Bloomberg's Clarice Couto reported this past Friday that "a surprising tax change in agriculture powerhouse Brazil has the potential to make soy grown in the world’s largest bean exporter less…

U.S., China Trade Dispute Ratchets Higher; USDA Releases September Soybean Estimates

President Trump indicated this week that the U.S. is planning to increase tariffs on Chinese imports, while China responded with proposed tariffs of its own on more U.S. exports. As trade tensions between the two countries increase, the U.S. Department of Agriculture released its latest soybean estimates earlier this month, which provided additional insight into the ongoing agricultural impacts of the trade war.

U.S., China Trade Dispute Ratchets Up

Financial Times writers James Politi and Demetri Sevastopulo reported Monday that, “Donald Trump moved to slap a 10 per cent tariff on about $200bn worth of Chinese imports beginning next week and threatened to increase the rate to 25 per cent in 2019 if no deal was reached to ease trade tensions between the US and China.”

The FT article explained that, “The US has already imposed levies on about $50bn of Chinese imports this year, mainly steel and aluminium products, but the addition of tariffs on a further $200bn worth of products would sharply increase the economic impact to the point where duties will cover about half of all Chinese imports.”

“The move by Mr Trump comes after months of talks between officials in Washington and Beijing that have yielded little progress and increased acrimony between the countries,” Monday’s article said.

"We have given China every opportunity to treat us more fairly, but so far, China has been unwilling to change its practices," Trump said, announcing new tariffs on $200 billion in Chinese imports https://t.co/U1wNrWz2Ra pic.twitter.com/8yk4mkn3rt

— TicToc by Bloomberg (@tictoc) September 18, 2018

Also Tuesday, Bloomberg writers Enda Curran, Andrew Mayeda, and Jenny Leonard reported that, “China announced it will take retaliatory tariff action against $60 billion of U.S. goods, sharply escalating their trade conflict as the Trump administration considers imposing duties on almost all Chinese imports.

China’s retaliatory tariffs, on items ranging from meat to wheat and textiles, will take effect on Sept. 24, China’s Ministry of Finance said in a statement posted on its website. Beijing is still ready to negotiate an end to the trade tensions with the U.S., the ministry said.

Meanwhile, Bloomberg writer Alex Wayne reported Tuesday that, “President Donald Trump threatened to hit back if China targets politically potent U.S. agricultural products for counter-tariffs, following an escalation in his trade war with Beijing.

“‘There will be great and fast economic retaliation against China if our farmers, ranchers and/or industrial workers are targeted!’ Trump said in a tweet Tuesday morning.”

China has openly stated that they are actively trying to impact and change our election by attacking our farmers, ranchers and industrial workers because of their loyalty to me. What China does not understand is that these people are great patriots and fully understand that.....

— Donald J. Trump (@realDonaldTrump) September 18, 2018

.....China has been taking advantage of the United States on Trade for many years. They also know that I am the one that knows how to stop it. There will be great and fast economic retaliation against China if our farmers, ranchers and/or industrial workers are targeted!

— Donald J. Trump (@realDonaldTrump) September 18, 2018

The Bloomberg article pointed out that,

The president’s posts appeared to recognize the potential political harm to him and his party if China targets American agriculture. Republicans are facing long odds in their quest to retain control of the House of Representatives in November’s midterm elections, and their narrow advantage in the Senate will hinge largely on winning seats in states where agriculture is a significant industry.

Peter Navarro on new tariffs on China: "Good for President Trump, it takes both courage and vision to do this." https://t.co/6hxUfwCDgm pic.twitter.com/pI9uVgA4TQ

— FOX Business (@FoxBusiness) September 18, 2018

Adriana Belmont reported last week at Yahoo Finance Online that, “The ongoing battle over tariffs between President Trump and China is negatively affecting farmers across the US.”

The article noted that, “‘The trade war is having impacts on all agricultural sectors,’ Gary Schnitkey, Professor in Farm Management at the University of Illinois, told Yahoo Finance in a phone interview.

