Bloomberg's Leah Nylen reported Thursday that "a Colorado judge issued an order temporarily blocking the proposed $25 billion merger of Kroger Co. and Albertsons Cos., which has been challenged by…

Producers Express Concern in the Midst of Price Turmoil, While ERS Looks at Farm Sector Financial Health

Financial Times writer Gregory Meyer reported on Monday that, “US soyabean futures have tumbled to the lowest price in nine years as the market succumbs to healthy growing conditions and fears over imminent tariffs from China.” Amid this climate, Secretary of Agriculture Sonny Perdue visited with producers in the northwest earlier this week and heard first hand concerns about trade and the current financial environment. With this background in mind, the USDA’s Economic Research Service (ERS) released a timely update on Monday that painted an interesting “snapshot” of the U.S. ag economy titled, “Current Indicators of Farm Sector Financial Health.”

Under Price Pressure, Producers Discuss Trade Concerns With Ag Secretary Perdue

A news release from CoBank on Tuesday stated that, “Despite the strongest global economic growth since 2011, uncertainty around trade presents escalating concern to U.S. agriculture. Seventy percent of U.S. agriculture exports are to destinations that are in current negotiation or trade disputes, according to the most recent Rural Economic Review from CoBank’s Knowledge Exchange Division.

The shift from trade war rhetoric to reality tempers the optimism felt in the first quarter. Aside from potentially losing market share in emerging markets, the U.S. may face shake-ups in historical supply chain commitments, as competitors seek new trade relationships amid current trade disputes.

The CoBank release added, “New tariffs from China and Mexico targeting agricultural products dampen the ag economy’s outlook. In mid-June, China announced 25 percent tariffs on $50 billion of U.S. goods, including soybeans. Those tariffs are slated to take effect July 6 and may severely impact prices.”

As it's the season of financial crisis commemorations: #soybeans are slipping again, heading for lowest close since Dec '08 pic.twitter.com/WprVq4jCxo

— Gregory Meyer (@meyer_g6) July 3, 2018

Recent news articles have documented the trade related concerns producers in many states are experiencing, including Minnesota, Iowa, and Utah. Meanwhile, former Secretary of Agriculture Tom Vilsack recently noted that producers in California could also be significantly impacted by adverse trade actions.

William L. Spence reported on Tuesday at The Lewiston (Idaho) Tribune Online that, “President Donald Trump won’t leave American farmers holding the bag.

“That was the message from U.S. Secretary of Agriculture Sonny Perdue on Monday during a lunch meeting with nearly 100 area farmers and ranchers at the McGregor Co. headquarters near Colfax.

‘The president told me, ‘You assure American farmers that we’re not going to let them bear the brunt of these trade disruptions,’ ‘ said Perdue, who was invited to the area by Washington Congresswoman Cathy McMorris Rodgers, who joined him at the meeting.

The article stated, “McMorris Rodgers asked Perdue to share the administration’s perspective on the trade dispute, saying it has farmers quite nervous.

“‘It’s making farmers nervous?‘ Perdue replied. ‘It makes me nervous. Overall, 20 cents out of every dollar in farm revenue comes from exports. When our entire production system is based on feeding the world, any disruption in trade raises concerns.’

“However, he said the president’s ultimate goal is to create a more level playing field for American producers by discouraging unfair trade practices.”

"No Assurances that #Trade Conflicts Won't Hurt #Farmers, but U.S. Will Help," https://t.co/SrADeLfF1Z (MP3- 1 minute) @USDA Radio- remarks from @SecretarySonny pic.twitter.com/A7Z69WZIkH

— Farm Policy (@FarmPolicy) July 4, 2018

Mr. Spence noted, “[Sec. Perdue] also said he expects to release a ‘mitigation strategy‘ this fall, outlining what the administration will do to shield farmers and ranchers from the negative consequences of the current trade disputes…’My timeline for implementing the mitigation strategy is Labor Day,’ Perdue said. ‘By then, farmers will need some idea (about what the administration will do).'”

Capital Press writer Dan Wheat reported earlier this week that at a breakfast at the Spokane [Wash.] Club on Monday with Rep. McMorris Rodgers, Sec. Perdue stated that, “The president says he won’t allow ag producers to bear the brunt of trade disputes. We are undergoing significant trade disruptions on corn and soybeans. I believe if we are not able to resolve this — I’m laying down a marker that we need to resolve it by Labor Day or we need some sort of mitigation.”

The article quoted Glen Squires, the CEO of the Washington Grain Commission as saying, “You will hear a lot about trade from every person because so much of our product is exported.”

And Wendy Culverwell reported on Tuesday at the the Tri-City Herald (Kennewick, Wash.) Online that, “As he did in Spokane, Perdue offered broad assurances that the Trump administration has farmers’ backs if tough moves on trade disrupts their business.”

The article pointed out that, “[Sec. Perdue] hinted the USDA’s longstanding commodity-buying ‘Section 32‘ program could play a role in supporting prices.”

