Bloomberg's Clarice Couto reported this past Friday that "a surprising tax change in agriculture powerhouse Brazil has the potential to make soy grown in the world’s largest bean exporter less…

Tariff Impacts on Soybean Trade

Business news articles continue to highlight how Chinese soybean tariffs are impacting the international sale and purchase of soybeans. Today’s update looks briefly at a few of these recent news items.

Last week, Reuters writers Josephine Mason, Hallie Gu, and Karl Plume reported that, “The executive from one of China’s biggest soybean crushers sat on a panel at a Kansas City agricultural exports conference, listening to an expert beside him explain why China would remain dependent on U.S. soybeans to feed its massive hog herds.

“When his turn to speak came, Mu Yan Kui told the international audience of soy traders that everything they just heard was wrong. Then Mu ticked off a six-part strategy to slash Chinese consumption and tap alternate supplies with little financial pain.

“‘Many foreign business people and politicians have underestimated the determination of Chinese people to support the government in a trade war,’ said Mu, vice chairman of Yihai Kerry, owned by Singapore-based Wilmar International.”

The article noted that,

The comments echo a growing confidence within China’s soybean industry and government that the world’s largest pork-producing nation can wean itself off U.S. soy exports – a prospect that would decimate U.S. farmers, upend a 36-year-old trading relationship worth $12.7 billion last year, and radically remap global trade flows.

The Reuters writers pointed out that, “Cutting the soy ration for hogs from the typical 20 percent to 12 percent would equate to a demand reduction of up to 27 million tonnes of soybeans per year – an amount equal to 82 percent of Chinese soy imports from the United States last year. Chinese farmers could cut soymeal rations by nearly half without harming hogs’ growth, experts and academics said.”

“At the Kansas City conference, held by the U.S. Soybean Export Council, Mu highlighted reduced soymeal rations as part of a broader strategy, including seeking alternative protein sources such as rapeseed or cotton seed; tapping surplus soybean stocks, including a government reserve, and domestically grown soybeans; and continuing to boost soybean imports from Brazil and Argentina,” the Reuters article said.

The article added, “USDA spokesman Tim Murtaugh downplayed the threat of China displacing U.S. soybean supplies. The Trump administration, he said, is analyzing import demand and ultimately aims to win back access to the China market under better terms.

‘It’s not surprising that China would float this idea, given the trade dispute,’ he said.

Meanwhile, in a separate Reuters article from Friday, Hallie Gu and Josephine Mason reported that, “At least two cargoes of U.S. soybeans are heading for China as some buyers are willing to risk taking up historically cheap U.S. beans even amid worries that Beijing may take further steps to deter imports amid mounting trade tensions with Washington.”

The article indicated that, “‘Whoever is buying the cargoes is really bold. We wouldn’t dare buy from the U.S. now,’ said a trader with a state-owned company.”

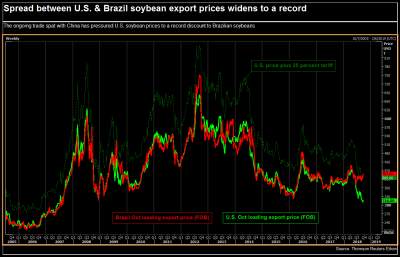

“Even with the additional 25-percent tariff, U.S. beans are still cheaper than Brazilian offerings, and the spread between the two producers for October widened to a record this week,” the Reuters article said.

But the article added, “Even so, most Chinese buyers have stepped up purchases of Brazilian soybeans in recent months, on worries of tight supplies in the fourth quarter, when U.S. soybeans usually dominate the market as the autumn harvest kicks in.”

With the end of 2017/18 (Oct/Sep) trade year for approaching, the share of #soybeans shipments to China in total Brazilian exports seen at 80%. In contrast, the share of China in US exports set to fall sharply y/y, to around 45%. For other exporters, the share is at below 35%. pic.twitter.com/GXYraX1Bo9

— International Grains Council (@IGCgrains) September 19, 2018

Brazil's ag consultancy @AgRural raised its projection for the country's 2018/19 soy planted area to 35.8 mln hectares from 35.69 mln has in August #Brazil #soybeans pic.twitter.com/75dL8mMLv1

— Marcelo Teixeira (@tx_marcelo) September 21, 2018

And Bloomberg writer Isis Almeida reported last week that, “President Donald Trump’s trade war with China is turning the global soybean market into a merry-go-round.

