A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

Farmland Values Currently Steady Economic Concerns- But Potential for Declines Exist

Recent news items from the Corn Belt point to several economic challenges facing producers as spring planting approaches. Nonetheless, relatively steady farmland values continue to be a bright spot. But a recent update from the Federal Reserve Bank of Kansas City noted that: “If farmland sales continue to increase in 2019 alongside persistently low agricultural commodity prices and higher interest rates, farmland values could decline further.”

Economic Challenges in the Corn Belt

Donnelle Eller reported on the front page of Sunday’s Des Moines Register that, “Dozens of Iowa farmers may be unable to get operating loans to buy seed, pay rent or make tractor payments this year, a sign of the growing cracks in the state’s ag economy.

“Nearly 3 percent of Iowa farm borrowers will be unable to get renewed financing, the Chicago Federal Reserve said in February, based on a survey of lenders.

‘We have a percentage of farmers who are at the end of their credit ropes,’ said Chad Hart, an Iowa State University agricultural economist.

The article explained that, “Farm bankruptcies remain relatively low in Iowa, but some financial data is raising concerns among economists:

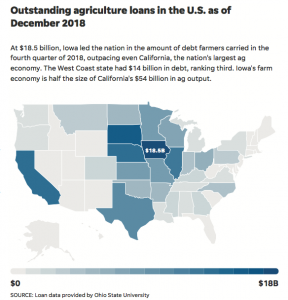

- Iowa had the most agriculture debt of any other state in the nation last year at $18.5 billion, outpacing even California, the country’s largest farm economy, which ranked third with nearly $14 billion in debt. Nationally, debt is projected to reach the highest level since the 1980s farm crisis.

- Iowa loan delinquencies nearly quadrupled to $223 million over the past five years, the fourth-largest amount nationally. Despite the increase, Iowa’s delinquency rate remains a low 1.2%, ranking 41st in the nation.

- Nearly 7% of the farm borrowers in the Chicago Fed district — all of Iowa and most of Illinois, Indiana, Michigan and Wisconsin — were struggling to repay loans, the largest percentage since 1999, based on a 2018 fourth-quarter report.”

Ms. Eller pointed out that, “Unlike the 1980s farm crisis, farmland values remain relatively strong, though down 17% last year from a 2013 high. U.S. farm income tumbled 44 percent during that same stretch.”

The Register article also noted that, “Soybeans are unlikely to reach pre-tariff prices for four more years, and exports won’t recover for seven years, USDA projections show.”

And earlier this month, Minneapolis Star Tribune writer Jim Spencer reported that, “America’s depressed agricultural economy is not yet at ‘a tipping point where vast numbers of farms will be lost,’ the CEO of one of the country’s biggest agricultural lenders says. But ‘there’s bleeding going on’ thanks to a confluence of low commodity prices, bad weather and tariffs.

It’s forcing some farmers to refinance loans and convincing others to retire.

“‘It’s a slow erosion,’ said Rod Hebrink, chief executive of Compeer Financial, a 43,000-member cooperative operating in the Midwest.”

The U.S. corn pile continues to grow. What impact will lower demand have on the market? Insights via @CMEGroup pic.twitter.com/jv2d0MeBWy

— TicToc by Bloomberg (@tictoc) April 12, 2019

The article stated that, “Many grain farmers have not generated income for four or five years owing to bad market and weather conditions, Hebrink said. They have been living off working capital.

“‘You can’t draw on equity forever,’ he said.”

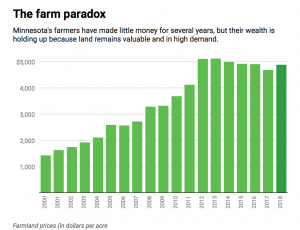

A Bright Spot: Farmland Values

However, in a separate Star Tribune article recently, Adam Belz reported that, “Farmland values leveled off after 2014, but acreage is still selling at historically high prices in the Upper Midwest. And that’s a good thing for Minnesota farmers, who endured their least profitable year in three decades in 2018 thanks to low grain, meat and milk prices, a trade war with China and bad weather.

“Despite all the headwinds in agriculture, average land values in Minnesota rose 4.5 percent in 2018, according to data compiled at the University of Minnesota. Anecdotally, land prices haven’t dropped this year.

