As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Federal Reserve Ag Credit Surveys- 2019 First Quarter Farm Economy Conditions

Last week, the Federal Reserve Banks of Chicago, St. Louis and Kansas City released updates regarding farm income, farmland values and agricultural credit conditions from the first quarter of 2019. And earlier this year, the Federal Reserve Bank of Dallas released its Agricultural Survey for the first quarter of 2019. Today’s update highlights core findings from the Fed reports.

Federal Reserve Bank of Chicago

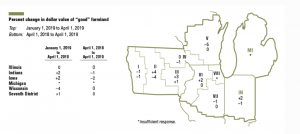

David Oppedahl, a Senior Business Economist at the Chicago Fed, explained in The AgLetter that, “District agricultural land values were the same in the first quarter of 2019 as in the first quarter of 2018, although they did move up 1 percent from the fourth quarter of 2018. Indiana and Iowa saw year-over-year decreases in farmland values, while Illinois and Wisconsin saw no changes.”

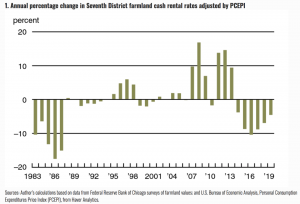

The AgLetter noted that, “After being adjusted for inflation with the Personal Consumption Expenditures Price Index (PCEPI), District agricultural land values were down (by 1 percent) on a year-over-year basis for the 19th straight quarter in the first quarter of 2019.”

The Chicago Fed stated that,

The stability of District farmland values persisted even as the demand for agricultural land softened from a year ago and the supply on the market grew modestly.

With respect to cash rents, Thursday’s update pointed out that, “Another indicator of weakening markets for farmland was a 3 percent decrease in cash rental rates for District agricultural ground from 2018 to 2019. For 2019, average annual cash rents to lease farmland were down 2 percent in Illinois, 3 percent in Indiana, 4 percent in Iowa, 2 percent in Michigan, and 4 percent in Wisconsin. After being adjusted for inflation with the PCEPI, District cash rental rates slipped 5 percent from 2018.

“This was the sixth straight year of declining real cash rents—the longest such downturn since 1981 (when the survey started to track cash rents).”

Mr. Oppedahl added that, “The vast majority of the survey respondents anticipated agricultural land values to be unchanged in the second quarter of 2019: 75 percent of responding bankers expected farmland values to be stable, 24 percent expected them to decline, and 1 percent expected them to rise.”

Federal Reserve Bank of St. Louis

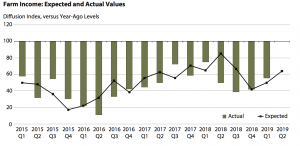

The Agricultural Finance Monitor stated on Thursday, “For the twenty-first consecutive quarter, a majority of agricultural bankers in the Eighth Federal Reserve District reported that farm income had declined compared with the same quarter a year earlier. However, some bankers expect farm income to improve in the second quarter.”

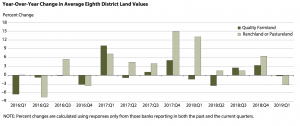

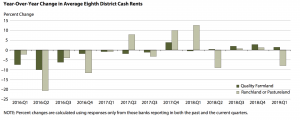

With respect to land values and cash rental rates, The Monitor noted that,

Bankers reported some erosion in land values in the first quarter, as quality farmland values declined 0.3 percent and ranchland or pastureland values declined 3.3 percent from a year earlier. Cash rents for quality farmland rose slightly in the first quarter, while cash rents for ranchland or pastureland fell appreciably.

The St. Louis Fed also indicated that, “The second special question asked the bankers to assess the most significant risk to the farm sector in 2019. Perhaps not surprisingly, a clear majority—62 percent of the respondents—indicated that an adverse trade outcome presents the most significant risk to the farm sector this year. A little less than a quarter of the bankers (23 percent), by contrast, believe that an increase in input prices is the most significant risk in 2019. Rising interest rates and declining land prices are generally not seen as significant risks to the farm sector in 2019.”

Federal Reserve Bank of Kansas City

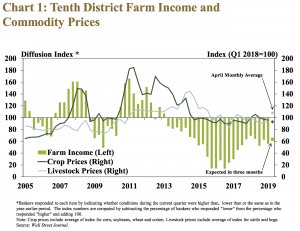

Nathan Kauffman and Ty Kreitman, writing in Thursday’s Ag Credit Survey from the Kansas City Fed, noted that, “A majority of bankers across the District continued to report decreases in farm income during the first quarter. Despite a slight improvement in livestock prices toward the end of the period, the pace of decline in farm income quickened slightly from a year ago and from the prior quarter. A similar pace of decline also was expected in coming months.”

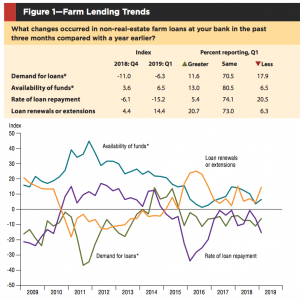

The Survey pointed out that, “As farm income remained low, demand for farm loans remained high and the ability of farm borrowers to repay loans weakened at a slightly faster pace than in previous quarters. Lower rates of repayment in Missouri and Nebraska were the largest contributors to overall weakness in farm loan repayment rates across the District.”

The Kansas City Fed also pointed out that,

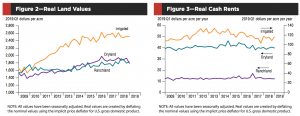

Farm real estate values in the Tenth District were relatively steady compared with a year ago despite pressure from weaknesses in the farm sector and higher interest rates.

“In fact, the value of nonirrigated cropland increased slightly for the first time since 2015.”

In summary, Thursday’s report noted that, “Despite higher interest rates and added deterioration in farm income and credit conditions, however, farmland markets remained relatively steady as an important source of support for Tenth District agriculture.”

Federal Reserve Bank of Dallas

Earlier this year, the Federal Reserve Bank of Dallas released its Agricultural Survey for the first quarter of 2019, which stated that, “Demand for agricultural loans overall declined for a 14th consecutive quarter. Loan renewals and extensions increased, and the rate of loan repayment declined to its lowest pace since the end of 2016. Loan volume fell across all major categories compared with a year ago, with the sharpest declines in dairy, farm machinery and farm real estate loans.”

The Dallas Fed noted that, “District ranchland values ticked up this quarter, while irrigated cropland values slipped modestly, and dryland values fell to a four- year low.”

“The anticipated trend in the farmland values index was flat for a second consecutive quarter, suggesting respondents expect farmland values to hold steady in the upcoming months,” the Survey said.