A new 10% tariff on goods from around the world took effect Tuesday — with a list of exemptions including beef. Other exemptions affecting the food and agriculture industries include…

U.S. Out of TPP- Ag Export Opportunities Potentially Lost

Financial Times writers Demetri Sevastopulo, Shawn Donnan and Courtney Weaver reported yesterday that, “President Donald Trump signalled he will put trade protectionism at the heart of his economic policy, withdrawing the US from a historic Pacific trade pact [the Trans-Pacific Partnership (TPP)] and threatening to punish American companies for moving production overseas on his first working day in office.”

The FT article noted that, “Advocates of TPP have insisted the pact is as much a geostrategic agreement as a trade deal, binding together the US with its closest Asian allies in an economic bloc that encircles a rising China, which has refused to participate in the deal and has been promoting its own regional trade arrangements.”

Wall Street Journal writer William Mauldin tempered the abrupt executive branch action by reminding readers that, “In one respect, Mr. Trump’s action was symbolic, because congressional leaders and the Obama administration had signaled after the November election that there was no path forward for the TPP.”

As a reminder, there are eleven other countries that participated in the TPP negotiations, six of these countries already have some form of trade agreement with the U.S., either bilaterally or through the North American Free Trade Agreement (NAFTA):

– Australia – Singapore

– Chile – Canada

– Peru – Mexico

(Recall that Canada and Mexico are currently two of three largest destinations for U.S. agricultural exports).

In his Journal article, Mr. Maudlin pointed out that:

Burying the TPP doesn’t mean U.S. exporters can’t access markets in the other countries.

“Washington already has bilateral trade agreements with Australia, Chile, Peru and Singapore, plus preferred access to Canada and Mexico through [NAFTA]. The others are members of the World Trade Organization, which mandates specific tariffs and quotas for all members.”

The TPP agreement would have brought enhanced market access to the following five countries:

– Japan – New Zealand

– Vietnam – Brunei

– Malaysia

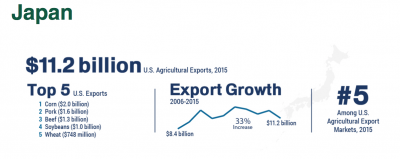

A Fact Sheet from USDA’s Foreign Agricultural Service (FAS) in May explained that, “Japan, Vietnam, Malaysia, New Zealand, and Brunei have a combined population estimated at nearly 257 million.

In 2015, these five countries accounted for 11 percent ($16.7 billion) of all U.S. agricultural and related product exports.

“The inclusion of Japan’s $4.7 trillion economy in the TPP agreement is of particular importance since Japan is already the United States’ fourth-largest agricultural export market despite substantial market access barriers.”

The FAS Fact Sheet pointed out that, “If the United States fails to implement the TPP agreement, it will likely lose market share to its competitors. Australia, Chile, Mexico, Vietnam and other countries already have preferential market access with Japan through their existing bilateral trade agreements. Additionally, the European Union is negotiating free trade agreements with many of the TPP countries.”

Meanwhile, a report from USDA’s Economic Research Service (ERS) (“Agriculture in the Trans-Pacific Partnership,” Oct. 2014) stated that, “This report assesses the potential impacts of eliminating all agricultural and nonagricultural tariffs and tariff-rate quotas (TRQs) under a TPP agreement on the region’s agriculture in 2025—the assumed end date of the pact’s implementation—compared with baseline values for 2025 without a TPP.”

The ERS report indicated that, “Cutting tariffs is only one of the many goals of the TPP negotiations, but it is an important one for agricultural trade. The value of intraregional agricultural trade in 2025 under a tariff- free, TRQ-free scenario is estimated to be 6 percent, or about $8.5 billion higher (in 2007 U.S. dollars) compared with baseline values. U.S. agricultural exports to the region will be 5 percent, or about $3 billion higher, and U.S. agricultural imports from the region in 2025 will be 2 percent, or $1 billion higher in value compared with the baseline.”

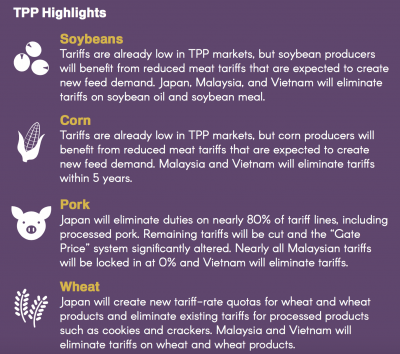

More specifically for Illinois agriculture and TPP, an update from USDA’s FAS provided the following highlights for soybeans, corn, pork and wheat:

An update yesterday from ERS pointed out that not all “rural” counties in the U.S. are necessarily “farming-dependent” counties. The potential impacts of trade policies may not apply universally to all counties in the same way.

ERS noted that, “[T]rends in agricultural prices have a disproportionate impact in farming-dependent counties, which accounted for nearly 20 percent of all rural counties and 6 percent of the rural population in 2015.”

“Meanwhile, the decline in manufacturing employment has particularly affected manufacturing-dependent counties, which accounted for about 18 percent of rural counties and 23 percent of the rural population,” the ERS update said.

At a time when farm sector profitability is forecast to decline for the third year in a row, and when changes to U.S. farm policies will be made in the 2018 Farm Bill, this is a particularly unsettling time for many producers who rely on increasing export demand to maintain market prices for agricultural commodities.

Todd Gleason highlighted some of the sentiment in a twitter post from yesterday:

LISTEN - Executive Order to Withdraw from TPP & Farmer Reaction https://t.co/mS5Pg2CHi4 on #SoundCloud

— Todd E. Gleason (@commodityweek) January 23, 2017

Wall Street Journal writers Jesse Newman and Jacob Bunge reported yesterday that, “Farm groups expressed dismay on Monday at President Donald Trump’s withdrawal from a Pacific trade agreement they were counting on to sell a glut of American agricultural products in new markets.”

The Journal article pointed out that, “Farm groups estimated the 12-nation Trans-Pacific Partnership would have added $4.4 billion annually to the U.S. agricultural sector, offering some relief to farmers during a multiyear slump in crop prices and farm profits.”

“Richard Guebert, Jr., president of the Illinois Farm Bureau, called Mr. Trump’s decision ‘another setback to an already struggling economy.'”