As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

ERS Report- “An Exploration of Crop Markets: A Deeper Look Into the USDA Crop Baseline Projections.”

On Monday, the USDA’s Economic Research Service (ERS) released a report titled, “An Exploration of Crop Markets: A Deeper Look Into the USDA Crop Baseline Projections,” which discussed the February 2018 USDA long-term crop projections in greater detail. Today’s update highlights aspects of the report relating specifically to corn and soybeans.

Background

The ERS report, which was authored by Mark Ash, Jennifer K. Bond, Thomas Capehart, Nathan W. Childs, Michael McConnell, Leslie Meyer, and Erik J. O’Donoghue, stated that, “This report complements the USDA Agricultural Projections to 2027 report released in February 2018 by providing a roadmap of the process for generating the U.S. Department of Agriculture’s long-term projections.”

Monday’s report explained that, “By outlining the assumptions and reasoning behind these projections, the report enables inferences on how the projections might change under varying circumstances.”

The Corn Market

The report noted that, “Ending stocks for corn are the largest they have been in over 20 years, and they continue to grow. This places downward pressure on prices, limiting the incentives to plant more acres in the future.

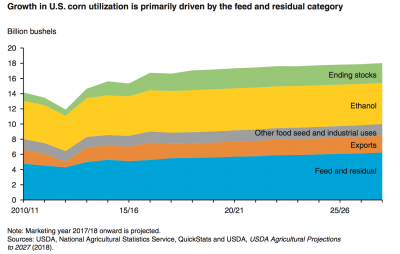

Domestically, the largest growth component for corn currently comes from the feed and residual category.

“As the population continues to grow, meat consumption is expected to grow as well, particularly for poultry. Over the next 10 years, feed and residual uses are expected to grow nearly 13 percent.”

“Other categories of corn use, however, including ethanol demand, remain comparatively flat. The ethanol market is relatively mature.”

The report indicated that, “Moreover, gasoline consumption is expected to decline, primarily due to increased vehicle fuel efficiency, and to be further constrained by lower estimates for miles driven, based on assumptions about economic factors, changes in driving habits, the number of drivers, and gasoline prices.”

In addition, the authors pointed out that, “Prospects for the other food, seed, and industrial categories are mixed. During the long-term, domestic production of HFCS is expected to continue a slight downward trend as sugar supplies remain strong and competitive…[and]…Starch production from corn, used in building materials and paper products, is expected to remain steady over the projection period.”

With respect to corn exports, the ERS report stated that, “Global demand for corn continues to grow. Rising global incomes mean that diets are shifting away from traditional sources of protein such as beans and backyard livestock and toward products supplied through cold-chain processing of domestic production and sales in fast-food venues, especially in urban areas. This translates to an increase in demand for feed, in which corn plays a large role.

Corn exports are expected to increase by roughly 16 percent over the next 10 years, growing from 1.9 billion bushels to 2.2 billion by 2027. However, despite the increase in exports, global demand will rise faster, and overall, the United States is expected to lose some of its share of world trade.

“Brazil corn production–particularly from its second-crop corn–along with production in Argentina and Ukraine, among other countries—is expected to continue expanding, leading to increased shipments from these countries.”

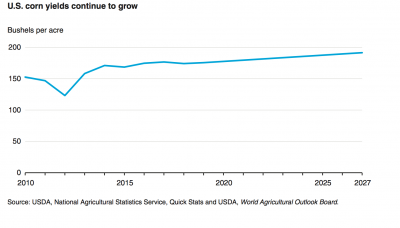

While addressing domestic production variables, Monday’s report stated that, “Corn yields are expected to continue to grow at roughly 0.9 percent per year, averaging over 191 bushels per acre by 2027.”

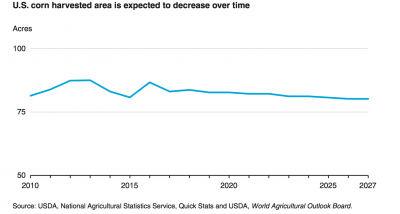

“Each year, given limited demand growth and continued yield gains, less land is required to produce the same level of output. These trends also free up land previously (or currently) planted to corn for other crops. Without constraining corn production, the land sown to corn is expected to decline over the next decade.”

“Despite a decline in planted area, corn plantings are still expected to remain between 87 and 90 million acres through 2027. Coupled with yield gains, slow domestic growth, and limited export opportunities, corn stocks will not be reduced easily.”

The Soybean Market

(Since Monday’s ERS report is a companion piece to the baseline projections released in February of 2018, it explains the main circumstances that, in the fall of 2017, were expected to drive these markets for the next 10 years. As such, the report does not incorporate a change in variables due to the implementation of soybean tariffs by China, that have subsequently occurred.)

The ERS authors pointed out that, “Exceptionally favorable weather over the last few years has produced soybean yields above the trend. Assuming average weather conditions in 2018/19, the U.S. average soybean yield may contract moderately. The combination of expected record acreage and good weather is projected to yield a harvest second only to the 2017/18 high. Coupling this production with larger than usual beginning stocks (the highest in 11 years) could result in the largest ever total supply of soybeans. Provided that the acreage and yield projections are realized, 2018/19 soybean prices would remain under pressure even with the most optimistic outlook for demand.”

Monday’s report noted that, “Domestic demand makes up roughly 48 percent of total soybean use over the projection period and is expected to grow slowly, with the abundant supplies supporting an increase in the soybean crush.”

The authors pointed out that, “Historically, U.S. soybean demand has had a predominantly domestic orientation, despite formerly being the world’s largest exporter of the crop. Over the last two decades, however, the U.S. market landscape has been permanently reshaped by the extraordinary gains in China’s soybean demand; for the last 2 years, more U.S. soybeans have been shipped into the export market than used domestically.”

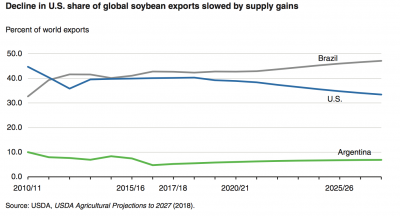

Also on soybean exports, the ERS report pointed out that, “The current U.S. share of the global export market is far from assured for next year, as foreign competition will remain formidable.”

“In South America, where exportable supplies are also at record highs, stiff export competition will persist. Each year, soybean supplies in Brazil are establishing new heights, with a steady expansion of area and yield improvement. Recent expansion of port capacity in the country is lowering the freight cost and delivery time of export shipments.”

Conclusion

The ERS authors noted that, “This report complements the USDA Agricultural Projections to 2027 report that was developed in late 2017 and released in February, 2018 by providing a general roadmap of the process by which those long-term projections are generated…[A]rmed with this understanding, the reader can adapt the projections to circumstances that were unforeseen at the time the projections were made.”