“According to a recent map, provided by the US Department of Agriculture’s Economic Research Service and highlighted by the farmdoc project at the University of Illinois, the net cash farm income has decreased in every American region in comparison to 2017.

#Farm business average net cash farm income by resource region, 2018F compared with 2017 @USDA_ERS pic.twitter.com/gWJzylJShb

— Farm Policy (@FarmPolicy) September 2, 2018

“The main agricultural commodities, Schnitkey explained, are soybeans and pork. To a second degree, there are corn, fruits, and vegetables.

‘All of these commodity prices are linked together,’ he said. ‘If soybean prices fall, so do corn and wheat.’ Eventually, every kind of farmer experiences a major loss of income.”

USDA September Soybean Updates

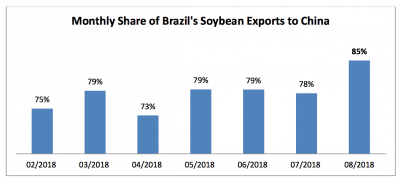

The USDA’s Foreign Agricultural Service (FAS) indicated in its monthly Oilseeds: World Markets and Trade report last week that, “The share of Brazil’s exports destined for China rose to 85 percent in August, 7 percentage points above the previous month. This increase is due to a turn to Brazilian sources by China following the implementation of duties on U.S. soybeans. This has resulted in higher prices for Brazilian soybeans that discouraged purchases by importers other than China. This trend seems likely to continue and may strengthen in the coming months.”

The FAS update stated that, “Using these projected trade flows and current import forecasts, U.S. trade opportunities for markets outside of China would rise nearly 13 million tons in the coming year compared to 2016/17. In contrast, increased purchases of Brazilian soybeans by China would result in an 8-million-ton decline in potential U.S. and other exporter trade to China for the same period. Any reduction in China’s demand in the coming year will likely be absorbed by the United States because of the duties.”

US soybean export prices slump to record discount versus Brazilian beans as trade war bites #USA #Brazil #soybeans #China #tradewar pic.twitter.com/fVTugeo92o

— Marcelo Teixeira (@tx_marcelo) September 18, 2018

And Reuters writer Roberto Samora reported recently that, “China has sought out alternative sources for soybeans after slapping a 25 percent tariff on the oilseed and a raft of other commodities in July in response to tariffs instituted by U.S. President Donald Trump. Brazil, the world’s largest exporter of soybeans, has been a prime target.

“But Brazil’s higher than usual soybean exports are driving down stocks, indicating the country likely will not have much more to offer China until it begins harvesting its next crop in January.”

Most analysts believe that China will be forced to buy U.S. soybeans this fall and into 2019, tariff or no tariff. Insights via @CMEGroup pic.twitter.com/7qT5W9rcqK

— TicToc by Bloomberg (@tictoc) September 12, 2018

In its monthly Oil Crops Outlook report, USDA’s Economic Research Service (ERS) noted last week that, “USDA’s Crop Production report this month indicated an increase in 2018/19 soybean production of 107 million bushels to 4.693 billion. A higher U.S. yield forecast was responsible, which climbed to a record 52.8 bushels per acre from 51.6 bushels last month…Production gains would swell USDA’s forecast of 2018/19 ending stocks to an all-time high 845 million bushels versus 785 million last month. USDA lowered its 2018/19 forecast range for the U.S. season-average farm price by 30 cents to $7.35-$9.85 per bushel.”

Soy hits 10-year low in Chicago. What next? pic.twitter.com/aLLwg5FPom

— Marcelo Teixeira (@tx_marcelo) September 18, 2018

The ERS update indicated that, “…Soybean use by China’s crushing industry is projected lower for both 2017/18 and 2018/19. This month, USDA trimmed its forecast of the country’s soybean crush by 1 million tons to 90 million for 2017/18 and by 1.5 million tons for 2018/19 to 93.5 million. All the shipments by exporters to China that are likely arrive in August and September have moderated. Consequently, USDA forecasts soybean imports by China to slow to 94 million tons for 2017/18 and could remain steady at 94 million through 2018/19. Next year’s carryout stocks in China may also tighten modestly to 20.8 million tons from 22.5 million at the end of 2017/18.”