A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

Farmers Seek Additional Markets for Soy, While Fears Grow for Lasting Trade Impacts

Reuters writers P.J. Huffstutter and Karl Plume reported Wednesday that, “Clouds crowded the Illinois sky as Nick Harre walked away from his combine at the peak of harvest to join four fellow farmers in greeting some unlikely visitors.

“Inside a nearby seed barn, they made their pitch to eight Sri Lankan government officials: Please buy our soybeans.”

The article noted that,

U.S. farmers would need about 11,000 markets the size of Sri Lanka to replace Chinese soybean purchases, but these days many growers will take any shred of new business they can get. A small but growing number of farmers have all but given up waiting for diplomatic solutions and started scrambling themselves to help open new markets and salvage existing ones disrupted by tariffs, according to dozens of interviews with producers, industry officials and trade lobbying groups.

Huffstutter and Plume explained that, “The grassroots movement comes as the agrarian economy is in its fifth year of financial woe, with oversupply undermining revenues. Corn and soybean prices are hovering near decade lows, and this year’s bumper harvest is further swelling U.S. farmers’ massive stocks of unsold grain.”

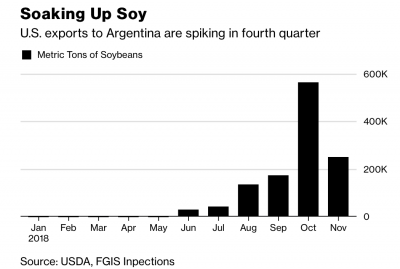

Meanwhile, Bloomberg writers Kevin Varley and Shruti Singh reported Tuesday that, “The world of soybean shipping has turned upside down thanks to the ongoing U.S.-China trade war.

“Argentina, the No. 3 global soy grower, is making major purchases of U.S. supplies. A weekly measure of American shipments to the Latin American nation just rose to the highest in at least 35 years, U.S. government data showed Tuesday.”

The Bloomberg article noted that, “With China shunning U.S. supplies, the Asian country is soaking up oilseeds from everywhere else. Argentina usually processes its beans at home before sending soy meal and oil abroad. Now, enticed by China’s voracious appetite and a changed domestic tax structure, the country is shipping more raw soy, with some analysts predicting exports could quadruple.

“In order to feed its domestic soy-crushing industry, Argentina is increasingly turning to imports, especially after a drought earlier this year hurt crops.”

And in its monthly Oil Crops Outlook report this week, USDA’s Economic Research Service (ERS) stated that,

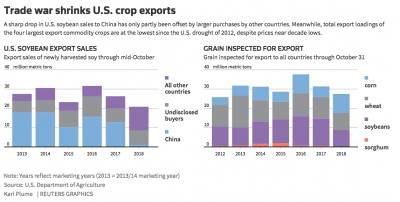

Even with robust soybean sales to other countries, the current lack of sales to China—the top global import market—prompted USDA to lower its forecast of 2018/19 exports this month by 160 million bushels to 1.9 billion, versus 2.13 billion for 2017/18.

ERS pointed out that, “Outside of China, foreign soybean importers have capitalized on bargain-priced U.S. supplies. In the European Union this year, a higher soybean crush is being encouraged by a diminished rapeseed supply and a scarcity of soybean meal shipments from Argentina. At the same time, competition from China has also depleted the normal supply of South American soybeans in Europe. Consequently, EU purchases of U.S. soybeans have swelled 150 percent compared to a year ago. Likewise, U.S. soybean sales to Mexico, Argentina, Egypt, and other Asian markets have surged. As of November 1, the year-to-year increase in U.S. sales to countries other than China is equivalent to 239 million bushels.”

“Still, robust U.S. soybean sales to these import markets have not fully offset the lack of purchases from China, which alone accounts for nearly 60 percent of global trade. A 25-percent hike in China’s import tariff on U.S. soybeans in July remains intact.

By November 1, U.S. export sales commitments of soybeans to China had plummeted 94 percent from a year earlier.

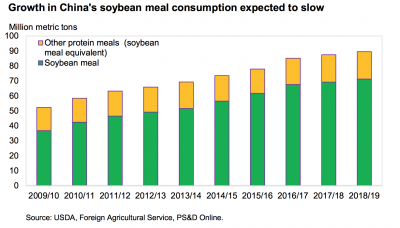

The Outlook report added that, “Rapidly rising costs of soybean meal in China are encouraging feed compounders to substitute as many other proteins as possible. China is facilitating the substitution by recently ending a ban on imports of Indian rapeseed meal. Higher costs for soybean meal could moderate the overall protein level of feed rations, as well.”

In a related article Wednesday, Reuters writers Hallie Gu and Dominique Patton reported that, “China’s top pig farming company Wens Foodstuffs Group Co Ltd will comply with new government-backed guidelines on lower protein in animal feed, a company executive said, adding however that the impact on its operations would be minimal.

“China’s Feed Industry Association last month approved new standards for pig and chicken feeds, with lower protein levels as Beijing seeks to reduce its consumption of soymeal amid an ongoing trade spat with major soybean supplier the United States.”

Also this week, Bloomberg writers Megan Durisin and Anatoly Medetsky reported that, “U.S. soybean prices are likely to drop further if the country doesn’t resolve its trade spat with China and if there are large South American supplies, said Dan Basse, president of consultant AgResource Co. Without a trade deal, futures could fall as low as $7.50 a bushel, he said.”

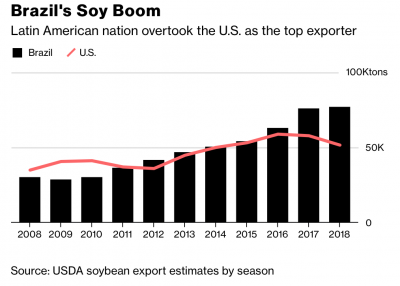

However, Reuters writers Hallie Gu and Dominique Patton reported this week that, “Farmers across South America are expected to produce more soybeans in 2018/19, an industry analyst said on Wednesday, as they take advantage of a trade war that has curbed U.S. exports to the world’s top buyer China.

“Producers in Brazil are investing more resources to increase the planted area in 2018/19 to a record 36.2 million hectares, Andre Debastiani, partner at Brazil Agroconsult told an industry conference in Guangzhou.”

More broadly, Bloomberg writer Isis Almeida reported this week that, “If history is any guide, the trade war with China will have lasting affects for U.S. farmers and their soybean crops that the president won’t be boasting about.

“Donald Trump is set to meet Xi Jinping, his counterpart in China, at the G-20 summit and traders are optimistic for a resolution.

But a flashback to Richard Nixon’s 1973 soybean embargo and Jimmy Carter’s 1980 Soviet grain ban suggest that what’s already happened this year may lead to permanent changes ahead as China seeks alternatives to the U.S. market.

The Bloomberg article added that, “As China looks elsewhere for its beans, many countries could jump on the bandwagon and look to boost planted areas. The obvious candidates would be in South America, but Russian Prime Minister Dmitry Medvedev has already warned his country is planning to increase production in the Far East for delivery to China.”