Bloomberg's Leah Nylen reported Thursday that "a Colorado judge issued an order temporarily blocking the proposed $25 billion merger of Kroger Co. and Albertsons Cos., which has been challenged by…

Kansas City Fed: Farm Lending Growth Slows, But Weakness in the Sector Persists

In an update last week from the Federal Reserve Bank of Kansas City (“Farm Lending Slows but Remains High“)

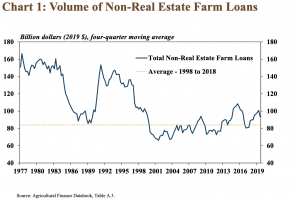

Last week’s update noted that, “Demand for farm loans remained strong, but slowed in the third quarter, according to the National Survey of Terms of Lending to Farmers. A significant increase in the volume of non-real estate loans in the third quarter of 2018 was offset by a decline of similar magnitude in the third quarter of 2019. However, on a rolling four-quarter basis, non-real estate lending only was about 2 percent lower than a year ago.”

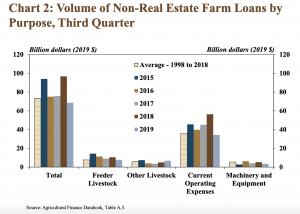

“A decrease in the volume of farm operating loans drove the slowdown in non-real estate lending relative to a year ago.

Following sharp increases in 2018, loans used to finance current operating expenses declined in the third quarter, returning to the prior 20-year average.

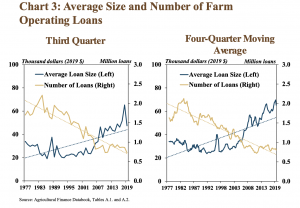

Cowley and Kreitman pointed out that, “A decline in average loan size contributed to the drop in operating loan volumes. The average size of operating loans continued to follow a long-term trend of increases, but the pace of increase slowed.”

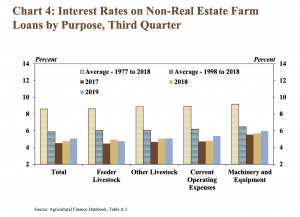

And with respect to interest rates, the Kansas City Fed update indicated that, “Interest rates on new non-real estate farm loans increased modestly. The average rate charged on all loan categories except feeder livestock rose slightly in the third quarter.”

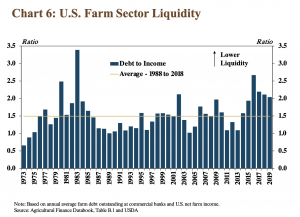

In a look at broader financial variables, last week’s update explained that, “Farm sector debt continued to increase as liquidity in the sector generally has remained low. Debt-to-income ratios have declined slightly from historically high levels in 2016.

However, in the third quarter, outstanding debt in the farm sector was more than twice as large as farm income and remained above a historical average.

“Although the USDA forecasted a slight increase in farm income in 2019, liquidity could remain weak, due, in part, to continued growth in farm debt.”

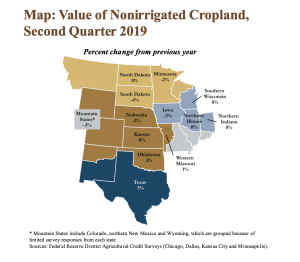

Cowley and Kreitman also pointed out that, “Despite further deterioration in agricultural credit conditions and weather constraints, farmland values remained relatively stable. In most states across the upper Plains, Midwest and Corn Belt, farmland values declined slightly or remained unchanged. Conversely, agricultural lenders in Oklahoma and Texas reported slight increases in farm real estate values.”

In conclusion, the Kansas City Fed update stated that, “Despite reduced agricultural lending activity at commercial banks in the third quarter, loan volumes in the farm sector remained elevated. Alongside elevated lending levels, credit quality has deteriorated slightly in recent years at agricultural banks. In general, agricultural lenders reported that the pace of weakening in credit conditions has slowed. However, adverse weather conditions and elevated levels of debt relative to income could continue to weigh on the outlook for agricultural lending conditions in 2019.”