China’s 2017/18 #soyabean import forecast cut by 0.5m t, to 98.0m, albeit still a y/y increase, based on a slower than anticipated underlying pace of shipments. pic.twitter.com/qBmgE4Niv1

— International Grains Council (@IGCgrains) July 2, 2018

Meanwhile, Bloomberg News reported on Tuesday that, “Chinese companies are expected to cancel most of the remaining soybeans they have committed to buy from the U.S. in the year ending Aug. 31 once the extra tariff on U.S. imports takes effect from Friday.”

However, the article added that, “Chinese companies have contracted to increase purchases from Brazil since April and soy inventories at major crushers are currently at the highest in years, according to the China National Grain and Oils Information Center. That’s likely to change later in the year.

“‘There will be a supply deficit from the fourth quarter as crushers won’t have enough supplies if they don’t take U.S. soybeans,’ [Gao Yanbin, an investment manager with agriculture investment firm Shanghai Shenkai Investment Co.] said. Brazilian supplies fall to seasonal lows in the first and fourth quarters — a period when China’s imports are normally dominated by the U.S. The CNGOIC expects Chinese companies may need to import at least 10 million tons from the U.S. when South American supplies run down.”

ERS Update: Current Indicators of Farm Sector Financial Health

Earlier this week, an Amber Waves update from USDA’s Economic Research Service (“Current Indicators of Farm Sector Financial Health,” by Nigel Key, Carrie Litkowski, and James Williamson) stated that, “Following a steep decline in agricultural commodity prices, the past several years have seen a weaker market for farmland and an uptick in interest rates. At the same time, farm sector income has declined and farm interest expenses have increased. Lower commodity prices in the near future could likely further reduce farm receipts, making it more difficult for some farmers to meet their loan obligations and pay for production expenses.”

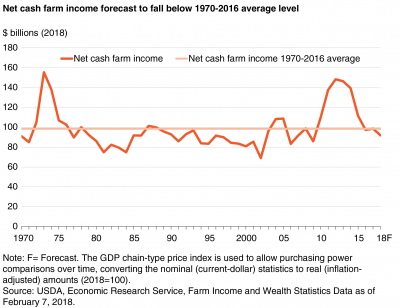

More narrowly ERS explained that, “Following the high incomes in 2012 and 2013, the sector’s net cash farm income started to decline in 2014, fell more sharply in 2015, and continued to decline in 2016. During the 2016 growing season, increased plantings, combined with good weather, led to record U.S. farm production and added to large stocks on hand for many major commodities due to multiple consecutive years of high production levels…Incomes in 2017 and 2018 are forecast to remain near or just below 2016 levels.”

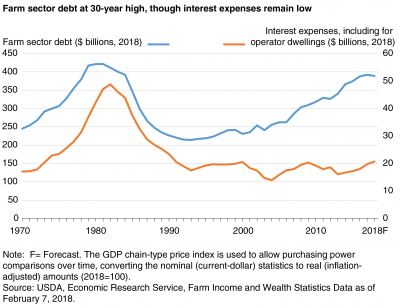

With respect to debt, the update indicated that, “Farm sector debt has reached levels near the peak levels of the late 1970s and early 1980s. From 1994 to 2016, inflation-adjusted farm debt increased by 79 percent, or 3 percent per year on average. ERS forecasts farm debt to increase 1 percent in 2017 and then decline 1 percent in 2018. Total farm sector debt in 2016 is 8 percent ($34 billion) below the peak in 1980 in inflation-adjusted terms.”

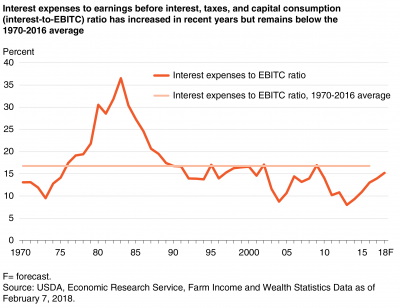

And on the issue of debt repayment capacity, ERS pointed out that, “The ratio of interest expenses to earnings before interest, taxes, and capital consumption (interest-to-EBITC) is a measure of a farm business’s ability to pay its interest expenses on its outstanding debt out of its earnings. High interest rates and low farm income caused the interest-to-EBITC ratio to peak at 36 percent in 1983. This coincided with higher rates of farm bankruptcies and loan defaults. After 1983, the interest-to-EBITC ratio fell below the 1970-2016 average level of 16 percent and reached a low of 8 percent in 2013. Since then, falling income and rising interest rates have again caused the ratio to climb, though the 2018 forecast of 15 percent remains below the long-run average. A 15-percent EBITC means that 15 percent of net farm earnings are spent on interest payments.”

As part of its conclusion, ERS noted that, “These trends indicate that U.S. agriculture is entering a less prosperous and potentially vulnerable period. However, current indicators of farm financial health do not suggest that the downturn is as severe as the farm crisis of the 1980s… If farm income remains near current levels and interest rates increase as currently forecast, projected interest expense-to-farm earnings ratios suggest that the farm sector is unlikely to face extensive debt repayment challenges by 2019. However, if farm income falls substantially, more farmers will find it difficult to meet their debt obligations.”