Farm Progress' Joshua Baethge reported at the end of last week that "it’s hard to find anyone optimistic about passing a new farm bill this year. While the two political…

Farm Bill: “Technical Adjustments,” and “Tweaks”

Jacqui Fatka reported on Friday at Farm Futures Online that, “House Agriculture Committee Chairman Mike Conaway, R-Texas, said [on October 25th] that the Congressional Budget Office (CBO) has sped up its analysis of farm bill provisions that the committee is considering. He told reporters that the committee is still on track to bring out a bill before the end of the year or early 2018. [Note that an audio replay of Chairman Conaway’s remarks is available here].

“Senate Agriculture Committee Chairman Pat Roberts, R-Kan., and Ranking Member Debbie Stabenow, D-Mich., have expressed a similar desire as Conaway to get a new farm bill across the finish line without the drama that was seen during passage of the last farm bill, which had to be extended more than a year.

However, the reality of getting it passed in 2018 looks less and less likely.

The Farm Futures article noted that, “The House will probably get its bill done early in 2018, said Informa policy analyst Roger Bernard, while the Senate likely will take longer.”

Ms. Fatka also explained that, “A bipartisan Senate proposal intended to address complaints about payment disparities in the Agriculture Risk Coverage (ARC) program was introduced [on October 24th]. The bill is sponsored by Senators Joni Ernst, R-Iowa, and Heidi Heitkamp, D-N.D.

Introduced bipartisan bill w/@SenJoniErnst to strengthen & improve the ARC-CO program, which helps farmers when commodity prices fall pic.twitter.com/oCjqdI6B3m

— Sen. Heidi Heitkamp (@SenatorHeitkamp) October 24, 2017

“It does not make any changes in the formula for ARC revenue guarantees to increase the likelihood of payments, but the legislation would make the changes that many producers have been requesting. According to Senate aids, the bill should not increase the cost of the program.

“The proposed legislation directs USDA to use more widely-available data from the Risk Management Agency as the first choice in yield calculations, calculates safety net payments based on the county where a farm’s is physically located, and provides the FSA state committee discretion to adjust yield data estimates to help reduce variations in yields and payments between neighboring counties.”

The article noted that, “The bill’s introduction was welcomed by eight major commodity groups including the American Farm Bureau Federation, National Farmers Union along with soybean, corn, wheat, sunflower, canola and dry pea and lentil groups.”

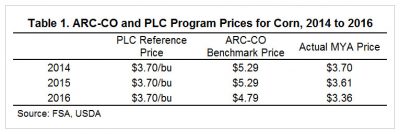

Also on this issue, DTN Ag Policy Editor Chris Clayton reported last week that, “While the bill makes some changes to how yields are plugged into the ARC-County benchmark formula, the proposed changes by the two senators do not address the declining overall revenue protection under ARC-County. Declining market-year average prices over the past four years have eroded ARC-County’s revenue protection. Without changes to the reference prices used to calculate ARC-County payments, corn farmers will largely shift base acres from ARC to Price Loss Coverage [PLC] under the next farm bill, according to a Congressional Budget Office analysis of farm programs.”

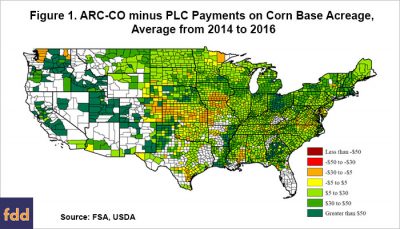

More broadly, with respect to ARC-CO and PLC payments from 2014-2016, a recent farmdoc daily article indicated that, “In general, the majority of corn base acres enrolled in the ARC-CO program would have received a greater level of support from that program when compared to the average payment that would have been received through the PLC program. Exceptions exist in areas where actual county yields have been sufficiently above benchmark yields.” (Click here to read the full farmdoc article and compare payments on multiple charts and county maps.)

Meanwhile, an Omaha World-Herald editorial item yesterday that addressed Farm Bill issues indicated that, “The farm legislation’s prospects will depend, too, on how Congress handles technical adjustments to formulas and other provisions. Those possible changes will be unfamiliar to most nonfarmers but have major ramifications for individual producers and ag sectors.

How Congress handles those technical changes can have a big effect on floor votes and the legislation’s ultimate fate.

“An example is the re-enrollment process for support programs, a technical issue of keen interest to the Midlands ag sector. The Congressional Budget Office predicts that with the new farm bill, most corn and wheat producers will shift from a support program known as Agriculture Risk Coverage, which covers income risk, to Price Loss Coverage, which compensates for price losses.”

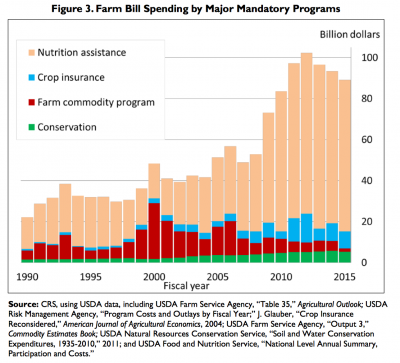

The World-Herald item also noted that, “Congressional disagreement over food stamp funding will be a big factor affecting the farm bill’s fate. The food stamp component accounts for 80 percent of expenditures in the current farm bill — up from 67 percent under the 2008 farm bill — and is a key to winning support from urban lawmakers.

“Conservative GOP lawmakers insist that food stamp expenditures be greatly reduced, repeating a message from 2013, when disagreement over food stamp costs led the House to reject farm bill legislation.”

Separately, Doug Rich reported earlier this month at the High Plains/Midwest Ag Journal Online that, “Economic conditions are much different today as Congress begins to work on the 2018 farm bill than they were in 2014 when the last farm bill was passed. Farm income this year will be about half of what it was in 2014. However, most farmers would be happy if Congress passed a bill that is very similar to the 2014 legislation with just a few changes.

“This was the consensus of many who attended the 2018 Farm Bill Summit held Oct. 18 at the University of Missouri Bradford Research Center in Columbia, Missouri.”

The article quoted Pat Westhoff, director of the Food and Agricultural Policy Research Institute at the University of Missouri, as saying: “Almost everyone wants tweaks to the farm bill somewhere. How we will pay for those tweaks has yet to be determined.”

Five former Ag Secretaries agree: we won't see radical changes in the next #FarmBill, but we must keep food aid programs in the Farm Bill.

— Mike Johanns (@SecJohanns) October 25, 2017

With respect to executive branch perspective on the Farm Bill, Amie Sites reported yesterday at Brownfield that, “The Secretary of Ag says crop insurance remains a top priority for farmers in the 2018 Farm Bill.

“Sonny Perdue says farmers would rather receive a fair price for the crop they produce than rely on a program, but a balanced safety net is necessary.

‘When nature doesn’t cooperate then they can do it again,’ he says. ‘You never get made whole with crop insurance, you never get made whole with a program, but we don’t want it to be a career-ending situation either.’

The Brownfield update added that, “He says a lot of progress was made for crop insurance to mitigate risk in the 2014 Farm Bill, but there will likely be some tweaks made in the upcoming farm bill for cotton and dairy.”