Bloomberg's Clarice Couto reported this past Friday that "a surprising tax change in agriculture powerhouse Brazil has the potential to make soy grown in the world’s largest bean exporter less…

Trade Tensions Simmer; China Purchases U.S. Farm Goods as African Swine Fever Impacts Pork Market

On Thursday, Wall Street Journal writers Lingling Wei, Chao Deng and Josh Zumbrun reported that, “China is looking to narrow the scope of its negotiations with the U.S. to only trade matters, seeking to put thornier national-security issues on a separate track in a bid to break deadlocked talks with the U.S.”

The Journal writers explained that,

Thursday’s move is the latest in a series of steps officials in Washington and Beijing are taking to ease trade tensions ahead of high-level negotiations in October.

“It followed President Trump’s move on Wednesday to postpone until Oct. 15 a tariff increase on roughly $250 billion in imports that had been set to hit on Oct. 1, in what he called a goodwill gesture as China marks the 70th anniversary of Communist rule on that date.

....on October 1st, we have agreed, as a gesture of good will, to move the increased Tariffs on 250 Billion Dollars worth of goods (25% to 30%), from October 1st to October 15th.

— Donald J. Trump (@realDonaldTrump) September 11, 2019

“Chinese negotiators, meanwhile, are making plans to boost purchases of U.S. agricultural products, give American companies greater access to China’s market and bolster intellectual-property protections, people familiar with their plans said. China also this week announced a series of exemptions to its tariffs on U.S. imports.”

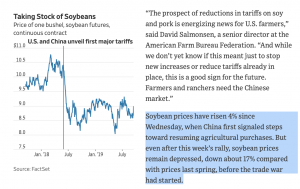

Also Thursday, Reuters writer Karl Plume reported that, “Privately run Chinese firms bought at least 10 boatloads of U.S. soybeans on Thursday, the country’s most significant purchases since at least June, traders said, ahead of high-level talks next month aimed at ending a bilateral trade war that has lasted more than a year.

“The soybean purchases, which at more than 600,000 tonnes were the largest by Chinese private importers in more than a year, are slated for shipment from U.S. Pacific Northwest export terminals from October to December, two traders with knowledge of the deals said.”

It is expected that China will be buying large amounts of our agricultural products!

— Donald J. Trump (@realDonaldTrump) September 12, 2019

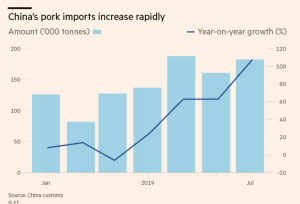

Mr. Plume added that, “Also on Thursday, the U.S. Department of Agriculture (USDA) reported China bought 10,878 tonnes of U.S. pork in the week ended September 5, the most in a single week since May.”

Private exporters reported to @USDA #export sales of 204,000 MT of #soybeans for delivery to #China during MY 2019/2020. https://t.co/n5rsFXKgME

— Foreign Ag Service (@USDAForeignAg) September 13, 2019

Private exporters report sales of 256,000 MT of #soybeans for delivery to China during MY 2019/2020. https://t.co/AV6kiamSxj

— Foreign Ag Service (@USDAForeignAg) September 16, 2019

Meanwhile, Bloomberg writer Josh Wingrove reported on Thursday that, “President Donald Trump said he would be open to an interim trade deal with China but would prefer a lasting deal.”

The Bloomberg article pointed out that, “Trump administration officials have discussed offering a limited trade agreement to China that would delay and even roll back some U.S. tariffs for the first time in exchange for Chinese commitments on intellectual property and agricultural purchases, according to five people familiar with the matter.”

Trump advisers are considering an interim deal with China to delay tariffs. @sdonnan breaks it down ▶️https://t.co/cThj0QtVnC pic.twitter.com/A7zFoHvbHo

— Bloomberg TV (@BloombergTV) September 12, 2019

Then on Friday, Tom Hancock and James Politi reported at The Financial Times Online that, “China said it would cancel additional tariffs on imports of soyabeans and pork that it intends to purchase from the US, in the latest of a series of goodwill gestures aimed at de-escalating a trade war between the world’s two largest economies.

