As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

USDA Releases Further Details of Trade Aid for Farmers

Recall that back in May, the Trump administration announced a new $16 billion trade aid package for U.S. farmers harmed by the ongoing trade conflict with China. In early June, the U.S. Department of Agriculture released additional details associated with the program. On Thursday, many final points of the program were made available. Today’s update highlights some of these additional program details.

This is the second year that producers will be compensated for trade related losses. The Department announced its initial trade compensation package last summer, which like the latest round of aid, was described as short-term relief, not a program that would make producers whole.

A U.S. Department of Agriculture news release on Thursday stated that, “American farmers have dealt with unjustified retaliatory tariffs and decades of non-tariff trade disruptions, which have curtailed U.S. exports to China and other nations. Trade damages from such retaliation and market distortions have impacted a host of U.S. commodities. High tariffs disrupt normal marketing patterns, raising costs by forcing commodities to find new markets. Additionally, American goods shipped to China have been slowed from reaching market by unusually strict or cumbersome entry procedures, which affect the quality and marketability of perishable crops. These boost marketing costs and unfairly affect our producers. USDA is using a variety of programs to support American farmers, ranchers, and producers.

“MFP signup at local FSA offices will run from Monday, July 29 through Friday, December 6, 2019.

“Payments will be made by the Farm Service Agency (FSA) under the authority of the Commodity Credit Corporation (CCC) Charter Act to producers of alfalfa hay, barley, canola, corn, crambe, dried beans, dry peas, extra-long staple cotton, flaxseed, lentils, long grain and medium grain rice, millet, mustard seed, oats, peanuts, rapeseed, rye, safflower, sesame seed, small and large chickpeas, sorghum, soybeans, sunflower seed, temperate japonica rice, triticale, upland cotton, and wheat.

MFP assistance for those non-specialty crops is based on a single county payment rate multiplied by a farm’s total plantings of MFP-eligible crops in aggregate in 2019. Those per-acre payments are not dependent on which of those crops are planted in 2019. A producer’s total payment-eligible plantings cannot exceed total 2018 plantings. County payment rates range from $15 to $150 per acre, depending on the impact of unjustified trade retaliation in that county.

Thursday’s update added that, “The MFP rule and a related Notice of Funding Availability will be published in the Federal Register on July 29, 2019, when signup begins at local FSA offices. Per-acre non-specialty crop county payment rates, specialty crop payment rates, and livestock payment rates are all currently available on farmers.gov.

Market Facilitation Program: county payment rates range from $15 to $150 per acre - lookup your county https://t.co/ku8cLjXo2o #grow19 pic.twitter.com/5WsPuXJ8x6

— Dept. of Agriculture (@USDA) July 25, 2019

“MFP payments will be made in up-to three tranches, with the second and third tranches evaluated as market conditions and trade opportunities dictate. If conditions warrant, the second and third tranches will be made in November and early January, respectively. The first tranche will be comprised of the higher of either 50 percent of a producer’s calculated payment or $15 per acre, which may reduce potential payments to be made in tranches two or three. USDA will begin making first tranche payments in mid-to-late August.”

In addition, Thursday’s release pointed out that, “Many producers were affected by natural disasters this spring, such as flooding, that kept them out of the field for extended periods of time. Producers who filed a prevented planting claim and planted an FSA-certified cover crop, with the potential to be harvested qualify for a $15 per acre payment. Acres that were never planted in 2019 are not eligible for an MFP payment.

5. I agree with USDA officials that MFP2 is not distortionary about WHAT you planted IF you could plant. The distortion has to do with WHETHER you plant something or not.

— Scott Irwin (@ScottIrwinUI) July 25, 2019

“In June, H.R. 2157, the Additional Supplemental Appropriations for Disaster Relief Act of 2019 was signed into law by President Trump, requiring a change to the first round of MFP assistance provided in 2018. Producers previously deemed ineligible for MFP in 2018 because they had an average AGI level higher than $900,000 may now be eligible for 2018 MFP benefits. Those producers must be able to verify 75 percent or more of their average AGI was derived from farming and ranching to qualify. This supplemental MFP signup period will run parallel to the 2019 MFP signup, from July 29 through December 6, 2019.”

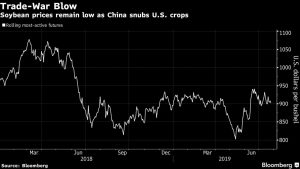

Wall Street Journal writers Jacob Bunge and Jesse Newman reported on Thursday that, “The tariffs slashed Chinese purchases of U.S. soybeans by 75% over the 12 months ended May 31, according to USDA data, reducing per-bushel prices paid to farmers and prompting many to shift fields to corn this spring. Tariffs on U.S. pork have left U.S. hog producers and meatpackers to watch while China ramps up meat purchases from countries like Spain, Brazil and Australia to replenish supplies after a pig disease decimated Chinese hog farms.”

