As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Kansas City Fed: Ag Banks Make Adjustments

An update last month from the Federal Reserve Bank of Kansas City (“Ag Banks Make Adjustments as Lending Remains Elevated,” by

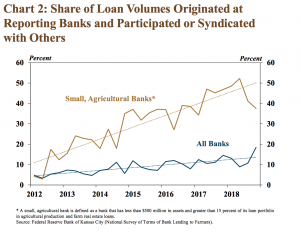

More narrowly, the Fed update explained that, “Alongside ongoing growth in demand for farm loans, a larger share of new loans has been originated with participation or syndication status. Although participations have been on a slight upward trend at all banks, they have risen significantly in recent years at small, agricultural banks.”

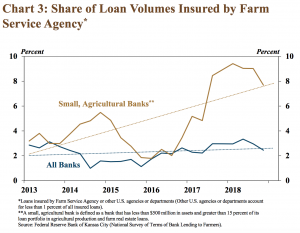

And with respect to federal lending assistance, last month’s update noted that, “In addition, more loans at small, agricultural banks have been insured by the Farm Service Agency (FSA) or other government agencies.

“Although a relatively small share of new loan volumes was insured by FSA, small, agricultural banks in recent years have utilized loan insurance and guarantees more than other banks.

Increased levels of loan guarantees and participations at small, agricultural banks relative to all banks could be an indication of elevated financial stress in the farm sector.

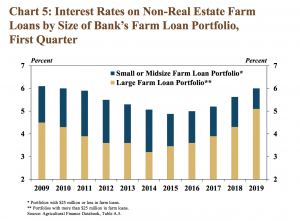

On the issue of interest rates, the Fed update stated that, “As agricultural lending activity continued to increase, interest rates on non-real estate farm loans also edged higher. Furthermore, interest rates on non-real estate farm loans at banks with large farm loan portfolios increased at a faster pace in the first quarter than interest rates at banks with small or midsized farm loan portfolios.”

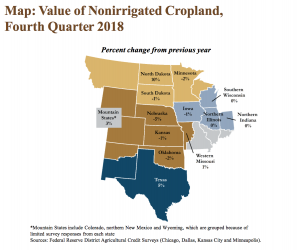

Turning to farmland values, the Fed update indicated that,

Despite lower farm income, weak credit conditions and higher interest rates, farm real estate values generally remained stable.

“For states exhibiting declines in the value of nonirrigated farmland, the changes remained modest through the end of 2018, providing ongoing support to the farm sector. As weaknesses in the overall farm economy have persisted, risks to the outlook for farmland include slightly higher interest rates and underlying supply and demand fundamentals of farm real estate markets.”

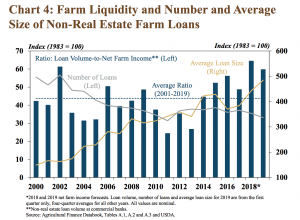

“Despite a slight decline in the total number of loans reported by agricultural bankers, farm lending continued to increase in the first quarter of 2019. The growth in loan volumes was due primarily to additional increases in the average size of loans to farmers. Alongside larger loans and higher loan volumes, small, agricultural banks have made adjustments to continue to meet strong demand from farm borrowers and mitigate risks associated with lending in a low income environment. Despite continued weakness in agricultural credit conditions, earnings at agricultural banks have remained strong, delinquency rates low and farmland values stable.”