As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Propane Supply Pressures Amid Late Harvest, Add to Unsettling Farm Economic Indicators

Propane Supply Concerns Amid Late Harvest

DTN writer Russ Quinn reported on Friday that, “As if the 2019 growing season didn’t have enough weather challenges, corn harvest has come to a complete halt for some farmers as propane for crop drying has been hard to secure. Increased demand nationwide due to extremely cold weather is limiting supplies available for drying crops.

“While extremely frustrating for these who have seen corn harvest stifled, the good news is more-seasonable temperatures are expected to return to most of the country. This, in turn, should lower demand for propane and make more available to the market; but it will take some time.”

Mr. Quinn explained that, “The lack of propane supplies for crop drying is more evident the farther north you move in the Midwest. This region faced a double whammy with crops that were wet and locations farther away from the pipelines that supply the product.”

Matt Undlin, a farmer from Lansford, North Dakota, told DTN his corn harvest could be stalled for the rest of November due to lack of propane to dry down his crop. His retailer said they were 10 semi-loads behind and priority will be given to hospitals, churches, schools, businesses and residences. If any propane is left, it will be made available for crop drying, he said.

“The same situation is also present farther east. Roxi Thompson, who farms near Harmony, Minnesota, could not get propane last week to continue harvesting corn,” the DTN article said.

A news release last week from the House Agriculture Committee stated that, “[Committee] Chairman Collin C. Peterson and a bipartisan group of lawmakers sent a letter today to Federal Energy Regulatory Commission (FERC) Chairman Neil Chatterjee on behalf of farmers and rural residents across the Midwest, to bring awareness to the need for a continued supply of propane to Midwest states.

“The letter aims to ensure that FERC is aware that farmers and grain elevator operators are dealing with propane shortages while trying to finish harvest and prepare grain for storage. This is happening as below normal temperatures have arrived early and residential use of propane is also increasing. In 2014, FERC took extraordinary measures to address catastrophic conditions and propane shortages. This letter intends to remind the commissioners that they have tools to help address the conditions facing our rural communities.”

.@FERC is concerned about the plight of Midwest farmers & grain elevator operators who are dealing w/ #propane shortages. We are aware this is a particularly difficult situation as they are finishing the harvest & preparing grain for storage. @HouseAgDemshttps://t.co/VABKe5UFUh

— Neil Chatterjee (@FERChatterjee) November 15, 2019

We thank FERC for taking this step as they work with the propane industry and pipeline companies to get supplies to those in rural America who need it, farmers, grain elevators, livestock producers and rural residents. https://t.co/EEzzI6KZsd

— House Agriculture Committee (@HouseAgDems) November 20, 2019

Meanwhile, Thursday’s Grain Transportation Report from USDA’s Agricultural Marketing Service indicated that, “This year’s wet grain harvest conditions in the Midwest have put pressure on propane supplies in the region. Propane remains the first choice of fuel in the Midwest for drying grain. According to the Department of Energy’s Energy Information Administration, propane stocks in the Midwest typically peak between late September and mid-October, then start slowly falling through November and December. As of November 1, stocks had fallen 6 percent since the end of September and were approximately 2 million barrels lower than the same week last year.”

I’ve consistently heard from Iowans about the insufficient supply of propane needed to dry grain, heat homes, heat livestock barns, and run businesses. @ChuckGrassley & I sent a letter pushing @FERC to prioritize pipeline shipments of propane to #Iowa. Read the full letter: pic.twitter.com/OldDkOk7LJ

— Joni Ernst (@SenJoniErnst) November 18, 2019

On Monday, Reuters News reported that, “Regional shortages of propane, which is used for heating homes and barns and by farmers to dry their crops, have led to emergency declarations covering nine U.S. Midwest states amid late harvests of soggy grains.

.@wqad: Sen. @ChuckGrassley and @SenJoniErnst sent a letter to Chairman @FERChatterjee to address the liquid propane shortage impacting Iowa's farmers. pic.twitter.com/q5b5dZrIo6

— Sen. Grassley Press (@GrassleyPress) November 18, 2019

“Iowa, Minnesota, North Dakota and Wisconsin declared state emergencies beginning in late October, and continued last Friday to ease hours of service or load restrictions on delivery vehicles. Federal motor carrier regulators later issued a regional waiver covering those states plus Illinois, Kansas, Missouri, South Dakota and Nebraska to help alleviate local shortages aggravated in part by a Midwest pipeline outage.”

Spring flooding in U.S. Midwest farming states led to late harvests that have triggered a surge in demand for powering grain dryers to reduce moisture in crops to ready for sale or to safely store corn and other grains.

