Bloomberg's Clarice Couto reported this past Friday that "a surprising tax change in agriculture powerhouse Brazil has the potential to make soy grown in the world’s largest bean exporter less…

Policy Change on U.S. Beef Exports to China- Early Impacts Explored

Recall that last month, trade rules regarding U.S beef exports to China were finalized. The U.S. had not exported beef to China since 2003, and on June 30th, an update from USDA indicated that, “U.S. Secretary of Agriculture Sonny Perdue today joined with U.S. Ambassador to China Terry Branstad to slice a Nebraska prime rib in a Beijing ceremony, formally marking the return of U.S. beef to the Chinese market after a 13-year hiatus.” Today’s update highlights a recent news report describing how this important trade policy change is beginning to impact market participants.

Background

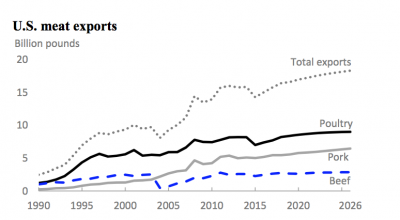

In its 10-year projections released earlier this year, USDA explained that, “U.S. beef exports are expected to grow slowly over the next 10 years. The United States maintains its place as the fourth largest exporter of beef in the world, behind Australia, India, and Brazil. The U.S. share of global exports among the top 11 major exporting regions of the world holds relatively steady, averaging just over 12 percent.”

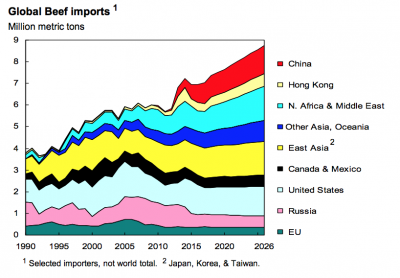

In its projections, USDA added that, “The combined beef imports by China and Hong Kong are projected to increase almost 42 percent in the coming decade to almost 1.9 million tons by 2026 due to rising demand for beef which outpaces production growth. This increase accounts for the largest growth in imports among major beef-importing countries.”

“Imports of grain-fed beef, mainly by higher-income countries, are projected to slowly rise. U.S. beef exports increases by almost 103,000 tons from 1.2 million tons in 2017 to 1.3 million tons by 2026. The United States is the largest exporter of grain fed beef in the world,” the USDA projections said.

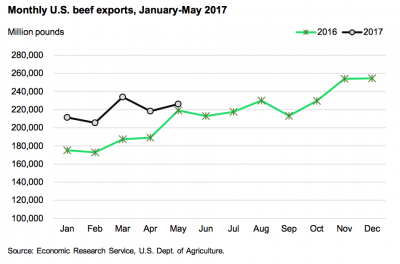

Meanwhile, in its latest Livestock, Dairy, and Poultry Outlook, the USDA’s Economic Research Service (ERS) explained that, “Beef exports during January through May were 16 percent higher than the same period a year ago, totaling 1.1 billion pounds.”

The ERS report added that, “Further, a recently concluded U.S.-China trade deal included reopening the Chinese market to U.S. beef for the first time in almost 14 years. Market access is provided for chilled, frozen, bone-in, and deboned beef, as well as a broad scope of offal products derived from cattle less than 30 months of age.

Although shipments commenced in June, immediate and short-term gains may be constrained given China’s market requirements such as traceability and its zero tolerance at ports of entry for prohibited substances.

“In the longer term, support for U.S. beef exports is likely to come from increased Chinese demand as incomes increase and consumers expand their preferences for a wider variety of meat protein.”

Current Developments: Recent News Article Highlights Policy Impact

Barbara Soderlin reported in yesterday’s Omaha World-Herald that, “The cattle waiting to eat in Terry Beller’s feed yard here one sunny afternoon last week didn’t know it, but they’re a hot commodity.

“Since China reopened its doors to U.S. beef, Beller’s phone has been ringing. Packing plants and exporters are on the hunt for specialty cattle like some of those Beller feeds. Green tags in their ears indicate they’ve been raised without artificial hormones and could qualify for the Chinese market.

