Bloomberg's Leah Nylen reported Thursday that "a Colorado judge issued an order temporarily blocking the proposed $25 billion merger of Kroger Co. and Albertsons Cos., which has been challenged by…

Ag Economy: Land Values and Farm Income Considerations

Today’s update looks briefly at recent reports from the Federal Reserve Bank of Dallas and the University of Nebraska at Lincoln that shed light on trends in farmland values. Also, a recent survey from Iowa State University that provides statistical insights into farmland owners, is examined. Lastly, news articles that continue to look at the deteriorating prices of some agricultural commodities, and their resulting potential negative impacts on farm financial well-being, are also discussed.

Farmland Values

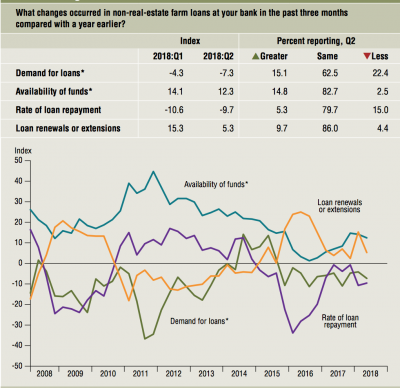

On Monday, the Federal Reserve Bank of Dallas released the results of its 2018 Second Quarter Agricultural Credit Survey, which stated that, “Demand for agricultural loans overall decreased for an 11th consecutive quarter. Loan renewals and extensions rose but at a slower pace, while the rate of loan repayment continued to decline. Overall, the volume of non- realestate farm loans fell compared with a year ago, as did the volume of farm real estate loans. The volume of operating loans flattened out, and feeder cattle loans stabilized after nearly three years of decline.”

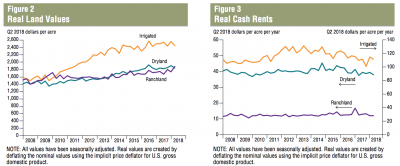

The Fed report stated that, “District real ranch-land values surged this quarter, while dryland and irrigated cropland values declined. According to bankers who responded in both this quarter and second quarter 2017, nominal dryland and ranchland values increased year over year in Texas.”

The Credit Survey also noted that, “The anticipated trend in the farmland values index rose to its highest level since mid-2014, suggesting respondents expect farmland values to trend up in the upcoming months.”

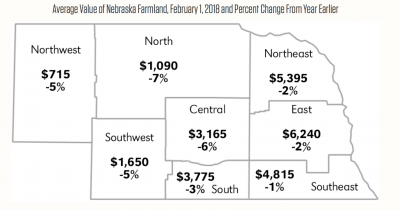

Meanwhile, an update last month from the University of Nebraska at Lincoln (“2018 Nebraska Farm Real Estate Report“) stated that, “Final results from the Nebraska Farm Real Estate Survey show a fourth consecutive year of declining Nebraska agricultural land values.

The statewide average value dropped 4 percent to $2,720 per acre. This is an 18 percent reduction since land values peaked in 2014.

Farmland Ownership Statistics- Iowa

Des Moines Register writer Donnelle Eller reported last week that, “Nearly 60 percent of Iowa farmland owners don’t actively farm, a new Iowa State University survey shows, and about one-third of owners have no farming experience at all.

“Twenty-four percent of those owners are retired farmers, according to the ISU Farmland Ownership Tenure Survey that looked at trends from 2012 to 2017.”

The Register article also noted, “Eighty-two percent of Iowa farmland is owned debt-free, which represents a significant increase from 62 percent in 1982 and 78 percent in 2012.”

“‘About 55 percent of all land in Iowa has been owned by the same owner for over 20 years,” said Wendong Zhang, an ISU economics assistant professor. ‘With low turnover, and with limited supplies, it supports higher land values.

“‘That’s provided a buffer in this current farm downturn,’ said Zhang, who led the survey with Alejandro Plastina, also an assistant ISU economics professor.”

Commodity Prices- Financial Conditions

Benjamin Parkin reported on Monday at The Wall Street Journal Online that, “Soybean prices fell to the lowest point in almost a decade on Monday, as looming Chinese tariffs threatened to kill off demand from the U.S.’s largest customer.

“Futures for July fell 1.2% to $8.48 1/2 a bushel at the Chicago Board of Trade, the lowest close since March 2009.

The market tumbled 15% in June as soybeans, which became a crucial cash crop for beleaguered American farmers in recent years, got caught up in a trade dispute between China and the U.S.

The article added that, “Beijing said it plans to introduce tariffs on U.S. soybean imports starting Friday, part of a package of measures retaliating against the Trump administration’s own threatened duties against hundreds of billions of dollars worth of Chinese goods. Soybean buyers in China—the world’s largest consumer of oilseed, which gobbles up around a third of all the U.S.-grown crop—have sharply slowed their purchases in anticipation of the duties.”

