Bloomberg's Clarice Couto reported this past Friday that "a surprising tax change in agriculture powerhouse Brazil has the potential to make soy grown in the world’s largest bean exporter less…

U.S.-China Trade Row Persists- Administration Says it Will “Be There For the American Farmers”

In conjunction with positive early season crop condition ratings, an ongoing and escalating trade dispute between the U.S. and China put negative pressure on corn and soybean prices Tuesday. Meanwhile, The Wall Street Journal indicated that the administration is ‘working on measures that will have the backs of farmers,’ as the trade dispute unfolds. Separately, farm state lawmakers stressed the importance of global markets for agricultural producers, who have already been struggling with lean farm income.

Background: U.S. – China Trade Dispute Escalates, Soybean and Corn Prices Fall

Wall Street Journal writer William Maudlin reported on Tuesday that, “President Donald Trump escalated a trade conflict with China Monday, asking his administration to identify a new list of $200 billion in Chinese goods that would be penalized with tariffs.

“The move followed tariffs applied last week on $50 billion in Chinese imports to the U.S., designed to punish China for unfair trade practices. Beijing immediately threatened to retaliate with its own equivalent tariffs on U.S. goods.”

Ana Swanson, Keith Bradsher and Katie Rogers explained earlier this week at The New York Times Online that, “The tit for tat began on Friday, when Mr. Trump said Washington would move ahead with tariffs on $50 billion worth of Chinese goods, including agricultural and industrial machinery. The action provoked an immediate response from Beijing, which said it would place its own tariffs on $50 billion worth of American goods, including beef, poultry, tobacco and cars.

“On Monday, Mr. Trump raised the ante even further, saying that he had directed Robert E. Lighthizer, the United States trade representative, to pursue another $200 billion worth of tariffs.

“China’s Commerce Ministry responded swiftly to Mr. Trump’s threat, issuing a statement on its website that warned that if the Trump administration followed through, China would ‘have to adopt comprehensive measures combining quantity and quality to make a strong countermeasure.'”

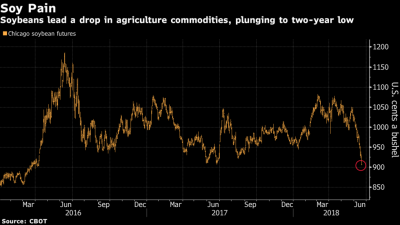

Bloomberg writer Thomas Biesheuvel reported on Tuesday that, “A rout in commodities deepened as the threat of a trade war between the world’s two biggest economies intensified, hitting markets from steel to soybeans.”

The article stated that,

Soybean futures were among the biggest losers, falling as much as 7.2 percent to the lowest in more than two years.

“The oilseed is the largest single American agricultural export to China, a trade valued at about $12 billion last year. Chinese demand for soy has surged in recent decades as the country uses more of it as food for hogs.”

Mr. Biesheuvel indicated that, “Agriculture has been a major battleground in the deepening trade dispute. By focusing on agriculture and energy, China is targeting rural communities in states that voted for Trump in 2016. As recently as May, the Asian nation said it would seek to buy more U.S. agricultural and energy products as part of a tentative trade truce between the two countries.

“‘Hopes of higher U.S. soybean shipments to China have been quashed by the retaliatory tariffs,’ Commerzbank said. ‘The U.S. will doubtless have a hard time finding alternative consumers without offering significant discounts.’

“Corn slipped to the lowest since January, while wheat and cotton also dropped.”

Wall Street Journal writer Benjamin Parkin reported Tuesday that, “Prices for grain and livestock also declined as traders bet Chinese tariffs would jeopardize demand for U.S. exports. Commodities from crude oil to copper to lumber also fell.”

The Journal article pointed out that, “Minnesota farmer Tim Velde said there’s little he can do to stem losses on the value of the 1,000 acres of corn and soybeans he’s planted this year. If prices continue to fall, he fears he could struggle to secure a loan for next year’s crop. He recently decided not to purchase a new planter he’d been shopping for.”

Farmer Michael Petefish said falling soybean prices this month had slashed about $60 an acre on the value of the crop he planted this spring on about 2,000 acres near Claremont, Minn.

“‘If you were close to operating in the red, the type of development could push you into the red,’ said Mr. Petefish, who heads the Minnesota Soybeans Growers Association. He said he’s been shielded from some of the recent price declines because he sold some of his crop in advance at a profitable price point.”