“Sorry, Beller tells the callers, but these cattle are already destined for the European Union.”

"In China, interest in U.S. beef is high, but ranchers and feeders need time to build supply," https://t.co/fHbGCXGdUW by @barbarasoderlin pic.twitter.com/Tdyo6LUa8L

— Farm Policy (@FarmPolicy) July 23, 2017

The article noted that, “He’d be willing to source and feed more cattle for China, though, if the price is right. He smiled and rubbed his fingers together: ‘Give me the money,’ he said.

It costs more to raise beef to China’s specifications, and Beller expects a premium price. Feeders like him are looking for an additional $150 to $250 per animal to cover the extra feed, time and paperwork. (That’s about a 10 to 15 percent premium from the typical price a fattened heifer or steer can fetch at auction.)

Ms. Soderlin explained that, “Negotiations like these are part of the scramble that’s on among exporters to ramp up shipments, gain a foothold and build market share in China, now that China has opened the door to U.S. beef with a June 12 trade agreement.

“Beef industry officials caution that the market will be slow to grow, and Beller agreed.”

Nebraska beef producers prepare for sales to China https://t.co/VQW1nAdwXe

— Farm Policy (@FarmPolicy) July 23, 2017

Yesterday’s article stated that, “Greater Omaha Packing, which said it was the first U.S. company to ship beef to China under the new trade deal, has hired two bilingual sales people to handle what its president, Henry Davis, said is an overwhelming number of calls and email inquiries, totaling in the thousands.”

The World-Herald article noted that, “[Davis] said his company has made two to three shipments a week to China since loading its first freight container in mid-June and hasn’t had a problem sourcing enough cattle for those shipments.

“Given the level of demand he’s seeing, Davis said, ‘It’ll ramp up as fast as we want it to.’ People who say the market will grow slowly aren’t thinking big enough, he said.”

“The list of U.S. beef plants approved to export to China has been growing. Half of the 18 locations are in Nebraska, underscoring how much Nebraska stands to gain from the deal as the nation’s top beef exporter and leader in cattle feeding and slaughter,” the World-Herald article said.

With respect to the requirements to export to China, Ms. Soderlin pointed out that, “The rules require cattle to be traceable to the place they were born. The beef exported must come from cattle under 30 months old. And China will test beef for growth promoters, including feed additives and artificial hormones. Beef that is detected to have these elements will be rejected.”

“Cargill estimated that just a small percentage of the current total U.S. beef supply meets China’s standards,” the article said.

Meanwhile, yesterday’s article indicated that, “While ranchers build the supply, the Nebraska Beef Council looks to prime the demand. The group committed $300,000 to the U.S. Meat Export Federation specifically for beef promotions in China. That’s above and beyond the usual amount the Nebraska group spends on foreign marketing, which is more than $600,000 a year, said Ann Marie Bosshamer, executive director of the Nebraska Beef Council. The size of the opportunity called for bigger spending, she said.”

“The U.S. has a growing cattle herd, but Americans aren’t expected to start eating significantly more beef. Chinese people are. [Buck Wehrbein, a Mead cattle feeder who serves on the Beef Council’s board of directors] said expanding the export market will help cattlemen stay in business.”

Cattle in the United States, as of July 1, 2017, totaled 103 million head. This is 4% above the 98.2 million head on July 1, '15, @usda_nass pic.twitter.com/KYCUUq8XA1

— Farm Policy (@FarmPolicy) July 21, 2017

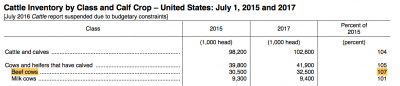

On Friday, USDA’s National Agricultural Statistics Service released its mid-year Cattle report, which stated in part that, “All cattle and calves in the United States, as of July 1, 2017, totaled 103 million head. This is 4 percent above the 98.2 million head on July 1, 2015.”

The report also noted that compared to 2015, there are seven percent more beef cows in the U.S.