With Brazilian exports drying up at this time of the year, traders are having to get creative to supply the world’s largest buyer. One strategy is to bring U.S. soy to Argentina and ship the South American nation’s output to China, thereby avoiding the Asian country’s 25 percent tariff on American product.

“‘Argentina is buying U.S. beans for the domestic market and exporting its own production to China,’ Matt Ammermann, a commodity risk manager at futures and options brokerage INTL FCStone Inc., said by telephone.”

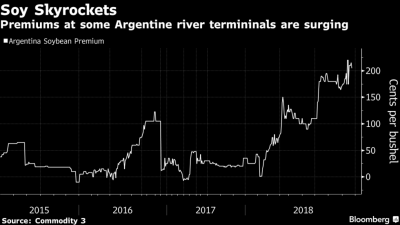

Also with respect to Argentina, Bloomberg writers Shruti Singh and Tatiana Freitas reported Friday that, “At some river terminals in Argentina, the premium for soybeans for November shipment has surged to more than $2.20 a bushel over benchmark futures this month, up from 30 cents a year ago, according to Commodity 3 data compiled by Bloomberg News. With the enticing outlook for export profits, the country has taken the rare step of importing the oilseed to meet domestic demand, while shipping its own crop over to China. The price is also climbing after drought earlier this year hurt yields.”

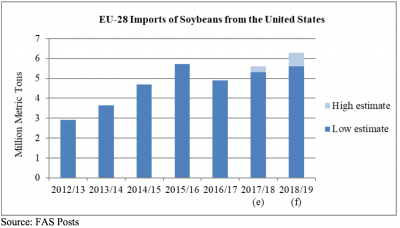

Meanwhile, a news release Thursday from the European Commission stated that, “Today the European Commission has published the latest figures on EU imports of soya beans, showing that the U.S. has become Europe’s main supplier of this commodity, reaching a 52% share compared to 25% in in the same period last year.”

A recent update from USDA’s Foreign Agricultural Service (“EU-28:Oilseeds and Products Update“) stated that, “Regarding the origin of imports, the EU-28 is expected to import more U.S. soybeans and less Brazilian soybeans than previous years. The price of U.S. soybeans collapsed in June 2018 following China’s announcement of retaliatory tariffs and good production forecasts. As a result, in June 2018, EU imports of soybeans from the United States were 6.5 times as high as in June 2017 whereas imports from Brazil were 18 percent lower. In July 2018, imports of U.S. soybeans were 2.7 times as high as one year earlier and imports of Brazilian soybeans were 29 percent lower. The EU-28 is expected to keep importing more U.S. soybeans and less Brazilian soybeans until March 2019. In March 2019, the EU-28 will either keep importing U.S. soybeans or switch to Brazilian soybeans, depending on price.”

ICYMI, @Cargill CEO Dave MacLennan discusses trade war, #agriculture, #soybeans, China with @adsteel on @BloombergTV . See here: https://t.co/wsqyqQgKBe

— Agnieszka de Sousa (@AggieDeSousa) September 25, 2018

In another twist regarding the political implications of the trade war, Bloomberg writers Jennifer A Dlouhy, Mario Parker, and Jennifer Jacobs reported Friday that,

The Trump administration is set to announce a policy change allowing year-round sales of gasoline with more ethanol, a move that could bolster Midwest Republicans in tough election contests and appease corn farmers battered by agricultural tariffs, according to people briefed on the plan.

“President Donald Trump is slated to unveil the new policy in coming weeks, possibly in Iowa, where farmers, biofuel producers and politicians have been clamoring for the move that’s likely to expand the U.S. market for corn-based ethanol. Although the timing of the announcement is in flux, administration officials have confirmed it is coming, said the people, who asked not to be named since the policy hasn’t been made public.”

Steep decline in the US export #prices for #soybeans and #maize (#corn) triggered by anticipated record high production of soybeans and all-time high maize yields pic.twitter.com/p4CjuXcZDt

— Abdolreza Abbassian (@AAbbassian_AMIS) September 21, 2018

Meanwhile, recent news regarding a potential truce in the ongoing trade dispute with China is not positive.

Wall Street Journal writer Lingling Wei reported Saturday that, “China scotched trade talks with the U.S. that were planned for the coming days, according to people briefed on the matter, further dimming prospects for resolving a trade battle between the world’s two largest economies.

“The decision to pull out of the talks follows the latest escalation in trade tensions.”