And Gregory Meyer reported on Tuesday at The Financial Times Online that, “The escalating trade fight between the US and China is taking a harsh toll on the market for soyabeans, pushing prices well below the level at which many American farmers can earn a profit.”

Mr. Meyer noted that, “Good field conditions in the Midwest dealt a further blow to US soyabean markets. With most of the crop seeded, 73 percent was rated good to excellent on Monday by the US Department of Agriculture.”

#Illinois #soybean condition 1% very poor, 3% poor, 19% fair, 54% good, and 23% excellent. #plant18 #agchat @ILAgriculture @usda_nass. Full report at: https://t.co/xch5oiFqNz pic.twitter.com/qFLtixxLRf

— Farm Policy (@FarmPolicy) June 18, 2018

The FT article added that, “For some farmers, the current price of soyabeans will lead to financial losses. Michael Langemeier of Purdue University’s Center for Commercial Agriculture estimated that high-productivity Indiana farms this year needed a price of more than $10 a bushel to break even.”

Also, Reuters writer Julie Ingwersen reported on on Tuesday that, “Additional pressure on corn and soybean prices came from crop-friendly weather across the U.S. Midwest.

“The U.S. Department of Agriculture (USDA) late on Monday rated 78 percent of the U.S. corn crop in good to excellent condition, up 1 percentage point from a week earlier. The rating was among the highest for this point in the season in USDA records dating back to the 1980s.”

#Illinois #corn condition now 81% good to excellent, down 1% from last week and highest in 10 years for this date. #plant18 #agchat @ILAgriculture @usda_nass. Full report at: https://t.co/xch5oiFqNz pic.twitter.com/dcfhuNUOBD

— Farm Policy (@FarmPolicy) June 18, 2018

Executive Branch Perspective

Vivian Salama reported on Tuesday at The Wall Street Journal Online that, “The Trump administration is working on measures that protect agriculture and other critical industries from retaliatory tariffs being threatened by China amid an escalating trade dispute between the two countries, a top adviser to President Donald Trump said.

Peter Navarro just now: "Let me be clear...President Trump will have the backs of all Americans who may be targeted by Chinese actions. I can assure you we are not unprepared. Pres. Trump & Sonny Perdue will be there for the American farmers."

— Heather Long (@byHeatherLong) June 19, 2018

(No further details given)

“Peter Navarro told reporters on Tuesday that Agriculture Secretary Sonny Perdue and others in the administration are taking into account the potential impact of retaliatory tariffs on those industries and are making provisions.

The administration is ‘working on measures that will have the backs of farmers,’ he said. ‘I can assure you we are not unprepared.’

The Journal article added that, “Mr. Navarro said that the president is willing to continue negotiations with China as he seeks to find a solution that will ultimately correct the trade imbalance. He added, however, that ‘talk is cheap‘ and the administration is now looking for China to show its goodwill through actions.”

Lawmaker Perspective

Donnelle Eller and Brianne Pfannenstiel reported on Tuesday at The Des Moines Register Online that, “‘We know what happens when tariffs are increased … and there’s retaliation. It hurts agriculture. It’s going to hurt Iowa tremendously,’ U.S. Sen. Chuck Grassley said during a weekly call with reporters.”

The Register article added, “‘We’re trying to impress on the president that this is a nervous situation for farmers,’ Grassley said. ‘It will affect farmers negatively if his plan doesn’t work.

“‘If it does work, then we’re probably going to be better off, the economy as a whole, maybe agriculture as a whole,’ he said.”

And a news release from Iowa GOP Senator Joni Ernst quoted her as saying, “Farmers need trade, not aid. These tariffs are nothing more than a tax on Iowa farm families and the escalating trade war is putting the livelihoods of our rural communities in the crosshairs.

With farmers facing increased financial pressure from low commodity prices and high production costs, it’s becoming harder and harder for producers to turn a profit. These aggressive trade actions will continue to have damaging consequences, including an impact on our commodity prices and farm futures, and increasing anxiety among the agricultural and business communities in Iowa.

And Senator Heidi Heitkamp (D., N.D.) stated on Tuesday that, “This administration is playing chicken with China, creating a trade war at farmers’ expense, which is bad news for their bottom lines and our economy, plain and simple.”