Bloomberg's Leah Nylen reported Thursday that "a Colorado judge issued an order temporarily blocking the proposed $25 billion merger of Kroger Co. and Albertsons Cos., which has been challenged by…

Ag Economy: Farmers “Battle for Profits”

Donnelle Eller reported on the front page of Sunday’s Des Moines Register that, “This year could be pivotal for many Iowa farmers, battling to turn a profit as they plant 23.4 million corn and soybean acres across the state.

“Financial pressure is beginning to show.

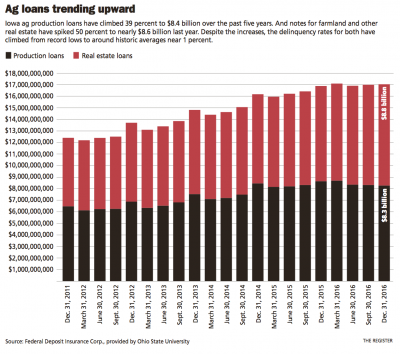

- Iowa farmers are leaning more on debt, with production loans climbing 39 percent to $8.4 billion over the past five years, federal bank data shows.

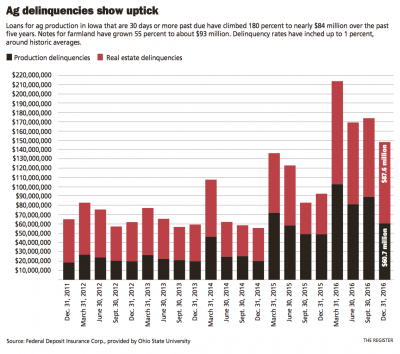

- Loans 30 days or more past due have increased 180 percent to about $84 million since 2011, Federal Deposit Insurance Corp. data shows.

- Even so, the delinquency rate, while pushing higher, remains near 1 percent, based on loan data provided by Ohio State University.

“Delinquency rates are rising from record lows to around historic averages, said Chad Hart, an Iowa State University agricultural economist.”

Sunday’s article explained that:

‘There could be a wave of financial issues still coming in the farm sector as we continue to see low prices and the erosion of the farm financial sheet,’ Hart said.

The Register article pointed out that, “Debt for Iowa farmland and other real estate has climbed 50 percent to $8.6 billion over the past five years, federal commercial bank data shows.

“The amount of delinquent loans also has risen 55 percent to nearly $93 million.

“Still, the delinquency rate for ag real estate has inched only to about 1.1 percent.”

The article added that, “Loans to producers in Iowa, Nebraska, South Dakota and Wyoming grew to $25.2 billion last year, a 6.5 percent increase over 2015 and a nearly 60 percent spike over 2011.

“Farm Credit Services of America’s at-risk loans climbed to $178.7 million last year, more than doubling over three years.”

FrtPg todays @DMRegister Make or break year? Iowa farmers battle for profits as debt, delinquencies rise https://t.co/Tw1mAzbATu; @DonnelleE pic.twitter.com/ZdR0chzCeF

— Farm Policy (@FarmPolicy) May 21, 2017

Ms. Eller also noted that, “Still, Steve Bruere, president of the Peoples Co., a Clive farm brokerage and management business, sees improving conditions.

“In March, none of Peoples Co.’s farm clients was delinquent on rent payments or pushed for last-minute lease renegotiations — far different from 2015.

“And Bruere said land values are stabilizing. Iowa farmland values have fallen about 18 percent to $7,183 an acre from a 2013 record high, according to ISU land surveys.”

The Register article also turned to the importance of trade:

In a year of uncertainties, trade could be the biggest.

“Any bumps in demand for grain and livestock exports would be troublesome for an industry fighting to hang on.

“‘If we have another bumper crop … we could take these markets another step down,’ Hart said. ‘I’m hoping for an average crop, not a great crop.'”

Sunday’s article reminded readers that, “President Trump has threatened tariffs on trade with China, Canada and Mexico, and announced Thursday he will renegotiate the North America Free Trade Agreement with neighbors in Canada and Mexico.

“‘The trade policy uncertainty has the potential to do more harm than good to the ag markets right now,’ Hart said.

“U.S. Ag Secretary Sonny Perdue created an undersecretary position directly overseeing trade. He said in Iowa he expected to have NAFTA renegotiated within six months.”

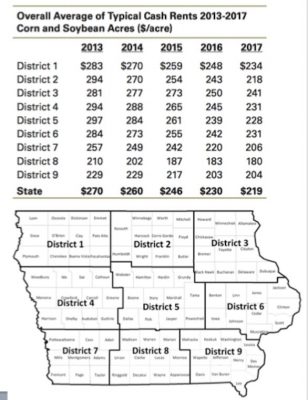

Meanwhile, a recent update from Iowa State University Extension (“Cash Rental Rates for Iowa, 2017 Survey“) indicated that, “The cash rental rate information presented in this publication is from a survey of farmers, landowners, agricultural lenders, and professional farm managers.”

