As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Conflicting Perspectives on China’s Promise to Purchase More U.S. Farm Goods

Recent news reports have noted that U.S., China trade negotiations have been revived, but that China has yet to move forward with large U.S. agricultural purchases, as promised by President Trump. Separately, news items last week also discussed recent U.S. agricultural export data.

China Yet to Make Large Purchases of U.S. Farm Products

Last week, Wall Street Journal writers William Mauldin, Josh Zumbrun and Chao Deng reported that, “Top American and China negotiators are set to speak this week in an effort to revive stalled trade talks, as discord over prior commitments and political considerations threaten to bog down discussions.”

The article explained that, “Among the sore spots: U.S. demands for China to buy more American agricultural and industrial products and to enforce protection of intellectual property and China’s insistence that the U.S. remove tariffs on $250 billion in Chinese goods.”

More narrowly, the Journal writers pointed out that, “In his press conference in Osaka, Mr. Trump also promised relief for U.S. farmers, who have been caught in the middle of the conflict as China slowed its purchases of U.S. soybeans, corn and other products.

“‘China is going to be buying a tremendous amount of food and agricultural product, and they’re going to start that very soon, almost immediately,’ Mr. Trump said.

“China, however, has made no official mention of a commitment to purchasing more U.S. agricultural products, and a person with knowledge of the event said Mr. Xi made no such promise during his meeting with Mr. Trump.”

Also last week, Reuters News reported that, “White House economic adviser Larry Kudlow on Tuesday said China was expected to move forward with agriculture purchases from the United States even as trade talks continued between the two countries.”

And, Ana Swanson and Keith Bradsher reported in Wednesday’s New York Times that, “President Trump emerged from a June meeting in Japan with Xi Jinping, the Chinese president, saying that China would immediately begin purchasing American farm products in return for a trade truce that would forestall more United States tariffs on Chinese goods.

China did not see it that way. People familiar with the negotiations say China has denied making any explicit commitment to buy American farm products during those discussions and instead saw large-scale purchases as contingent on progress toward a final trade deal that is still nowhere in sight.

The Times article noted that, “In the days leading up to the meeting between Mr. Trump and Mr. Xi in Osaka, China made large purchases of soybeans as an apparent good-will gesture. On June 28, the United States Agriculture Department announced that Chinese importers had bought 544,000 tons of soybeans, the largest sale to China since late March.

“But no unusually large purchases have been reported since then, and it remains unclear whether China will continue making significant purchases.”

Mexico is doing great at the Border, but China is letting us down in that they have not been buying the agricultural products from our great Farmers that they said they would. Hopefully they will start soon!

— Donald J. Trump (@realDonaldTrump) July 11, 2019

On Friday, Bloomberg News reported that,

When it comes to Chinese purchases of U.S. agricultural goods, signs are growing that President Donald Trump won’t get what he wants anytime soon.

“Trump complained Thursday that China hasn’t boosted its purchases of U.S. farm products, a promise he claims he secured in a meeting with his counterpart Xi Jinping in June. But according to officials in Beijing familiar with the talks, no such agreement was made. China’s Commerce Ministry yesterday also indicated that in their view, substantial discussions have yet to restart even though both sides spoke on the phone.

“China has started preparing to buy farm products, including gauging the prices of U.S. soybeans, but will not purchase large amounts until it sees concrete progress in the negotiations, a person familiar with the matter said Friday. Small purchases could happen before that, the person said.”

Friday’s article added that, “U.S. Department of Agriculture data indicate that China actually slowed its purchases of American agriculture products following the Osaka meeting. The nation bought 127,800 metric tons of U.S. soybeans last week, a 79% reduction from the previous week. Similarly, China bought just 76 tons of American pork, compared to 10,400 tons in June.”

Closer Look at U.S. Agricultural Exports

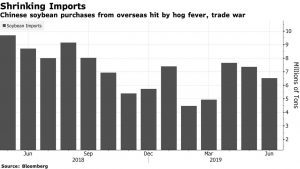

A separate Bloomberg News article Friday reported that, “Soybean imports by China, the top buyer, tumbled in June and in the first half as African swine fever slashed hog herds and cut demand for feed. Private Chinese companies are still not buying U.S. supplies because of 25% retaliatory tariffs on American imports imposed as part of the trade war.

“China bought 6.51 million tons of soybeans last month, down from 7.36 million tons in May and from 8.70 million in June last year, according to official customs data.”

Meanwhile, this month’s Oilseeds: World Markets and Trade report from USDA’s Foreign Agricultural Service (FAS) stated that, “This month, U.S. soybean exports for 2019/20 are lowered from 53.1 million tons to 51.0 million despite near-record supplies. The reduction is driven by a sharp cut to U.S. soybean production (by 8.3 million tons to 104.6 million) due to difficult planting conditions. These factors, paired with large Brazilian supplies and uncertainties over China’s demand caused by the outbreak of African swine fever and the trade tensions, will continue to fuel market uncertainty.”

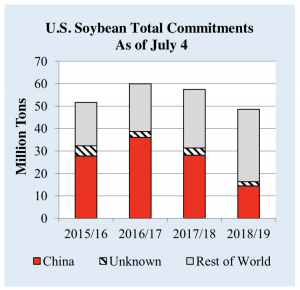

The FAS report also stated that, “For the week ending July 4, 2019, U.S. 2018/19 soybean export commitments (outstanding sales plus accumulated exports) to China totaled 14.5 million tons compared to 28.1 million a year ago. Total commitments to the world were 48.6 million tons, compared to 57.5 million for the same period last year. Accumulated soybean exports were at 38.5 million tons, down 11.8 million from last year. Accumulated soybean exports to China were at 8.7 million tons, 18.7 million tons lower compared to last year. Shipments to the rest of the world were at 29.8 million tons, 6.9 million above last year for the same period.”

More broadly, Bloomberg writer Mario Parker reported last week that,

The longer the trade war between the U.S. and China persists, the more permanent the shift in trade flows of agricultural products will become.

“That’s according to David Dines, the chief financial officer of Cargill Inc., America’s largest privately-held company. The agribusiness giant on Thursday posted the steepest profit decline in four years partly because of the tumult caused by Donald Trump’s spat with China.”

#Soybean Stocks, #UnitedStates, @usda_nass pic.twitter.com/cMBAiDNP8n

— Farm Policy (@FarmPolicy) June 28, 2019

Mr. Parker noted that, “American farmers have suffered a series of blows over the past year. As the trade war damps demand, crop inventories have built up, adding to a supply overhang. Meanwhile, a torrent of rain in the U.S. Midwest this year has flooded waterways, washed out farms and even kept consumers from taking to outdoor grills, hurting prospects for meat demand.”