Recent news articles and government reports show that African Swine Fever (ASF) continues to have a disrupting impact on soybean and pork markets. Today's update highlights key points from several…

African Swine Fever: Market Impacts Persist

Articles last week documented some of the recent impacts that African swine fever is having on hog markets, including in the U.S. Today’s update looks at key points from several of these news items.

Bloomberg writers Alfred Cang and Atul Prakash reported last week that, “The relentless proliferation of African swine fever on farms in East Asia is sending shivers through the region’s livestock industry, with more than a million hogs culled since the disease first appeared in August, and that’s just according to official tallies.

“Demand for soybean meal, an essential ingredient for animal feed, is expected to shrink in China for the first time in more than a decade after the sickness spread to almost the entire country.

The nation is the world’s biggest hog producer and top importer of soybeans.

“In Vietnam, the virus has reached 23 provinces and cities, while about 10 percent of the herd in Mongolia has perished or been destroyed since January. Thailand is keeping a close vigil after cases were reported in neighboring Cambodia.”

The Bloomberg article explained that, “The deadly pig illness has the potential to further depress soymeal futures in China, which have already slumped 25 percent from an October high. Shrinking hog herds and heavy economic losses for farmers may scar the business for years to come. A recent outbreak of H5N1 bird flu in China’s northeast only adds to their plight. Still, one person’s loss is another’s gain as hog futures in Chicago have soared on optimism over import demand from China.”

On Wednesday, Wall Street Journal writer Jacky Wong reported that, “China, which produced and consumed around half of the world’s pork last year, could face a shortage of the meat because of the disease [African swine fever], which is highly infectious but harmless to humans.”

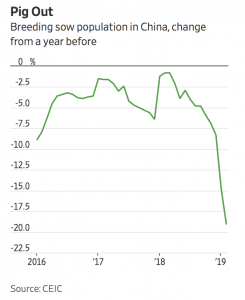

The Journal article explained that, “China’s pig population in February was 17% lower than the year before, according to the government—a decline almost equal to the total number of pigs in U.S. farms. The population of breeding sows has fallen even faster, down almost 20%.”

“U.S. pork exports to China and Hong Kong fell 21% in 2018, according to the U.S. Meat Export Federation, after China slapped retaliatory tariffs of up to 70% on the meat.

But faced with the shortage, China may have no choice but to import much more pork, even from the U.S. Hog futures traded on the Chicago Mercantile Exchange have surged nearly 50% in the past month amid expectations that China will push up pork prices in the U.S.

Reuters writer Tom Polansek reported late last week that, “China’s purchases of U.S. pork climbed to the highest in at least six years last week, U.S. Department of Agriculture data showed on Thursday, as a fatal hog disease continued to spread in the Asian country. The sale of 77,732 tonnes of U.S pork in the week ended April 4 gives hope to U.S. hog farmers and meat companies such as WH Group Ltd’s Smithfield Foods that China’s demand will increase further. U.S. pork sales to China sank last year after Beijing imposed retaliatory duties of 62 percent on shipments in the two countries’ ongoing trade war.

“The weekly sales were the biggest to China since the U.S. Department of Agriculture records began in 2013.”

Mr. Polansek pointed out that,

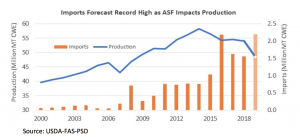

The USDA, in a report published this week, forecast that China will increase pork imports from the U.S. and other countries by 41 percent from 2018 to a record high because of African swine fever.

“Chinese pork production will likely decline 10 percent due to the liquidation of hog herds, according to the agency’s Foreign Agricultural Service.”

Meanwhile, Bloomberg writer Irene Garcia Perez reported on Thursday that, “Meat prices — whether it’s chicken, beef, seafood or even fake meat — are likely to rise because of a global shortages caused by a deadly hog virus that’s sweeping across China.

“That’s according to a new report by Rabobank, which predicted widespread knock-on effects for the agriculture industry globally as African swine fever decimates Chinese hog farms. More than a million hogs have been culled in East Asia since the disease first appeared in August, and the consequences are already reshaping global trade.”

The Bloomberg article noted that, “Chinese pork production may decline about 30 percent in 2019 because of the virus, Rabobank predicted. To put that figure into context, a drop of that size would be roughly the same as Europe’s entire annual pork supply, the bank said.”

Ms. Perez noted that, “Chinese consumers will have to eat less pork and turn to other kinds of meat, like poultry, beef, fish and ‘alternative proteins,’ according to Rabobank, a Dutch lender that specializes in agriculture financing. Additionally, meat supplies around the world may be redirected to China to satisfy the country’s deficit in protein, the bank said.”

A pig apocalypse in China due to African swine fever has farmers putting their animals in high-security farms #非洲豬瘟 pic.twitter.com/bsCPjFckEh

— TicToc by Bloomberg (@tictoc) April 12, 2019

And Huileng Tan reported last week at CNBC Online that, “China’s March consumer inflation rose to a five-month high due to rising food prices, data from the country’s National Bureau of Statistics released Thursday showed.

“Consumer price index (CPI) in March rose 2.3 percent from a year ago — the quickest pace since October 2018.”

The article stated that, “Food CPI was up 4.1 percent on year in March, up sharply from a 0.7 on-year rise in February due to a seasonal rise in vegetable prices and an on-year rise in pork prices, said the statistics bureau. Farmers in China have been culling their hogs in a bid to stem the spread of African swine fever, driving up pork prices.”