Bloomberg's Clarice Couto reported this past Friday that "a surprising tax change in agriculture powerhouse Brazil has the potential to make soy grown in the world’s largest bean exporter less…

U.S., China Trade Talks Continue as the Farm Economy Shows Signs of Strain

China purchased more U.S. soybeans last week as trade negotiations between the two countries are set to continue this week in Beijing. Meanwhile, a front page article in the Wall Street Journal last week pointed to signs of strain in the U.S. agricultural economy. It appears that farmers will continue to deal with uncertainty on the trade front as 2019 unfolds.

Background: China Buys Some U.S. Soybeans, Trade Talks Progress

Recall that late last month, at the conclusion of trade talks between the U.S. and China, President Trump met with Chinese Vice Premier Liu He in the oval office.

The Wall Street Journal reported at the time that, “At the meeting, Mr. Liu said China would buy 5 million tons of U.S. soybeans daily, a number Mr. Trump repeated, adding it would ‘make our farmers very happy.’ The administration later clarified that China has agreed to buy an additional 5 million metric tons of soybeans—but not daily, and no time frame was specified.”

In addition, Associated Press writer Paul Wiseman reported on Tuesday that, “The world’s two biggest economies didn’t make much progress [in trade talks] on their differences over the aggressive tactics — including cybertheft — that Beijing is allegedly using to challenge U.S. supremacy in cutting-edge industries like driverless cars and artificial intelligence.

But to the president’s delight, they did agree on one thing: In an unexpected deal that even surprised the top U.S. trade negotiator, China said that it would buy 5 million metric tons of American soybeans over an unspecified period.

“‘China as a sign of goodwill has agreed to purchase a tremendous, massive amount of soybeans,’ Trump told reporters.”

Bloomberg News reported Tuesday that, “China’s back buying more U.S. soybeans just days after the last round of purchases by the world’s top importer.

“State-run buyer Cofco Corp. bought almost 1 million metric tons of the oilseed, while Sinograin purchased more than a million tons, the two companies said in separate statements on Tuesday. That follows an announcement on Saturday that they had purchased 2 million tons from America after officials from the two countries met in Washington for trade negotiations.”

The Bloomberg article added that, “American exporters sold 2.603 million tons of soybeans to China for delivery by Aug. 31, the U.S. Department of Agriculture said on Tuesday. That’s the third-largest daily transaction in the agency’s records. On Monday, the USDA reported sales of 612,000 tons for the same period.”

In a tweet on Wednesday morning, Karen Braun, a global agriculture columnist at Thomson Reuters, provided a summary of last week’s daily USDA soybean sales announcements:

Here's a summary of the week's daily sales announcements so far:

— Karen Braun (@kannbwx) February 6, 2019

▪️4.257 million tonnes of #soybeans in total

▪️3.8 million to #China (3.74M for 18-19, 63K for 19-20)

▪️456K tonnes to unknown for 18-19 pic.twitter.com/TVAkcu08J7

Meanwhile, Wall Street Journal writers Bob Davis and Vivian Salama reported last week that, “The U.S. is dispatching its chief trade negotiator, Robert Lighthizer, and Treasury Secretary Steven Mnuchin to Beijing early next week to continue trade talks as a March 1 deadline to reach an accord nears, a senior Trump administration official said Tuesday.”

The Journal article noted that, “In talks between the two nations last week in Washington, the official said, the Chinese agreed to broaden the areas for discussion to include items China had previously declared off-limits because of national-security reasons.”

Treasury Secretary @stevenmnuchin1 is going to Beijing next week to work on a trade deal: "We are very focused on free and fair trade for U.S. companies to have access there and to have a more level playing field which will bring down the trade deficit." pic.twitter.com/hhmQvx5nDU

— Squawk Box (@SquawkCNBC) February 6, 2019

With respect to the outlook on the talks, Jeff Cox reported last week at CNBC Online that, “White House economic advisor Larry Kudlow said Thursday that the administration is hoping for a trade agreement with China but much work remains before anything is finalized.

‘The president has indicated that he’s optimistic with respect to a potential trade deal,’ Kudlow, director of the National Economic Council, said on Fox Business. ‘But we’ve got a pretty sizable distance to go here.'”

White House announces details of @USTradeRep Lighthizer’s Feb. 14-15 trip to China next week. pic.twitter.com/t337xVnEg6

— Adam Behsudi (@ABehsudi) February 8, 2019

And New York Times writer Alan Rappeport reported late last week that, “President Trump said on Thursday that he would not meet this month with President Xi Jinping of China, raising new concerns that the United States will not be able to complete a trade deal with China before American tariffs increase on March 2.”

