The world's farmers face soaring fertilizer and fuel prices as the war in the Middle East escalates, leaving some scrambling for supplies as the spring planting season approaches and causing…

U.S. Agricultural Exports Set July Record as China Trade Row Persists

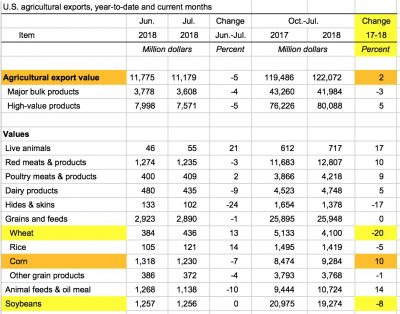

A radio update from USDA on Thursday indicated that U.S. agriculture exports set a record in July. “It’s the best July that the U.S. has seen as far as agricultural exports go, the value total,” said Bryce Cooke, an economist with USDA’s Economic Research Service. The total value of U.S. agricultural exports in July totaled just over $11 billion.

In the radio update, Gary Crawford pointed out that the USDA trade data showed U.S. agricultural exports at $122 billion for first ten months of the fiscal year (October – July), which is two percent ahead of last year.

Nonetheless, soybeans dropped eight percent in value terms, and the value of wheat exports was down by twenty percent. The value of corn exports increased by ten percent.

More narrowly with respect to soybean exports, additional USDA data from last week showed that the total volume of U.S. soybean exports to the world are down about four percent from the time period last year, but for for the month of July, the volume of total U.S. soybean exports were up about forty-eight percent from July of 2017.

The volume of U.S. soybean exports to China were down over fifty percent this July compared to last year, but exports to the EU, Mexico, Egypt, Taiwan and Vietnam increased (see table below).

Recall that late last month in its Outlook for U.S. Agricultural Trade, USDA explained that, “Agricultural exports to China are forecast down $7.0 billion from fiscal 2018 to $12.0 billion as soybean sales are expected to be sharply lower due to retaliatory tariffs, which also curb demand for other products.”

Recent business news articles also provided additional perspective on U.S. soybean exports to China.

Reuters writers Hallie Gu and Dominique Patton reported last week that, “China will almost entirely replace its soybean imports from the United States with Brazilian beans and other origins in the upcoming season, but may run out of the oilseed in early 2019, said an executive with a top crusher on Tuesday.

“The forecast was one of the most bearish yet on the impact of the Sino-U.S. trade war for American farmers.”

Bloomberg News: "One of the biggest U.S. #agricultural exports to #China caught up in the tit-for-tat is #soybeans. The commodity has tumbled about 22 percent since April..." https://t.co/8iXoDEkthx pic.twitter.com/Mmyg0pq1yU

— Farm Policy (@FarmPolicy) September 7, 2018

The article noted, “Imports from the United States will plunge further in the 2018/19 season starting this month to just 700,000 tonnes, said Guo Yanchao, deputy chairman of Jiusan Group.

“That compares with 27.85 million tonnes of U.S. soybeans imported in the prior year.

“Overall, China’s imports of soybeans for the year will drop to 84.67 million tonnes, down 10.79 million tonnes from last year’s purchases, Guo told an industry conference.”

Brazil has expanded its traditional soy exporting windows in recent years. It is happening again this year, of course, as trade war boosted Chinese demand, shows data from Thomson Reuters Eikon/Williams shipping service #Brazil #soybeans pic.twitter.com/otzDy8AurZ

— Marcelo Teixeira (@tx_marcelo) August 27, 2018

On Tuesday, Bloomberg News reported that, “JBA Holdings, a joint venture between companies including Heilongjiang Agriculture Co. and Joyvio Group, will invest $100 million over three years to build a soybean crusher and grain port in Russia amid a push by Chinese firms to diversify their sources of crop supplies.”

#Soybean export forecasts for 2018/19 @AMISoutlook https://t.co/GKYhZ7a2L8 - - #Argentina (up), #Brazil (up), #UnitedStates (down) pic.twitter.com/2dJlbeShS6

— Farm Policy (@FarmPolicy) September 6, 2018

And Reuters writers Hallie Gu and Josephine Mason reported Friday that, “China will start allowing soybean imports from Ethiopia, customs authorities said on Friday, as the world’s top importer seeks to reduce its reliance on supplies of the oilseed from the United States amid a trade row with Washington.”

With respect to U.S. beef and pork exports, USDA’s Agricultural Marketing Service (AMS) pointed out in the September edition of The Economic Landscape that, “The [beef] export volume and value were both up 1 percent from June.

Cumulative beef exports were higher in volume by 10 percent relative to 2017, and value was 20 percent higher.

“Japan, South Korea and Canada were our largest export markets in July.”

The AMS report added, “Pork export volume was 8 percent below June while the value was down 9 percent.

For 2018 so far, pork exports are up from 2017 by 2 percent in volume and 2 percent in value.

“The largest overseas markets for U.S. pork were Japan, Mexico and Canada.”

Additional analysis regarding USDA’s Market Facilitation Program was included on the front page of Saturday’s Des Moines Register.

Donnell Eller reported that, “Iowa farmers could get $550 million from the federal government to help offset damage from a summer of escalating tit-for-tat trade disputes.

“Iowa soybean farmers will receive an estimated $479 million, based on the state’s projected harvest. Iowa pork producers would get between $60 million and $70 million.

Front Page today's @DMRegister: "@realDonaldTrump bailout could yield $550M for #Iowa," https://t.co/O4hjTobn3p by @DonnelleE #trade, #China, #soybeans, #pork pic.twitter.com/s41XzCyxVh

— Farm Policy (@FarmPolicy) September 8, 2018

“The money is part of a $12 billion emergency farm aid program President Donald Trump announced in July and is being provided through the Commodity Credit Corp., an agency formed in 1933 that has $30 billion in bonding authority to support farm prices and incomes.”

The Register article added, “The money comes as Iowa and U.S. farmers face a cash-flow crisis, struggling with four years of falling income.

“‘This is basically a very quick, cash-flow infusion,’ said Iowa State economist Chad Hart, who calculated the amount of aid to Iowa producers with ISU economist Alejandro Plastina.”

.@POTUS on trade: "We have to be treated fairly." https://t.co/NstPrwAW01 pic.twitter.com/Gbli1v5fpn

— Fox News (@FoxNews) September 7, 2018

“On Friday, Trump threatened to impose another $267 billion in tariffs on Chinese goods, on top of the $200 million in new tariffs the president said probably will be implemented soon. If that happens, virtually everything coming from China would be subject to a U.S. tariff,” the Register article said.