Monday’s Journal article also noted that, “Researchers at the University of Illinois and Ohio State University estimate that Chinese tariffs of 25% on U.S. soybean imports would cut income for a midsize Illinois grain farm by an average of 87% over four years, prompting a loss of more than $500,000 in the farm’s net worth by 2021.”

farmdoc webinar: Soybean Balance (#Trade Issues) pic.twitter.com/KVSP1dNIpG

— Farm Policy (@FarmPolicy) June 29, 2018

Also Monday, Wall Street Journal writer Jesse Newman reported that, “Mounting trade disputes, spurred by U.S. threats to withdraw from the North American Free Trade Agreement and tariffs on billions of dollars’ worth of goods from key trading partners, have cut U.S. agricultural exports and sent commodity prices tumbling. Many farmers, who depend on shipments overseas for one-fifth of the goods they produce, say they are anxious, especially because they are already expecting bumper harvests or grappling with a dairy glut.”

From the @WSJ via @FarmPolicy, a sobering look at the states that will be most immediately impacted by retaliation for the president's misguided tariffs. pic.twitter.com/c5SwocLCrJ

— House Agriculture Committee Democrats (@HouseAgDems) July 2, 2018

Ms. Newman explained that, “Disquiet among farmers grew in June as crop prices fell thanks to benevolent U.S. weather and additional duties expected from China on products like soybeans, for which it is the U.S.’s top customer.

The total value of this year’s U.S. corn, soybean and wheat crops dropped about $13 billion, or 10%, in June, said Chris Hurt, an agricultural economist at Purdue University.

And Gregory Meyer reported on Monday at The Financial Times Online that, “The Trump administration is exploring the use of a New Deal-era agency to salve financial wounds US farmers have suffered from its trade battle with China.”

The FT article stated, “Sonny Perdue, US agriculture secretary, last week told reporters that the federal Commodity Credit Corporation was among the tools under consideration to offset farmers’ losses.”

Mr. Meyer explained, “The corporation has the purpose of ‘stabilising, supporting, and protecting farm income and prices’. Its powers include making loans and payments to farmers and buying their crops, according to its charter.

‘It was always the emergency break-the-glass programme that we could tap into if really extreme situations popped up,’ said Robert Holifield, a former staff director for the US Senate agriculture committee.

“Congress in March broadened the CCC’s remit by lifting curbs on its authority to prop up crop prices and remove commodities surpluses, giving the administration more firepower to confront Chinese tariffs.”

The FT article also pointed out that, “A lobbyist familiar with the discussions said the USDA sought to make a decision by September, when US harvesters will be collecting summer crops such as soyabeans [Listen to additional remarks on this issue from Sec. Perdue in the brief one minute audio clip below from USDA Radio News].

"@SecretarySonny -Details of Plan To Help #Farmers Hurt by #Trade Actions Due by Labor Day," https://t.co/XFOnXv6oRl (MP3- 1 minute). @USDA Radio. pic.twitter.com/ihM1nNibfT

— Farm Policy (@FarmPolicy) July 3, 2018

“That month is also when farmers in Brazil, the world’s biggest soyabean exporter, are making planting allocations.

“‘The long-run costs of this are bringing more land into soyabeans in Brazil,’ [Joseph Glauber, a former USDA chief economist, who is now with the International Food Policy Research Institute] said of the soyabean tariffs. ‘We’re going to see a lot of land get converted. That is a loss of markets that the US would have participated in.'”

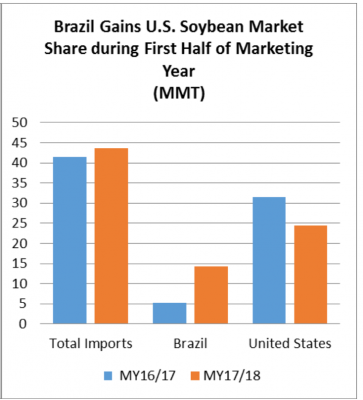

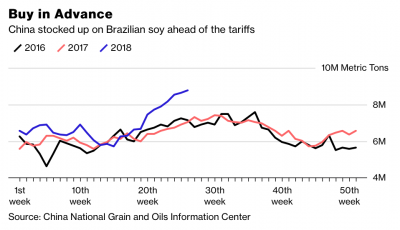

Also, on Tuesday, Bloomberg News reported that, “Chinese companies are expected to cancel most of the remaining soybeans they have committed to buy from the U.S. in the year ending Aug. 31 once the extra tariff on U.S. imports takes effect from Friday.”

The article stated, “Chinese companies have contracted to increase purchases from Brazil since April and soy inventories at major crushers are currently at the highest in years, according to the China National Grain and Oils Information Center. That’s likely to change later in the year.”