Bloomberg's Leah Nylen reported Thursday that "a Colorado judge issued an order temporarily blocking the proposed $25 billion merger of Kroger Co. and Albertsons Cos., which has been challenged by…

U.S. Farm Income Forecast Released

2017 Farm Sector Income Forecast, USDA-ERS

Jesse Newman reported yesterday at The Wall Street Journal Online that, “U.S. farm incomes will drop 8.7% in 2017, a fourth consecutive year of declines amid a deep slump in prices for many crops.

“The U.S. Department of Agriculture Tuesday said net farm income will drop to $62.3 billion, half of the record $123 billion farmers earned in 2013.

“The forecast highlights a deepening downturn in the U.S. agricultural economy, brought on by four straight years of bumper corn and soybean harvests that have added to record grain supplies globally. U.S. farmers last year harvested the biggest corn and soybean crops ever: 15.2 billion bushels of corn and 4.3 billion bushels of soybeans.”

Yesterday’s ERS report stated that, “The annual value of U.S. agricultural sector production is expected to fall $5.3 billion (1.3) percent in 2017, as declines expected for the value of animals/animal products and especially crops more than offset a predicted increase in other farm-related income (see table on value of production).

If realized, the forecast 2017 value of crop production ($176.8 billion) would represent a decline of $9.2 billion (4.9 percent) from 2016.

More specifically, the report noted that, “Expected weakening of corn prices more than offsets an expected increase in quantity sold, leading 2017 corn cash receipts to fall by almost $0.4 billion (0.8 percent) from 2016. Wheat receipts are expected to decline almost $1.5 billion (16.6 percent) from 2016 as price declines accompany an expected decline in wheat quantities sold…[and]… Higher soybean receipts ($0.4 billion or 1.1 percent) in 2017 reflect higher soybean prices despite a slight decline in quantities sold.” (Data on crop cash receipts can be found here).

With respect to the livestock sector, ERS pointed out that, “Overall, animal/animal product cash receipts are expected to remain stable in 2017, rising $53 million (0.03 percent) in 2017.”

On the issue of federal government financial support, yesterday’s update explained that, “Direct government farm program payments are forecast to decline by 4 percent in 2017 to $12.5 billion (see table on government payments). USDA’s Price Loss Coverage (PLC) and Agricultural Risk Coverage (ARC) programs are collectively expected to account for over two-thirds of all direct government payments in 2017. While Price Loss Coverage (PLC) payments are expected to increase by $1.24 billion in 2017, declines of $0.56 billion are anticipated in ARC as well as the other major programs.”

PLC payments forecast to rise, ARC payments forecast to fall @USDA_ERS #FarmBill pic.twitter.com/Er6Bm6yEy0

— Farm Policy (@FarmPolicy) February 7, 2017

On the cost side of the ledger, ERS stated that, “After reaching record highs exceeding $390 billion in 2014, farm sector production expenses are forecast at $350 billion in 2017. If realized, farm sector expenses would stabilize following 2 consecutive years of declines in 2015 (down $32 billion) and 2016 (forecast down $8.9 billion).”

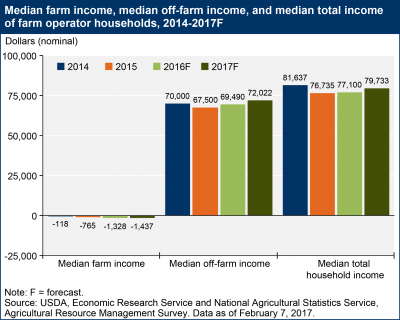

In a broader look at “farm household income,” an issue that was discussed in greater detail here last week, ERS indicated that, “The median income of U.S. farm households increased steadily over 2010-14, reaching an estimated $81,637 in 2014. After dipping in 2015 to $76,735, median household income is forecast to rise over the next 2 years, reaching an expected $79,733 in 2017.”

Looking a bit closer at “off-farm income” by farm size, this ERS data set (“Principal farm operator household finances, by ERS farm typology, 2015”) showed that in 2015, median off farm income for commercial farms (“Farms with $350,000 or more annually in gross cash farm income”) was an important aspect of farm household income, but represented a smaller share than residence (“Gross cash farm income under $350,000, but the operator’s occupation is not farming”) or intermediate farms (“Gross cash farm income under $350,000, operator’s primary occupation is farming”).

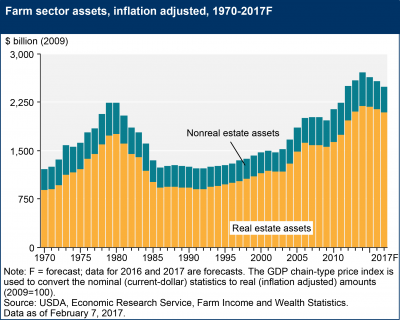

Also yesterday, ERS pointed out that, “The value of farm real estate assets, forecast to be about $2.4 trillion in 2017 (nearly $2.1 trillion in inflation-adjusted terms), accounts for the major part of the value of total farm sector assets—about 84 percent. In 2016 and into 2017, ERS anticipates a slight decline in real estate values. This reflects falling farm profit margins, increased interest rates, and more restrictive debt terms.”

January Ag Economy Barometer

Interestingly, the same day as ERS released it’s 2017 forecast, the Purdue/CME Group Ag Economy Barometer for January was also posted.

A news release associated with the Ag Barometer stated that, “The dramatic improvement in ag producers’ sentiment that started following the November election continued into the new year. The Purdue/CME Group Ag Economy Barometer—based on a monthly survey of 400 agricultural producers from across the U.S.—reached 153 in January 2017, 21 points higher than December’s survey and 61 points higher than in October (Figure 1).

Ag producers’ sentiment in January was not only the most positive recorded in the Ag Economy Barometer’s history, but it was also the biggest month-to-month sentiment change since data collection began in October 2015.

The release added that, “Some of the improvement in producers’ perceptions of current conditions was motivated by improvements in commodity prices. Prices for key commodities, including soybeans, cattle and hogs, were increasing during much of the fall.”

Producer sentiment on the rise while @USDA_ERS says incomes will continue to fall https://t.co/arNqmkGR3y

— Todd Kuethe (@TKuethe) February 7, 2017

The Ag Barometer update also pointed out that, “The improvement in producers’ perceptions of current economic conditions is tempered by the fact that in January a majority (58 percent) of respondents indicated that their farm operations’ financial conditions were worse than a year ago. Although producer responses to this question have improved markedly since August, when 81 percent of respondents felt their farms were in worse financial condition than a year earlier, it still indicates financial conditions have been worsening on most farms.”