The operative word is "additional" tariffs--i.e., the additional 5% China imposed on Sep 1. Still means the 25% surcharge is on the books. Lets get back to 3% and let commercials (not COFCO or Sinograin) decide when to import. https://t.co/YXKdwDEQQ3

— JoeGlauber--IFPRI (@JoeGlauber1) September 13, 2019

“China has encouraged companies to buy ‘a certain quantity’ of pork and soyabeans from the US and they will be exempted from additional tariffs, state-run broadcaster CCTV reported, apparently referring to duties imposed since the start of the trade war.”

China said it is encouraging companies to buy U.S. farm products including soybeans and pork as trade tensions thaw https://t.co/PSaK1xzRLb pic.twitter.com/5MuLOBd9ST

— Bloomberg TV (@BloombergTV) September 13, 2019

The FT writers explained that, “Beijing’s pledge to purchase unspecified amounts of both products from the US at the same tariff rates it applies to other WTO members came hours after US President Donald Trump said he would consider doing an ‘interim deal’ with China.

People briefed on the matter said the idea being discussed within the Trump administration was to return to the status quo earlier this year, when tariffs were in place on $250bn of Chinese exports.

New York Times writer Alexandra Stevenson provided additional perspective on this development Friday, pointing out that, “The easing of agricultural tariffs could also help China with its own problems. Food inflation has been rising as the Chinese authorities battle an epidemic of swine fever, which has forced China to cull more than a million pigs. Pork is a staple of the Chinese diet.”

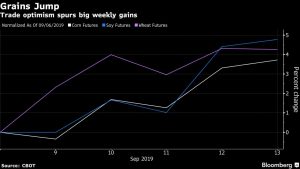

With respect to the market impact of some of these trade developments, Bloomberg writer Michael Hirtzer reported on Friday that, “There’s been plenty of back and forth in the U.S.-China trade war. But for the first time in months, crop markets have started to show some optimism that the two sides can reach a deal, giving American farmers some hope.”

“Soybean futures closed the week up more than 4%, the biggest gain for the November contract since May. October hogs surged 10%, the most since April, and cotton had its best week since June 2018,” the Bloomberg article said.

Additional trade news regarding soy, China and Argentina also emerged last week.

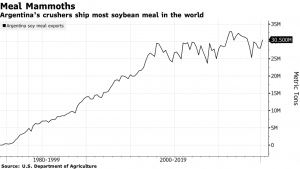

Reuters writers Hugh Bronstein and Maximilian Heath reported last week that,

China will allow the import of soymeal livestock feed from Argentina for the first time under a deal announced by Buenos Aires on Tuesday, an agreement that will link the world’s top exporter of the feed with the top global consumer.

The Reuters article explained that, “Argentina had tried for years to break into the Chinese market, the biggest consumer of the meal it uses to feed its massive hog herd. China, with its own crushing industry to protect, had steadfastly resisted.

“The U.S.-China trade war, however, strengthened Argentina’s hand, prompting China to expand its soymeal import options, market sources say.”

Jonathan Gilbert noted last week at Bloomberg that, “Beijing has been loathe to accept Argentine meal because it prefers to import raw soybeans and process them in China to promote its own crushing industry. But the trade war has been turning global supply chains on their head.”

In other developments, Washington Post writer Jeff Stein reported last week that, “Senior government officials, including some in the White House, privately expressed concern that the Trump administration’s nearly $30 billion bailout for farmers needed stronger legal backing, according to multiple people who participated in the planning.”

And on Saturday, Washington Post writers Jeff Stein and Mike DeBonis reported that, “House Appropriations Committee Chair Nita Lowey (D-N.Y.) is proposing to block the White House request over its farm bailout program, according to a draft of legislation reviewed by the Washington Post, potentially imperiling President Trump’s ability to direct payments to thousands of farmers.”