“‘The current land market defies economic logic a little bit,’ said Wendong Zhang, an economist who runs the Iowa State University Farmland Value Survey.”

The article noted that,

The resilience of land prices is staving off a deeper financial crisis for farmers as the trade war drags on, commodity prices stay low and another wet spring threatens to delay planting.

“Zhang, at Iowa State, said growing farm financial stress is starting to force lenders to encourage farmers to sell land. As that happens more, supply may increase and prices may be affected. Another reason more land could come on the market is the age of farmers. In Iowa, for instance, more than 60 percent of land is owned by a farmer older than 65,” the article said.

Farmland Values- Future Concerns

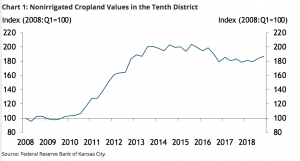

An update last week from the Federal Reserve Bank of Kansas City, (“The Outlook for Farmland Values amid Higher Interest Rates,” by Cortney Cowley and Nathan Kauffman) stated that, “Over the last four years, farm real estate markets have faced pressure due to low commodity prices and deteriorating farm income. From 2013 to 2018, farm income in the United States declined more than 50 percent, and working capital declined 65 percent. Despite these developments, the Federal Reserve Bank of Kansas City’s Survey of Agricultural Credit Conditions shows farmland values remained relatively stable, declining only modestly in most areas. Indeed, Chart 1 (below) shows that in the Tenth District, cropland values declined only 16 percent from 2013 to 2018. Farmland values in other states across the Midwest and Great Plains declined by similarly modest amounts over this period.”

The Kansas City Fed update noted that,

Although farm real estate markets have been relatively stable amid significant declines in commodity prices and farm income, risks of further declines in farmland values appear to have increased.

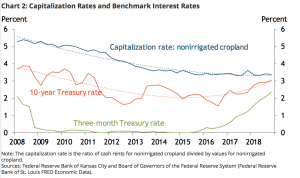

“Chart 2 (below) shows that capitalization rates, which can be calculated as the ratio of cash rents to farmland values, have decreased continuously over the past decade, falling from 5.4 percent in 2009 to 3.3 percent by the end of 2018. Capitalization rates approximate the annual rate of return a buyer or investor expects to receive on farm real estate; lower capitalization rates imply, from an investment perspective, that land owners are receiving lower returns on capital invested in farmland.”

Discussing Chart 2 (above) in more detail, Cowley and Kauffman explained that, “The decline in capitalization rates coincided with a rise in interest rates. The gaps between the blue line and the green and orange lines in Chart 2 show that in 2018, the spread between capitalization rates on farmland and risk-free returns narrowed to its lowest level in 10 years. For the spread to return to a more historical level in the current interest rate environment, either cash rents would need to increase or farmland values would need to decline. Given current commodity prices in agriculture, it seems unlikely that cash rents will increase in the foreseeable future. Thus, for the spread to return to a more historically normal level, farmland values would need to decline.”

This graph should scare anyone thinking of buying Corn Belt farm land right now. https://t.co/rFfJv32Bjg

— Scott Irwin (@ScottIrwinUI) April 15, 2019

The Fed update also pointed out that, “A recent increase in farmland sales in some states also suggests a decline in farmland values could be on the horizon. In 2018, the volume of farmland sales increased in some Tenth District states for the first time in several years.”

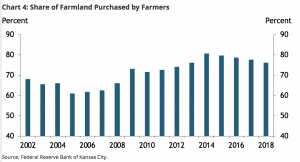

Cowley and Kauffman indicated that, “Together, the uptick in farmland sales in some states and the lower spread between returns to farmland and benchmark interest rates suggest farmland values could decline further. Thus far, farmland values have remained relatively stable, and demand for farmland has generally remained steady. For example, despite significant declines in farm income, farmers have generally remained active buyers in farm real estate markets. In fact, Chart 4 (below) shows that farmers accounted for more than 75 percent of farmland purchases in the Tenth District in 2018.

“One explanation for this trend is that farmers and investors continue to be attracted to farmland as a strategic investment. In addition, farmers and investors may be more willing to accept lower returns on farmland than in the past. However, if farmland sales continue to increase in 2019 alongside persistently low agricultural commodity prices and higher interest rates, farmland values could decline further.”