Bloomberg's Leah Nylen reported Thursday that "a Colorado judge issued an order temporarily blocking the proposed $25 billion merger of Kroger Co. and Albertsons Cos., which has been challenged by…

FAPRI Baseline Update: A More Nuanced Outlook for Agricultural Markets

Last month, the Food and Agricultural Policy Research Institute (FAPRI) at the University of Missouri released its latest baseline update for U.S. agricultural markets. Recall that in its March baseline report, FAPRI indicated that, “The latest analysis of national and global agricultural trends from the University of Missouri indicates continued financial pressure on United States farm sector.” Today’s post summarizes highlights from the August FAPRI baseline report, which noted that, “the outlook now is more nuanced.”

Check out the August Baseline Update for U.S. Agricultural Markets https://t.co/vimprLtQBp

— FAPRI-MU (@FAPRI_MU) August 30, 2017

The August FAPRI baseline report stated that,

After several years of declining prices for many agricultural commodities, the outlook now is more nuanced.

“Large global supplies continue to weigh on markets for several major crops, but strong demand has provided support to U.S. livestock sector prices.”

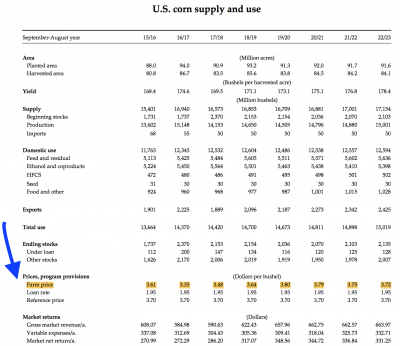

More specifically with respect to commodity prices, FAPRI indicated that, “Reduced U.S. production results in a small increase in corn prices, to $3.48 per bushel for the 2017/18 marketing year. Continued large world grain production and stocks limit the price recovery. Projected prices remain below $3.80 per bushel through 2022/23.”

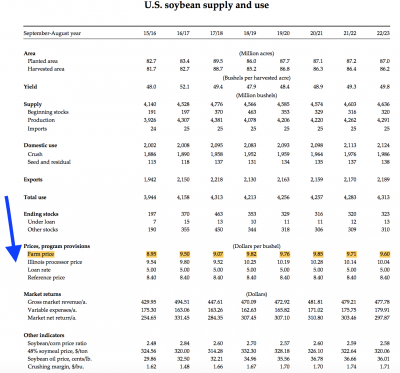

And regarding the outlook for soybeans, FAPRI explained that, “The projected record 2017 U.S. soybean crop puts further downward pressure on soybean prices. Projected prices drop to $9.07 per bushel for the 2017/18 marketing year. The result is lower expected soybean acreage in 2018, which allows a modest increase in prices.”

And in a closer look at wheat variables, the report stated that, “The smaller 2017 U.S. wheat crop contributes to higher wheat prices, but global supplies remain large and projected prices remain below $5.00 per bushel for the next three marketing years.”

Beyond grains and oilseeds, Scott Brown and Daniel Madison, of the MU Agricultural Markets and Policy team, provided additional detail on the livestock, poultry and dairy sectors in a companion report, that was also released late last month.

That report indicated that, “Increased supplies of meat and dairy products have challenged livestock commodity markets throughout 2017, and supply pressure is expected to continue through at least 2019. Consumer demand has held up very well to this point, however, allowing prices for many livestock products to remain near or even above last year’s levels. Feed prices have also remained in check, providing profitability levels for many producers that encourage maintaining if not further increasing production. While this is welcome news for the industry today, it may be setting up a situation in which output prices suffer a severe drop if demand growth is not able to keep pace with further increases in supply.”

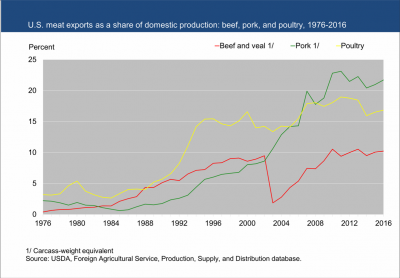

Brown and Madison went on to explain that, “International market developments are providing some optimism, though risks are also evident. While U.S. meat production was nearly 1.3 billion pounds above the year ago level through the first two quarters of 2017, meat net exports grew by 0.8 billion pounds over the same period, absorbing over 60 percent of the production increase.”

However, there is concern that the pace of recent trade gains may not continue as other world exporters increase production growth relative to the last couple of years and trade pact re-negotiations with nations that are important markets for U.S. meat and dairy products take place.”

U.S. Beef Exports: Japan, South Korea and Canada were largest U.S. export markets in July- (#TPP, #Korus) https://t.co/lPQOS2Bgiy @USDA_AMS

— Farm Policy (@FarmPolicy) September 8, 2017

Brown and Madison also pointed out that, “Hog producers continue to increase the size of the U.S. breeding herd as new slaughter capacity is scheduled to begin operation this fall.

Higher sow numbers and continued productivity growth have led to the second highest pork production growth rate since 2008 this year. Pork production is expected to increase by more than three percent again in 2018.

“Pork exports grew by more than 12 percent during the first half of this year, and continued increases will be required to offset some of the additional pork production and keep hog prices from sharper declines. Prices have remained above expectations this year, as bacon demand has depleted pork belly stocks to record low levels and fueled higher pork wholesale prices. Hog prices should receive another boost as additional processing capacity leads to greater demand for live hogs.”

And with respect to dairy, the report stated that, “Despite continued growth in the U.S. dairy cow herd, milk prices have remained above year ago levels for the past eight months.”

“Relatively low feed prices have kept MPP-Dairy margins near or above $9 per cwt. in the last five bi-monthly periods. Dairy Margin Protection Program payments are not expected to be made in coming months, though a return to more historical butter demand levels could quickly change the milk price outlook. Discussions continue regarding possible changes to the dairy safety net for the 2018 Farm Bill.”