However, Bloomberg News reported on Saturday that, “China said Vice Premier Liu He will join U.S. Trade Representative Robert Lighthizer and Treasury Secretary Steven Mnuchin in high-level trade talks between the two countries next week.”

More optimistically, Wall Street Journal writer Jacob Bunge reported on Tuesday that, “Agricultural executives are upbeat that the U.S. and China will resolve a nearly yearlong trade dispute that has upended food exports and hurt business for both countries’ farmers and food companies.

“Archer Daniels Midland Co. Chief Executive Juan Luciano said the Chicago-based grain company anticipates a trade deal in the months ahead that will enable U.S. soybeans and other agricultural products to resume their normal flow to China by the end of 2019.”

Farm Strain, Producer Uncertainty

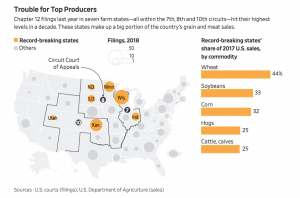

Jesse Newman and Jacob Bunge reported on the front page of Thursday’s Wall Street Journal that, “A wave of bankruptcies is sweeping the U.S. Farm Belt as trade disputes add pain to the low commodity prices that have been grinding down American farmers for years.

“Throughout much of the Midwest, U.S. farmers are filing for chapter 12 bankruptcy protection at levels not seen for at least a decade, a Wall Street Journal review of federal data shows.”

Ryan McCrimmon reported last week at Politico that, “President Donald Trump’s trade war is magnifying some of the toughest farm conditions since the crisis that bankrupted thousands of farmers in the 1980s — and threatening a constituency crucial to his reelection hopes.

“The president’s trade policies have sent U.S. agricultural exports plunging, exacerbating already difficult economic conditions facing farmers. Average farm income has fallen to near 15-year lows under Trump, and in some areas of the country, farm bankruptcies are soaring.”

As a result of the #TradeWar, the value of total US #agricultural #exports in 2019 is expected to fall to $141.5 B, down $1.9 B YoY, according to @USDA’s latest projections. The loss of #soybean exports will account for most of the decline https://t.co/LQdIN4FsaV @CoBank pic.twitter.com/2MRUzco1Tc

— Farm Policy (@FarmPolicy) January 25, 2019

And Kevin Barlow reported last week at the Pantagraph Online (Bloomington, Illinois) that, “Some farmers are starting to get anxious for news about trade agreements and the prospects for 2019.

“‘Once the first of the year gets here, you start getting anxious for the new season,’ said Bob Freeman, who farms near Lincoln in Logan County. ‘I have been farming for 25 years and I don’t remember a year with this much uncertainty. Some of us are thinking about new equipment, but you kind of hate to buy anything if you aren’t exactly sure what is going to happen.'”

‘I just need to know what I’m dealing with,’ he said. ‘From there, I can manage.’

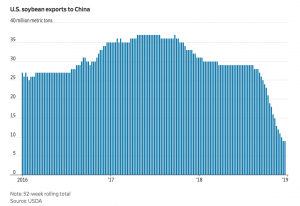

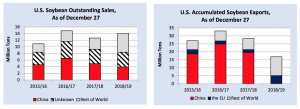

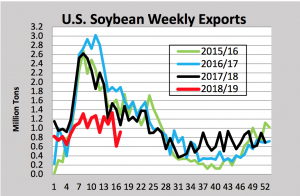

An update on Friday from USDA’s Foreign Agricultural Service (“Oilseeds: World Markets and Trade“) stated that, “For the week ending December 27, 2018, U.S. 2018/19 soybean export commitments (outstanding sales plus accumulated exports) to China totaled 4.3 million tons compared to 24.5 million a year ago. Total commitments to the world were 31.0 million tons, compared to 41.1 million for the same period last year.

“Accumulated soybean exports were at 16.9 million tons, 40 percent below the same period last year. Accumulated soybean exports to China were at 341,000 tons, 19.2 million tons less compared to last year. Shipments to the rest of the world were at 16.6 million tons, 7.8 million above the last marketing year for the same period.”

On Friday, the World Agricultural Outlook Board pointed out in its latest World Agricultural Supply and Demand Estimates report that, “The 2018/19 U.S. season-average farm price forecast for soybeans is projected at $8.10 to $9.10 per bushel, unchanged at the midpoint.”