MFP payments range from $15 to $150 across the U.S., rates are higher in #cottonbelt and along Mississippi River MAP: every county's MFP payment rate, more today from @FarmBureau @NepveuxMichael pic.twitter.com/P2SmgOsxJ3

— John Newton (@New10_AgEcon) July 26, 2019

The Journal article added that, “No applicant can collect more than $500,000 under the program, and farmers can’t get a payment if they have made more than $900,000 a year in 2014 to 2016, the USDA said.”

Also Thursday, Bloomberg writers Mike Dorning and Mario Parker reported that,

The aid uses similar damage criteria as last year’s $12 billion tranche. But rather than payments based on crop type, the new program sets a per-county rate based on the blend of crops grown in the area of $15 to $150 an acre.

“Agricultural markets largely took the announcement in their stride given the package is designed to avoid distorting planting decisions.”

The Bloomberg writers explained that, “The aid calculation may be more generous than last year because of a modification in the way the department calculates trade losses.

“The new payments will be based on the shortfall in exports of each crop compared to the highest year of exports over the past decade, said USDA Chief Economist Robert Johannson. Last year’s payments were based on the shortfall in exports compared to 2017.

“Still, [Sec. of Agriculture Sonny Perdue] said individual farmers shouldn’t expect the aid will fully compensate them for trade losses. ‘There’s no promises and no thoughts this will make anyone whole,’ he said.”

And Des Moines Register writer Donnelle Eller reported on Thursday that, “Depending on where Iowa farmers live, they could receive between $40 and $79 an acre in the latest round of federal payments, designed to soften the blow from an ongoing trade war with China.”

County level payments rates for MFP announced by USDA today. Sign up begins Monday, July 29 through December 6, 2019. See https://t.co/UY0vv6FEWT for program details. Prevented planting acres with cover crop may be eligible for $15/acre. pic.twitter.com/OUmDVev0xd

— Ag Decision Maker (@ISU_AgDM) July 25, 2019

The Register article stated that, “This year’s $16 billion trade bailout is the Trump administration’s second round. Last year, the Trump administration provided $12 billion to offset trade damage caused by disputes with China, Mexico, Canada and the European Union.

“China’s soybean purchases dropped 74% to $3.1 billion in 2018, and pork sales fell 21% to $852 million. Mexico’s purchases of U.S. pork fell 13% to $1.3 billion.

“This year, the agency didn’t include trade damage from Canada and Mexico, which has lifted retaliatory tariffs, given a proposed new trade deal, said Rob Johannson, USDA’s chief economist.”

Gregory Meyer reported at The Financial Times Online on Thursday that, “The first round of federal payments has shored up farm finances as a grain surplus weighs on prices. US stocks of soyabeans in June stood at 48.7m tonnes, 47 per cent higher than a year before. Despite scattered purchases, US soyabean export commitments to China have halved from a year ago to 14.3m tonnes in the marketing year that ends August 31. Grain futures are near the lowest level in decades.”

The FT article noted that, “In addition to the direct farm payments, the agriculture department plans to spend $1.4bn to purchase foodstuffs for donation to charities, expanding last year’s programme, and to provide funds to organisations that promote exports of US agricultural goods.

Mr Perdue said he did not expect to repeat the programme next year: ‘There are no plans for 2020.’

Meanwhile, Associated Press writer Joe MacDonald reported on Thursday that, “Chinese companies are willing to import more U.S. farm goods, the Ministry of Commerce said Thursday, as envoys prepared to meet in Shanghai next week for talks aimed at ending a tariff war.

“The announcement appeared to be aimed at defusing President Donald Trump’s criticism that Beijing was backsliding on a promise to narrow its trade surplus with the United States by purchasing more American farm products.”

And Bloomberg News reported Thursday that, “The Chinese government has approved several domestic companies to buy U.S. cotton, corn, sorghum and pork without being subject to hefty retaliatory tariffs, according to people familiar with the situation.

“Some textile mills have been given permission to purchase a total 50,000 tons of U.S. cotton without paying the 25% retaliatory duty, the people said. A number of companies will also be exempt from the tariffs on American pork, corn, and sorghum, the people said, without specifying the volume.

“The move follows the approval of some 3 million tons of U.S. soybeans for purchase with tariff waivers, according to people familiar with the situation earlier this week. There could be a second round of exemptions depending on how the trade talks progress, they said. China’s commerce ministry didn’t respond to a fax seeking comment.”

However, Reuters writers Hallie Gu and Shivani Singh reported earlier this week that, “Despite the carrot of a potential exemption from import tariffs, Chinese soybean crushers are unlikely to buy in bulk from the United States any time soon as they grapple with poor margins and longer-term doubts about Sino-U.S. trade relations, people familiar with the matter said.”

The article pointed out that, “But even without the extra tariffs, U.S. soybeans could not compete with Brazilian supplies on price until at least October, based on current premiums and margins, according to six traders and analysts surveyed by Reuters, making immediate orders unlikely.

“‘It is hard to see buying of large U.S. shipments (for delivery to China) for the time being,’ said Li Qiang, chief analyst with Shanghai JC Intelligence Co Ltd.”