A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

In Retaliation for U.S. Tariffs, China Targets Soybeans, Corn

Bloomberg News reported on Friday that, “Trade tensions between the U.S. and China ratcheted higher after the Asian nation said it will follow through on plans to levy tariffs on a range of American farm goods including soybeans and corn.

“An additional 25 percent tariff will be levied on about $50 billion of U.S. imports, China’s Ministry of Finance said Saturday in a statement on its website. Tariffs on about $34 billion of those imports will start July 6, covering agricultural products including: soy, corn, wheat, cotton, rice, sorghum, beef, pork, poultry, fish, dairy products, nuts and vegetables.”

President Trump moved the U.S. to the brink of a trade war with China, announcing tariffs on $50 billion in Chinese imports https://t.co/KWjEJNlkbM #tictocnews pic.twitter.com/JeHxKib1JF

— TicToc by Bloomberg (@tictoc) June 15, 2018

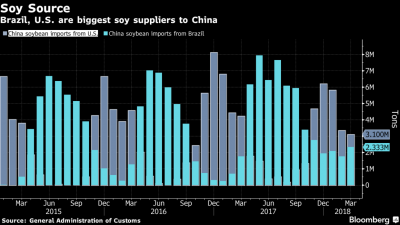

The Bloomberg article explained that, “China still buys more soybeans from the U.S. than any other agricultural commodity, in a trade that was worth $14 billion last year. It’s the world’s biggest importer and America’s largest buyer. While about a third of U.S. production goes to the Asian country annually, China last year bought more from Brazil. The existing import duty is 3 percent.”

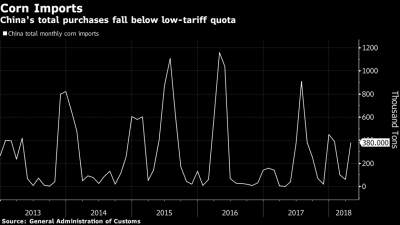

Friday’s article added that, “China’s corn imports from the U.S. surged almost 240 percent last year to about 757,000 tons, worth $160 million, according to customs data. That compares with 1.8 million tons imported from Ukraine. Total imports were 2.8 million tons in 2017, well below its 7.2 million ton low-tariff-rate quota. So-called in-quota corn imports incur a 1 percent duty.”

Peter Wells reported on Friday at The Financial Times Online that, “Soft commodity markets dropped after the US revealed new tariffs on $50bn of Chinese imports, with soyabeans heading for their worst weekly performance in almost two years.

For the week, soyabeans were down 6.7 per cent, setting them up for their worst week since early July 2016.

Reuters writer Mark Weinraub reported Friday that, “U.S. soybean futures plunged 2.5 percent to a one-year low on Friday on concerns that escalations in a trade fight with China would threaten shipments to the biggest buyer of the oilseed, traders said…[and]…Corn futures sank to their lowest in more than five months before recovering some of their losses.”

Mr. Weinraub noted, “U.S. Agriculture Secretary Sonny Perdue, speaking on a conference call from Canada, said the United States has tools such as the Commodity Credit Corporation to aid farmers whose incomes are harmed by trade fights.

“But he said it is too soon to assess such damage or how the government might respond.

“‘You can’t demonstrate any damage on the day that tariffs are announced,’ Perdue said. ‘We’re going to look at this very carefully. We have been calculating market impact on a weekly basis for a number of months now.'”

For additional perspective from Sec. Perdue, listen to this brief one-minute audio clip (MP3- 1 minute) from USDA radio on Friday.

Meanwhile, on Saturday, Donnelle Eller reported on the front page of The Des Moines Register that, “U.S. and Iowa agriculture is caught in the crossfire, with farmers selling $14 billion in soybeans to China last year, its top export market.”

Iowa farmers could lose up to $624 million, depending on how long the tariffs are in place and the speed producers can find new markets for their soybeans, said Chad Hart, an Iowa State University economist.

The Register article added, “Escalating trade disputes come as farm income has tumbled with falling commodity prices: U.S. farm income has been cut in half over the past five years, while Iowa farmers’ income shrank nearly 75 percent.”

