Trump is committed to renegotiating NAFTA. If our partners refuse a renegotiation that gives American workers a fair deal, then the President will give notice of the United States’ intent to withdraw from NAFTA.”

And CNN reported on Sunday that, “President Donald Trump said Sunday he will begin renegotiating the North American Free Trade Agreement when he meets with the leaders of Canada and Mexico.”

The CNN article added that, “At a White House event Sunday, Trump said he had scheduled meetings with Canadian Prime Minister Justin Trudeau and Mexican President Enrique Peña Nieto.

“We’re going to start some negotiations having to do with NAFTA,’ Trump said.

In a related article, Bloomberg writer Josh Wingrove reported on Sunday that, “Donald Trump won’t be there, but the new U.S. president will factor in to nearly every discussion as Canadian Prime Minister Justin Trudeau’s cabinet meets ahead of the start of new continental trade talks.

“Trudeau, Foreign Minister Chrystia Freeland and other top Liberal lawmakers convene in Calgary for talks beginning Monday to figure out how to limit losses from any renegotiation of the North American Free Trade Agreement. The Trump administration intends to act quickly on resetting its relationship with its neighbors in Canada and Mexico.”

Beyond trade agreements, and more specifically with respect to tariffs, Wall Street Journal writers William Mauldin and Ben Leubsdorf reported last week that, “A top Trump trade adviser [Wilbur Ross, Mr. Trump’s pick for commerce secretary], on Wednesday [at a Senate Commerce Committee nomination hearing] emphasized tougher enforcement of existing rules as a way to confront China and other countries, reassuring some lawmakers worried by President-elect Donald Trump’s talk of broad tariffs on U.S. imports.”

The Journal article explained that, “The billionaire private-equity investor didn’t threaten the unilateral, pre-emptive tariffs on U.S. imports from China and Mexico that Mr. Trump repeatedly warned of during the election.”

“Mr. Ross didn’t rule out the use of broad tariffs, but focused his testimony on the rapid processing of cases against foreign companies accused of benefiting from subsidies or dumping products on the U.S. market below their fair value.”

Don Lee reported in last week’s Los Angeles Times that, “Asked about Trump’s repeated threats to impose a 45% tariff on Chinese goods and 35% on Mexican products, Ross responded that it’s a ‘complicated issue.’ And of tariffs more generally, he said that they ‘play a role both as a negotiating tool and if necessary to punish the countries that don’t play by the rules.'”

President Trump’s nominee for U.S. trade representative, Robert Lighthizer has not participated in a Senate confirmation hearing yet. Peter Navarro, who has been tapped to head the administrations new National Trade Council, and has been described as “an ardent skeptic of trade with China,” does not have to be confirmed by the Senate. A column by Forbes contributor Charles Tiefer last month noted:

What does it mean to put Peter Navarro in charge of a White House council…It [c]reates a base for China policy that is not, like the Pentagon, CIA, or State, subject to Senate confirmation or regular Congressional oversight.

Agricultural Implications

University of Illinois agricultural economist Kathy Baylis indicated last month at the farmdoc daily blog (“A Quick Primer on US Agricultural Trade“) that, “Potential trade disputes with China and Mexico are of particular concern in agriculture, given that they involve our largest (China) and third largest (Mexico) export markets. Canada comes in as a close second. These are also the markets where we’ve seen the most growth:

The largest expansion in exports over the past 25 years have been to China, followed by North America.

“And this growth is expected to continue. Our exports to both China and Mexico are predicted to increase in FY 2017, with exports to China expected grow to $21.8 billion from $21.5 billion and exports to Mexico expected to increase to $18.3 from $18 billion.”

Top 3 mrkts for US ag exports: are China, Canada, Mexico, in that order. Together account for 47% of total US ag exports in FY2016, CRS pic.twitter.com/0VW5aTbBMD

— Farm Policy (@FarmPolicy) January 18, 2017

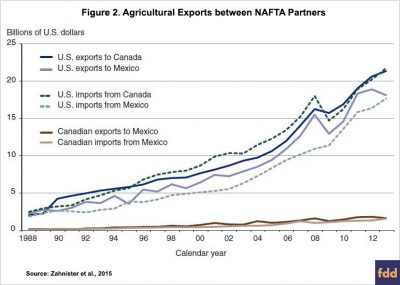

Dr. Baylis added that, “As illustrated in figure 2, the USDA ERS estimates massive growth in agricultural trade under NAFTA, growing from $16.7 billion in 1993 to $82 billion in 2013. Taking inflation into account, this increase amounts to a growth of 233 percent over those 20 years.”

More specifically, this month’s Livestock, Dairy, and Poultry Outlook from USDA’s Economic Research Service (ERS) pointed out that pork exports to Mexico, a leading destination for U.S. pork exports, increased by nearly 23 percent from November 2015 to November 2016.

Lower prices are expected to drive US pork exports to 5.44 billion pounds in '17, 4% greater than '16- https://t.co/tmvlGoN4bY #Trump #NAFTA pic.twitter.com/OrJT0lQWfS

— Farm Policy (@FarmPolicy) January 19, 2017

The same ERS report stated that beef exports to Mexico were 8 percent higher over the past year.

US beef exports were 11% above year-earlier levels, exports to Mexico were 8% higher https://t.co/5PCxF83rL7 -@USDA_ERS pic.twitter.com/LfLSb38cty

— Farm Policy (@FarmPolicy) January 19, 2017

Retaliation Issues- Ag Trade Promotion

The Associated Press reported on January 18th that, “China is preparing to retaliate if U.S. President-elect Donald Trump raises duties on Chinese goods and already has toughened its stance, an American business group said Wednesday.”

The AP article noted that, “Already, China has ordered unusually high anti-dumping penalties against a U.S.-made agricultural chemical;” and added that, “On Jan. 11, the Ministry of Commerce raised duties on DGGS, an additive for livestock feed, to up to 53.7 percent, nearly double the 33.8 percent rate it recommended in September before Trump was elected.”

“Officials have not said publicly that China is preparing retaliatory measures but state media have emphasized its importance as a market for U.S. soybeans and other exports and warned against starting a ‘trade war,'” the AP article said.

Meanwhile, Wall Street Journal writers Jacob Bunge, Jesse Newman and Kelsey Gee reported late last week that, “Donald Trump’s pick to run the U.S. Department of Agriculture, Sonny Perdue, is a Georgia farm boy with a record of promoting U.S. meat and crops overseas…”

The Journal article stated that, “Farmers are hoping Mr. Perdue will continue the efforts of his predecessor at the USDA, former Iowa Gov. Tom Vilsack, to keep U.S. grain, produce, meat and cotton flowing to foreign markets when the U.S. farm economy is suffering through a multiyear downturn. They also are hoping Mr. Perdue will shield U.S. agricultural exports from any potential fallout as Mr. Trump looks to renegotiate existing trade deals and strike new ones.”