USDA is asking farmers and other stakeholders to help examine how USDA can improve its data collection and analysis. The department is issuing a Request for Information (RFI) to examine…

USDA Crop Surveys- Falling Response Rates from Producers

An update posted yesterday at the farmdoc daily blog by USDA Chief Economist Robert Johansson, Anne Effland of USDA’s Economic Research Service, and Mississippi State University agricultural economist Keith Coble, explored issues associated with response rates from USDA’s National Agricultural Statistics Service (NASS) surveys, and examined the impact of response rates on county yield estimates for an important new farm program–the ARC-CO program.

Background

The authors noted that, “[NASS] conducts a series of surveys throughout the year to assess farmer planting decisions and production conditions. Among other things, those surveys use farmer responses to estimate crop acreage and yields and provide early information on likely production outcomes for various crops in the current crop year. Those estimates underlie USDA and private analysis that affect markets throughout the year. The public benefits of those surveys are notable, and the literature on those benefits was recently reviewed by the Council on Food, Agricultural and Resource Economics (C-FARE), which highlighted how public information on market prices and quantities helps improve market efficiency.

Producers and other decision makers depend on the objective information and decision support tools that analysts and researchers develop from NASS producer survey data.

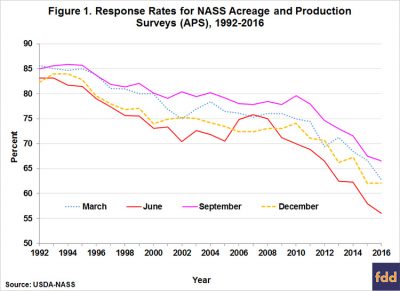

Yesterday’s update stated that, “Response rates on NASS crop acreage and production surveys have been falling in recent decades. From response rates of 80-85 percent in the early 1990s, rates have fallen below 60 percent in some cases.”

“Reduced response rates can potentially introduce bias or error to the estimates released by USDA,” yesterday’s update said, while adding that: “[R]esponse rates become increasingly important for estimates at the state and especially county levels. So while the quality of national and published state estimates is still high, falling response rates have led to decreases in the number of counties for which estimates can be published.”

Farm Bill- County Estimates

Yesterday’s farmdoc daily update explained that, “Since the 2014 Farm Bill, sufficient response rates on NASS surveys for crop planted acres, harvested acres, yield, and production to support county-level estimates can have an even more direct impact on many producers. The 2014 Farm Bill replaced commodity programs that provided direct payments to farmer regardless of adverse conditions with programs that trigger when a safety net is needed to offset revenue declines (e.g., farmdoc daily, February 20, 2014). One of those, the Agricultural Risk Coverage (ARC) program, relies heavily on NASS county yield estimates to determine if the program will provide payments in a given year on a given commodity and, if so, to what extent.

“A majority of producers opted for the ARC-CO program (farmdoc daily, June 16, 2015), which provides farm payments when county crop revenue is less than the ARC-CO guarantee, calculated as 86 percent of the most recent 5-year Olympic average price multiplied by the most recent 5-year Olympic average county yield. While ARC payments have risen as commodity prices have fallen over the past few years, the payments under ARC-CO have not been uniform, by design. Under ARC-CO, the county payment rates per base acre will vary geographically based on the county-level yields in a given year.

An integral part of administering the new program requires knowing what county yields were for covered commodities not only for the payment year, but also for the preceding 5-year period.

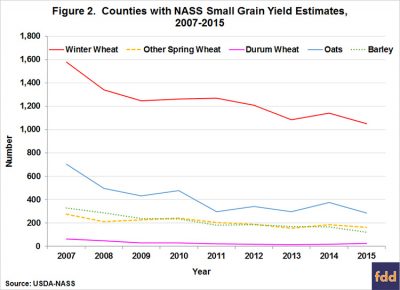

The authors noted that, “Because NASS county yield estimates require sufficient responses to develop a statistically valid estimate, response rates on NASS surveys are getting more attention. NASS must get at least 30 survey responses for a particular crop in a particular county, or it must receive survey responses from at least 3 producers representing a minimum of 25 percent of the county acreage in the particular crop. If those criteria are not met, then NASS will not publish a yield for that crop in that county in order to protect farmer privacy.

“When NASS doesn’t get enough responses to publish an estimate, the Farm Service Agency (FSA) of the USDA must rely on other data to develop yield estimates for implementing the ARC program.”

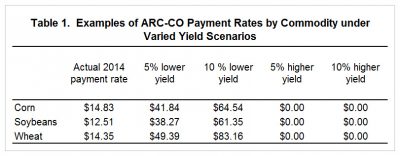

More specifically, the update indicated that, “The yield estimates used to calculate ARC-CO payment rates determine the level of payments producers with base acres will receive for that year. A relatively small change in the yield estimate for a county can have a substantial effect on the payment rate, in part due to the tight range (10 percent) around the revenue guarantee that limits ARC-CO payments.”

See an example below:

“Achieving sufficient survey responses to support NASS yield estimates for as many counties as possible offers the best chance for ensuring that county yield estimates employed in determining ARC-CO payment rates are as accurate and comparable nationwide as possible,” the authors said.

In conclusion, yesterday’s update stated that, “The fact that USDA reports its estimates freely means that both buyers and sellers can have equal information about the supply and demand of a crop. Such information may come directly through USDA’s own reports, but often reaches users through news and information sources that depend on USDA reports to inform their clients and customers. In a market without this free information, large firms might well be able to invest in market intelligence that small firms and farms would not have available. Voluntary participation in surveys that gather such information is essential for USDA continuing its role as an objective unbiased provider of market intelligence and is critical for accuracy in design and implementation of farm policies.”

Meanwhile, Reuters writer Michael Hirtzer reported on yesterday’s update and stated that:

Record-low responses from farmers to surveys threaten the U.S. Department of Agriculture’s status as the gold standard in crop data collection and potentially open up trading advantages to big firms, the agency’s chief economist said on Thursday.

Mr. Hirtzer indicated that, “Ways to combat loss of farmer data could include using information from the USDA’s Risk Management Agency, which manages federal crop insurance policies, as well as remote sensing and weather data.

“Costs for the surveys increase when farmers have to be contacted by phone or in person, sometimes with several attempts, instead of via the internet.

“The USDA is one of the top 10 spenders of federal funds, with a budget of $156 billion in 2016.”