And, Los Angeles Times writers Don Lee and Jim Puzzanghera reported on the front page of Saturday’s paper that, “Last month, it appeared the Chinese offer might resolve, or at least put on hold, a looming trade war between the world’s two largest economies. But in the last couple of weeks, the influence of trade hard-liners in the White House has grown, and Trump has moved back toward confrontation with Beijing.”

In a broader look at soybean supply and demand variables, the USDA’s Economic Research Service (ERS) indicated in its Oil Crops Outlook report on Thursday that, “Export shipments of soybeans for 2017/18 are now also running at a seasonally strong pace, based on a revival of new sales this spring to Europe, Taiwan, Mexico, and Egypt. This is supportive of this month’s U.S. export forecast is unchanged at 2.065 billion bushels.”

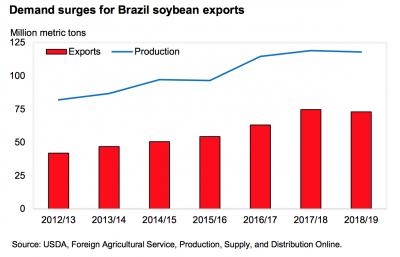

The report stated that, “Although USDA sees Brazilian soybean exports for 2018/19, at 72.95 million tons, declining from the current year, they are 650,000 tons above last month’s forecast.”

The ERS update also explained that, “Supply rationing may lower Argentine soybean exports for 2017/18 another 700,000 tons this month to a 19-year low of 3.5 million tons. Both Paraguay and Canada would overtake Argentina as the world’s third and fourth largest soybean exporting countries.”

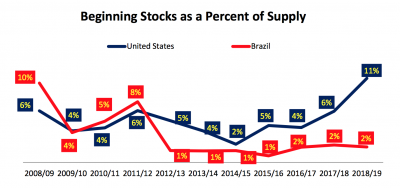

Also this month, USDA’s Foreign Agricultural Service stated in its Oilseeds: World Markets and Trade report that, “Since 2014/15 when stocks in both Brazil and the United States reached minimum levels, Brazilian stocks have remained relatively unchanged while stocks in the United States, as a percent of supplies, are projected to rise to 11 percent in the coming year. The high prices in reals have provided Brazilian producers the flexibility to undercut U.S. prices and have encouraged continued acreage expansion, all factors contributing to Brazil’s rising global market share. As long as U.S. producers continue to battle against a weak real, this trend will likely continue.”

Regarding corn exports, ERS stated earlier this month in its Feed Outlook report that, “For 2017/18, corn exports are increased 75 million bushels to 2.3 billion, bringing total use to 14.8 billion.”

The Feed Outlook update indicated that, “For corn, a sharp reduction in projected corn supplies and exports in Brazil this month are projected to further support U.S. exports during the latter part of 2017/18.”

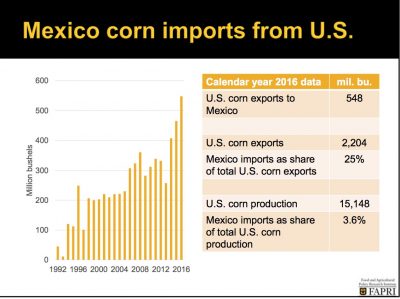

In other trade news, Reuters writers David Alire Garcia and Suman Naishadham reported on Thursday that, “Mexico could strike at $4 billion in annual imports of U.S. corn and soybeans if President Donald Trump escalates a trade spat with new tariffs, officials told Reuters this week, and it is studying how to reduce the pain of such a move.

“Earlier this month, Mexico swiftly retaliated when Trump imposed metals tariffs, hitting dozens of American imports including steel, apples and pork.

“But it held back from the most lucrative class of U.S. farm products: grains, especially feed corn and soybeans, used to fatten Mexico’s cows, hogs and chickens.”

The Reuters article indicated that, “Imposing such tariffs would be a last-ditch option hitting at U.S. corn farmers’ top export market, and such a move would hurt Mexico’s own industry. But it has already been increasing its imports of grains from suppliers like Brazil and Argentina that could enable it to lessen the impact.”

The article also pointed out that, “If retaliatory Mexican tariffs were imposed on soy and corn the industry would scramble to find enough alternative suppliers without significantly higher costs. Some in Mexico don’t believe it can be done without inflicting serious damage.”