As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

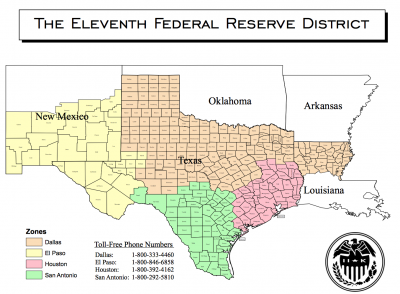

Federal Reserve Bank of Dallas Ag Credit Survey- Fourth Quarter 2017

Earlier this week, the Federal Reserve Bank of Dallas released its Agricultural Credit Survey for the fourth quarter of 2017.

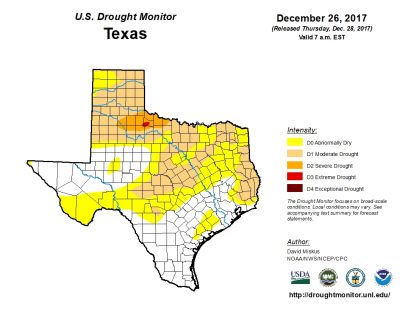

The Fed update indicated that, “Bankers responding to the fourth quarter survey noted conditions had turned dry again across a number of regions. Crop yields varied by region and commodity from below average to slightly above average. Respondents noted that the winter wheat crop needed rain. Livestock markets have remained decent.”

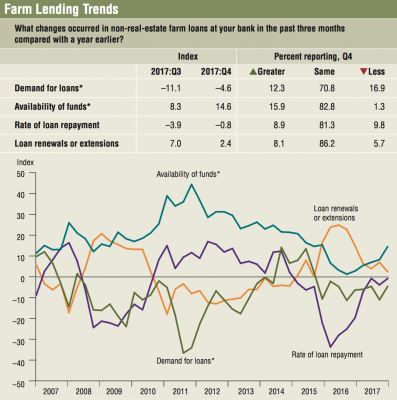

The Ag Survey noted that, “Demand for agricultural loans overall continued to decrease for a ninth consecutive quarter. Loan renewals and extensions continued to increase, while the rate of loan repayment stabilized after falling last quarter. Overall, the volume of non-real-estate farm loans was lower than a year ago, as was the volume of farm real estate loans. The volume of operating loans increased; all other loan categories’ volumes fell year-over-year this quarter.”

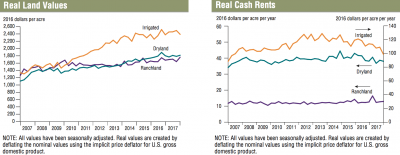

The Fed update also pointed out that, “District real ranchland and dryland values increased this quarter, while irrigated cropland values decreased. According to bankers who responded in both this quarter and fourth quarter 2016, nominal cropland and ranchland values increased year over year in Texas. Southern New Mexico respondents indicated cropland values increased while ranchland values decreased, and northern Louisiana respondents reported irrigated cropland and ranchland values increased while dryland values decreased.”

This week’s update also stated that,

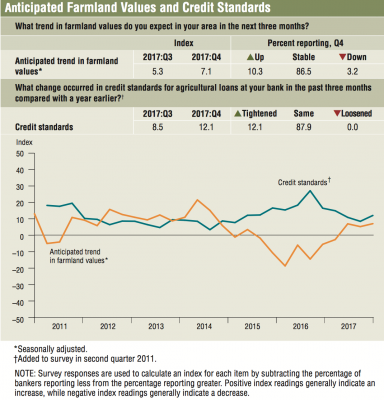

The anticipated trend in the farmland values index remained positive for a third consecutive quarter, suggesting respondents expect farmland values to trend up in the upcoming months. The credit standards index indicated continued tightening of standards on net.

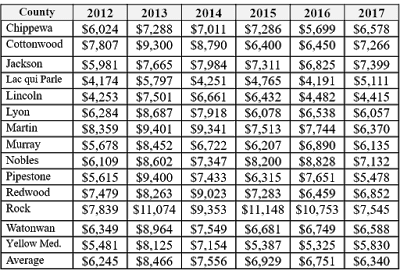

In other developments regarding farmland values, an update on December 27th from University of Minnesota Extension (“Southwestern Minnesota Farmland Values Decline 6.1 percent in 2017“) stated that, “At the end of each year for the last twenty-three years, a survey has been conducted of farm land sales in fourteen southwestern Minnesota counties. The survey reports bare farm land sales to non-related parties for the first six months of each year. Land values had been steadily increasing until 2014. After reaching record high prices in 2013, the upward trend was broken as prices declined in 2014. The downward trend continued through 2017.”

The Minnesota Extension update noted that, “Data from these counties indicate prices decreased from an average of $6,751 in 2016 to $6,340 in 2017 or a decrease of 6.09%. This is only the fourth decrease as far back as this data has been collect since 1995. In 2013 was the largest year to year increase of 35.6%.”