With cold temperatures in the forecast & a tough harvest, limited propane supply is hurting Illinois farmers working to dry wet corn crops, & heat poultry & livestock. That's why I joined my colleagues in urging FERC to do what they can to ensure the continued supply of propane. pic.twitter.com/ORtcj6zGgn

— Darin LaHood (@RepLaHood) November 19, 2019

In related developments, the USDA’s National Agricultural Statistics Service indicated on Monday that nearly twenty-five percent of the U.S. corn crop remains in the field; sixteen percentage points behind the five-year average.

Tuesday’s Agricultural Weather Highlights, from USDA’s Office of the Chief Economist, noted that, “Through November 17, this remains the second-slowest U.S. corn harvest in the last 25 years, faster than only 2009.”

(Graphical depictions of corn harvest progress in Iowa, Illinois and Indiana, as well as Midwestern fall season snow, are included below).

#Iowa: Seventy-seven percent of the #corn for grain #crop has been harvested, 10 days behind last year and 12 days behind the 5-year average. @usda_nass pic.twitter.com/t6WBpOYRUX

— Farm Policy (@FarmPolicy) November 18, 2019

#Illinois #Corn Percent Harvested, @usda_nass pic.twitter.com/uK4JW0iLff

— Farm Policy (@FarmPolicy) November 18, 2019

#Indiana: Harvest progress halted last week due to #snow events and extreme cold throughout the State, keeping #corn harvest behind schedule, @usda_nass pic.twitter.com/RsQPjKqKWX

— Farm Policy (@FarmPolicy) November 18, 2019

It has been an exceptional start to the snow season in the Midwest. Since the start of the snow year (July 1), a large portion of the region has had more than 750% of normal. pic.twitter.com/enZR8YZZxL

— MRCC (@MidwestClimate) November 18, 2019

#Snow Depth, November 16, https://t.co/J93RSQHqyL @usda_oce pic.twitter.com/HrJhssdLKP

— Farm Policy (@FarmPolicy) November 19, 2019

Farm Economy Indicators

As producers deal with the difficult factors associated with wrapping up the 2019 harvest, recent news articles have pointed to some unsettling indicators from the U.S. farm economy.

Reuters writer P.J. Huffstutter reported last week that, “As the U.S.-China trade war drags on, more farmers are expected to take out debt against the land they own – their collateral of last resort – to keep their operations going, according to a survey of lenders.

“The survey found that bankers are increasingly worried about farmers facing cash-flow problems: 46% of bankers expect an increase in loans secured by farmland for the 2019/20 growing year, up from 37% for the previous period.

The concern comes as the U.S. farm economy deteriorates. Farmland is the key pillar of equity in the U.S. agricultural heartland, which has been suffering from lingering weakness in commodity prices and loss of key export markets due to President Donald Trump’s trade disputes.

The Reuters article stated that, “Previously, bankers had been focused on commodity prices falling and decreases in overall farm income, said Jackson Takach, chief economist for Farmer Mac, which provides a secondary market for a range of loans made to borrowers in rural America.

“‘But this year, for the first time, it was liquidity,’ Takach said in an interview with Reuters.”

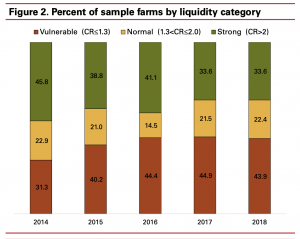

Also last week, Des Moines Register writer Donnelle Eller reported that, “Despite President Trump’s agriculture bailouts, Iowa farmers continue to see their financial condition erode, a cash crunch that had 44% of producers last year struggling to cover their bills, an Iowa State University report shows.

“The percentage of financially vulnerable farmers climbed from 31% in 2014, according to the report that examines growers’ ability to cover short-term liabilities such as seed, fertilizer and herbicides with easily accessible assets such as cash, stored grain and market-ready livestock.

“It’s very, very concerning,” said Alejandro Plastina, the ISU agriculture economist who conducted the study. ‘It’s getting harder and harder for farm operations to cash-flow their business.'”

The Register article added that, “Plastina said cash-strapped farm operations ‘are running out of options,’ since they’ve likely already taken steps to restructure debt or receive new loans with land or machinery as collateral, Plastina said.

“‘We don’t see an improvement in commodity prices,’ he said. ‘That’s what makes the outlook scary.'”

Additional information on the price outlook for corn and soybeans can be found in this tweet from Pat Westhoff, the director of the Food and Agricultural Policy Research Institute at the University of Missouri (FAPRI-MU).

We've posted our November update of the crop price outlook for the next 5 years. No big changes from October--still saying that a rebound in corn and soybean supplies in 2020 could put downward pressure on prices. https://t.co/oZQx9cyUu5

— Pat Westhoff (@WesthoffPat) November 18, 2019