The report also included the following graphs, which pointed to a statewide average of cash rental rates from 2013-2017 on corn and soybean acres.

The statewide average rate has gone down from $270 in 2013, to $219 in 2017.

Looking at at the agricultural economy from a different perspective, Wall Street Journal writer Bob Tita reported late last week that, “Farm-machinery maker Deere raised its profit forecast for the year by 33% on booming demand in South America, an unexpectedly rosy outlook that sent shares in agricultural equipment and supply companies up sharply.

“Cash-flush farmers in Brazil and elsewhere in South America are expected to buy 20% more tractors and harvesting combines after record harvests this year, Deere said, even as industrywide sales are expected to fall 5% in the U.S. and Canada amid a multiyear slump in prices for corn, wheat and soybeans.”

The Journal article noted that, “Deere’s bullish outlook marks a rare bright spot for an industry struggling amid a long downturn in the U.S. farm economy. The Moline, Ill.-based company said it still expects lackluster sales of its green-and-yellow tractors and combines this year in the U.S. and Canada, which accounted for about 70% of its farm-equipment sales last year.

“The slump, driven by years of strong harvests that have produced record global grain stockpiles, is pushing some U.S. farmers to the brink of bankruptcy. That has left them with less cash to buy everything from seeds to combines, weighing on major agriculture-focused firms. Deere’s farm equipment sales fell 36% to $18.5 billion in 2016 from a peak of $29.1 billion in 2013.

‘We’re not seeing significant changes in the outlook for our farmer customers,’ said Tony Huegel, Deere’s director of investor relations. ‘It’s hard to argue today for significant recovery in commodity prices.’

In other news, Stephen Steed reported last week at ArkansasOnline that, “Heavy rains in late April and floods in early May cost farmers $175 million, with rice farmers being hit the hardest, according to the latest estimates by the University of Arkansas System’s Agriculture Division.”

Mr. Steed indicated that, “According to the latest figures, some 977,800 acres of crops in 21 counties were affected by storms and flooding, with 361,650 acres a complete loss. The May 5 estimate put damaged crops at 937,000 acres, also with about two-thirds likely to survive.

“Farmers lost 181,450 acres of rice, the most heavily planted crop at the time the rains began.”

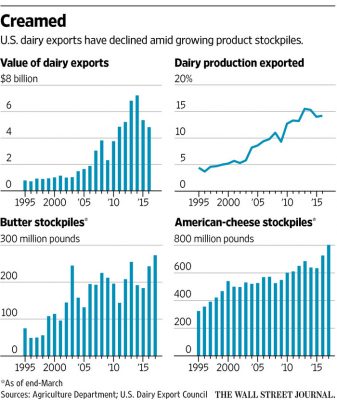

And with respect to the dairy sector, Heather Haddon reported on Saturday at The Wall Street Journal Online that, “U.S. dairy farmers’ big bet on global demand for milk is souring.

“The industry was in trouble long before a trade squabble with Canada last month that reduced demand for ultrafiltered milk, a cheese ingredient. Dairy farmers fear a spat that has jeopardized roughly $150 million in sales for Wisconsin, New York and Minnesota producers is just a prelude to disruptions to come if President Donald Trump renegotiates the North American Free Trade Agreement as promised.”

The Journal article pointed out that, “Dairy farmers aggressively expanded their herds three years ago when milk prices were driven up by growing demand from middle-class consumers in North America, Asia and other markets. By March, there were 9.4 million commercial dairy cows in the U.S., a 20-year high, according to the Agriculture Department.

“But China, Russia, Venezuela and other importers scaled back their dairy purchasing in recent years due to domestic troubles. The European Union, meanwhile, greatly increased its dairy production after lifting 30-year-old quotas in 2015. Then came a world-wide surge in agricultural production that has pushed down prices for grains and meat as well as for dairy.”

Ms. Haddon stated that:

Commodities markets like dairy are prone to booms and busts because of the long lead time to ramp up supply. But the current glut—and the accompanying downswing in exports—may pose one of the biggest challenges yet to the U.S. dairy industry.

“The glut is likely to grow this spring, the most productive time of the year as temperatures rise and days grow longer. An unusually mild winter started this year’s milking season months early at some dairies, further contributing to the milk crush.”

Milk production in the 23 major States during April totaled 17.2 billion pounds, up 2%t from April 2016, @usda_nass pic.twitter.com/EYcivBm8ZQ

— Farm Policy (@FarmPolicy) May 19, 2017

The Journal article also indicated that, “In a recent interview, Agriculture Secretary Sonny Perdue said renegotiating Nafta could improve access to Canada for U.S. farmers. ‘We’re going to try and balance the scorecard in a number of ways,’ he said.

“Tom Vilsack, agriculture secretary during the Obama administration and current president of the U.S. Dairy Export Council, urged the Trump administration to find new foreign buyers for American milk.

“‘To keep pace with those efficiencies in productivity, we have to look for additional markets,’ Mr. Vilsack said.”