As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Kansas City Fed Examines Second Quarter Farm Lending

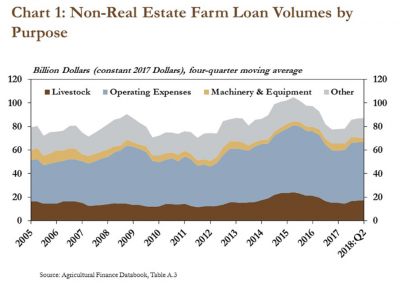

An update on Friday from the Federal Reserve Bank of Kansas City (“Large Loans for Livestock Drive Uptick in Farm Lending,” by Cortney Cowley and Ty Kreitman) stated that, “Farm lending activity increased slightly in the second quarter, according to the National Survey of Terms of Lending to Farmers. The total volume of non-real estate farm loans was about 2 percent higher than the same period last year.”

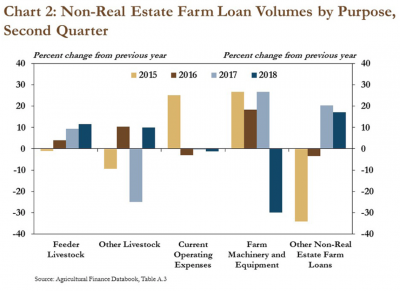

More specifically, the Fed update noted that, “Total loan volumes increased relative to last year, driven primarily by moderate increases in livestock loans. Loans for both feeder and other livestock increased 10 percent from a year ago. In contrast, farm machinery and equipment lending contracted nearly 30 percent, following three consecutive years of increases. Loans to finance farm machinery and equipment make up the smallest category of agricultural loans at commercial banks. Therefore, although the decline in machinery and equipment loans was large, the overall impact on total loan volumes was relatively small. In addition, loans to finance current operating expenses, the largest category of farm loans at commercial banks, declined slightly.”

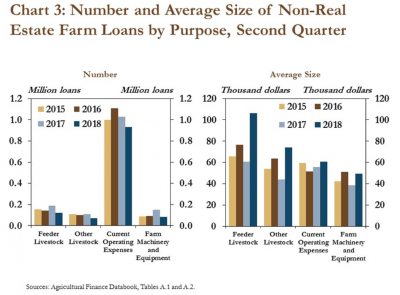

Friday’s update pointed out that, “Despite fewer loans being originated in the second quarter, larger loan sizes, particularly for livestock, supported higher total loan volumes.

The number of livestock loans originated in the second quarter declined 35 percent, on average, compared to the previous year. However, the average size of loans for feeder livestock and other livestock increased 75 percent and 70 percent, respectively.

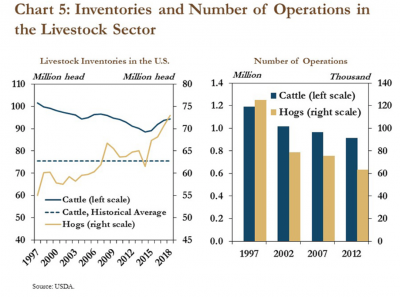

Cowely and Kreitman explained, “Consolidation in the livestock sector has led to larger inventories on fewer farms with greater financing needs. For example, in the hog industry, inventories in the last 20 years have grown significantly. Over the same period, the number of hog operations has declined almost 50 percent. Larger inventories on fewer farms indicate that remaining farms have grown and/or consolidated. There also has been consolidation in cattle and other industries, but at a slower pace. As the industry transitions to fewer, larger farms, lending needs per farm will be likely to increase.”

And on the issue of interest rates, the Kansas City Fed stated, “Increased lending and larger loan sizes in the livestock sector have coincided with higher interest rates on livestock loans. Interest rates on feeder livestock loans have increased 15 percent from last year, and interest rates on loans to finance other livestock have increased 18 percent since the first quarter of 2016. Higher interest rates on larger loans have increased debt obligations for farmers. Although the increase in interest expense has remained relatively small compared with other expenses on farm balance sheets, higher expenses during a period of relatively tighter profit margins (compared to previous years), increased market volatility and trade uncertainty could put additional pressure on some livestock operations.”

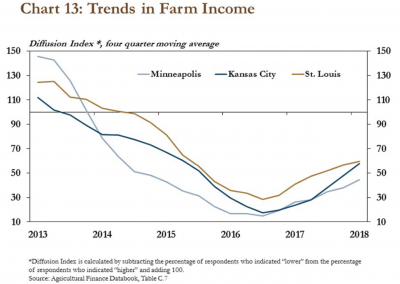

While addressing farm income variables, Friday’s update stated, “Financial conditions for farmers also showed some signs of steadying in the first quarter. Since reaching historical lows in 2016, farm income has stabilized over the last four quarters in the Minneapolis, Kansas City and St. Louis Districts.

Recent declines in the prices of key agricultural commodities could lead to further reductions in farm income, however, and expenses generally have remained elevated.

“Interest expenses associated with farm loans also increased slightly in the first quarter as interest rates continued to edge higher.”

And while discussing farmland values, the Kansas City Fed indicated that, “Overall, farmland values have continued to hold relatively steady in comparison to historically weak agricultural credit conditions, and the variations among regions are likely influenced by differences in conditions across individual commodities.”