Bloomberg's Clarice Couto reported this past Friday that "a surprising tax change in agriculture powerhouse Brazil has the potential to make soy grown in the world’s largest bean exporter less…

U.S. Agricultural Exports- Data Update from USDA

Last week, the U.S. Department of Agriculture updated its monthly agricultural trade data. Today’s update includes an overview of some observations from the data with a focus on corn, soybeans, wheat and livestock.

Background

A report on Thursday by Gary Crawford of USDA radio indicated that, “The 2017 fiscal year is over, but it takes a month to gather and process all of the agricultural trade numbers. So what we have reported this week is for August, taking us through the first 11 months of the 2017 fiscal year. The [USDA] has been forecasting that for the whole year, the U.S. would export $139 billion worth of ag products.”

In the radio report, USDA trade economist Bryce Cooke stated that, “[The $139 billion forecast] at this point, looks like a pretty reasonable estimation.”

Mr. Crawford pointed out that the U.S. sold $10.2 billion worth of ag products in August.

Latest U.S. Agricultural Trade Data, @USDA_ERS pic.twitter.com/0DYr5vV9DB

— Farm Policy (@FarmPolicy) October 5, 2017

The radio update added that after 11 months, the U.S. had sold $129.9 billion worth of agricultural exports, about 10 percent more than the same time frame from a year ago.

Mr. Crawford added that, “So if October runs as expected, the U.S. would meet that $139 billion mark.”

Dr. Cooke noted that,

This would be the fourth highest export total on record.

And, the radio segment indicated that, “After 11 months, compared to the same frame a year ago, the value of corn exports is up 12 percent, wheat 25 percent, soybeans 17 percent [and] cotton [up] 79 percent.”

"#Corn, #Wheat, #Soybeans and #Cotton Exports Ahead of a Year Ago," https://t.co/OZLLynU9bL (MP3-1 min) Bryce Cooke, @USDA trade economist. pic.twitter.com/JsfIBxiNUe

— Farm Policy (@FarmPolicy) October 6, 2017

Corn, Soybean and Wheat Exports

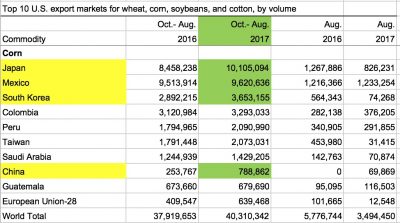

The USDA data also detailed the top ten export (by volume) destinations for U.S. corn, soybeans and wheat.

Japan, Mexico and South Korea topped the list of destinations for U.S. corn exports, while China was eighth on the list.

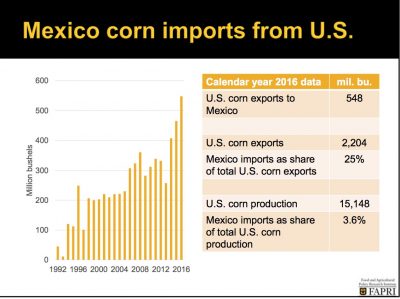

Note also that last week, Dr. Pat Westhoff, the Director of the Food and Agricultural Policy Research Institute, presented a webinar that was sponsored by the University of Arkansas (“The Ag Policy & Market Outlook: What Now?”) which included a slide providing a more detailed look at U.S. corn exports to Mexico.

Approximately 25 percent of U.S. corn exports go to Mexico.

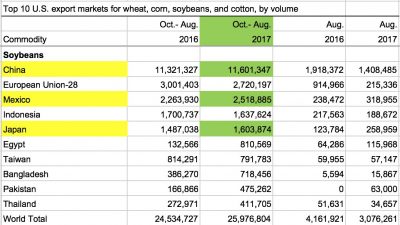

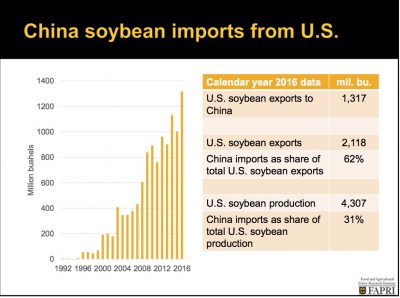

And three of the top five export markets for U.S. soybeans also included China, Mexico and Japan.

More specifically, the slide below from Dr. Westhoff’s webinar pointed out that China imports about one-third of U.S. soybean production.

Livestock Exports- Beef, Pork

The October edition of The Economic Landscape from USDA’s Agricultural Marketing Service (AMS) indicated that, “Compared to August 2016, beef and veal exports (including variety meats) rose 4 percent to 112 thousand MT. The export value was up 19 percent to $679 million. The export volume was 7 percent higher and value increased 9 percent from July…[and]…Japan, South Korea and Mexico were our largest export markets in August.”

Meanwhile, Robert Pore reported earlier this week that, “Japan’s beef tariff increase has resulted in a 26 percent decline in U.S. frozen beef exports to the country, which is having a negative impact on Nebraska’s beef industry.

“‘As anticipated, Japan’s tariff increase is negatively impacting exports of frozen beef from the U.S. to Japan,’ Gov. Pete Ricketts said Wednesday.

“Last month, Ricketts conducted a trade mission to Japan where he urged Japanese officials to come to the table to negotiate with the U.S. to lower their tariff.”

The article noted that, “‘This news also underscores the urgency for Congress and the Trump administration to negotiate a bilateral trade agreement with Japan to address the beef tariff rates as well as other agricultural market access issues,’ [Gov. Ricketts] said. ‘A new deal is critical to growing our number one commodity here in the beef state.’

Mr. Pore added that, “Rep. Adrian Smith, R-Neb., said that U.S. beef producers have already been placed at a competitive disadvantage in the Japanese market due to this country’s inaction on trade.”

Note also that the Omaha World-Herald recently published an editorial on this issue, and at a Senate Finance Committee hearing last week, Gregory Doud, the nominee to be Chief Agricultural Negotiator at the Office of the U.S. Trade Representative, noted that, “One area where work is needed is Japan.”

For additional analysis on U.S. beef exports, see, “Global Beef Competition is Getting Fierce. How is the U.S. Fairing?,” by Montana State University agricultural economist Eric Belasco.”

With respect to pork, the AMS Economic Landscape update noted that, “Pork exports in August (including variety meats) were down 1 percent from 2016 to 179 thousand MT, with the value also down 1 percent to $487 million. Pork export volume was up 6 percent, and value was up 4 percent from July. Year-to-date exports increased 9 percent in volume and 11 percent in value compared to 2016. The largest overseas markets for U.S. pork were Japan, Mexico and Canada.”