As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Coronavirus Cases Increase, But More U.S. Soybean Sales Expected

Wall Street Journal writers Wenxin Fan, Natasha Khan, and Chao Deng reported this week that, “New cases of the coronavirus rose sharply after Chinese authorities changed the criteria for diagnosing the illness, raising questions about how soon the outbreak will peak.

“On Thursday, health officials in Hubei province, the epicenter of the infections, announced the largest one-day jump in cases—14,840 on Wednesday, about nine times the number of new cases a day earlier. Epidemiologists, government officials and investors may now need to recalibrate their projections for the trajectory of a virus that remains little understood.”

Here's how the number of daily confirmed cases spiked after China's Hubei province (epicenter of outbreak) revises the counting method.https://t.co/hxGJ0OfHpm#CoronavirusOutbreak pic.twitter.com/CPAPpgPgoC

— David Ingles (@DavidInglesTV) February 13, 2020

Nonetheless, the Journal writers added that, “Such a dramatic surge in cases as announced Thursday is likely a one-off. It reflects the shift in how authorities in Hubei province are classifying patients as having clinically confirmed infections after they are diagnosed by a doctor, such as through an X-ray, rather than just those patients who have positive laboratory identification of the virus. That is not standard practice for diagnosing the presence of a specific virus.

‘This does not represent a significant change in trajectory of the outbreak,’ said Michael Ryan, executive director of the World Health Organization’s Health Emergencies Program. He called the jump in cases ‘an after-fact of reporting.’

The Journal article added that, “The vast majority of Thursday’s newly confirmed cases—13,332—were retroactively reclassified. But the broader classification rules mean the daily rise in the number of new cases could continue to gain because more undiagnosed cases may come to light.”

Today's number of new coronavirus cases in China's Hubei provinces confirms Thursday's spike was a one-off after the adoption of a different, wider counting method. It's still unclear with one data point what the trend is.https://t.co/illRZW8MMR pic.twitter.com/0vP1Ib955x

— David Ingles (@DavidInglesTV) February 14, 2020

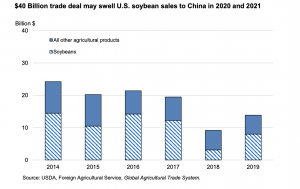

And earlier this week, Financial Time writers Tom Mitchell, Ryan McMorrow, and Sun Yu reported that, “The epidemic may also prevent China increasing purchases of US goods and commodities by $200bn over the next two years, compared to 2017 levels, as agreed in its recent ‘phase one’ trade deal with the US.” (Although China recently reassured the U.S. that the Phase One commitments will be met).

Mnuchin says implementation of phase 1 of the China trade deal has "to a certain extent slowed down" due to coronavirus.

— Alan Rappeport (@arappeport) February 12, 2020

Also this week, Reuters writer Stephanie Kelly reported that, “China has not informed the United States of any delays or reductions of its planned purchases of U.S. agricultural goods under the Phase 1 trade deal due to the outbreak of coronavirus, U.S. Department of Agriculture Under Secretary of Trade Ted McKinney said on Wednesday.

‘We have not received any formal notification of a delay, which pleases me. We hope it doesn’t come,’ he said on the sidelines of an ethanol conference in Houston.

“White House national security adviser Robert O’Brien said on Tuesday the coronavirus outbreak could reduce Chinese purchases of U.S. agricultural products this year.”

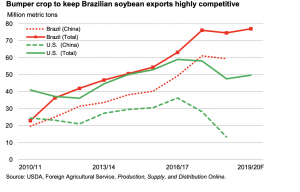

On Thursday, in February’s Oil Crops Outlook report, Mark Ash from USDA’s Economic Research Service stated that, “While China has agreed to buy more agricultural products from the United States, the sales are still conditional on market circumstances. This means that any export gains for soybeans might not be immediately apparent. Moreover, in the next few months, Brazil is set to harvest and export a record volume of competitively priced soybeans. Substantial U.S. sales to China then could be deferred until late in the 2019/20 marketing year. By that time, the disposal of Brazil’s crop and the advance of U.S. new-crop development should start to make U.S. supplies more price-competitive again. So, despite the current lack of outstanding sales, more U.S. soybean shipments might be forthcoming by the end of the summer. Under these circumstances, USDA raises its forecast of 2019/20 soybean exports this month by 50 million bushels to 1.825 billion.”

The ERS Outlook also noted that, “Brazilian soybean exports could surge to new heights this year with a record supply and a weak exchange rate. Valuation of Brazil’s currency with the U.S. dollar has now sunk to at an all-time low (at approximately 4.3 real per dollar). Also, as of November, soybean transportation costs from Brazil have fallen. This development stems from completion of paving for a major highway, which is expediting new-crop shipments by truck and Amazon River barges to the country’s northern ports.”

Here's some of the key changes USDA made to #soybeans. #China's imports up 3 mmt to 88 mmt (1 mmt of extra use, 2 mmt into stocks). #Brazil crop to a record 125 mmt, exports up. USA exports up, stocks/use 10.5%. No changes in #Argentina. pic.twitter.com/aD6DUjNx1X

— Karen Braun (@kannbwx) February 11, 2020

“In 2019/20, USDA forecasts soybean shipments from Brazil to rise to a record 77 million tons— up 1 million from last month. Exports are forecast to exceed the 74.6 million tons shipped last year and would far surpass U.S. soybean trade at 49.7 million tons. While Brazil’s soybean exports to China may not possess the same advantages they did in early 2018/19, in other import markets they could gain at the expense of U.S. exports,” the ERS Outlook said.

The ERS Outlook also stated that, “USDA hiked its forecast of China’s 2019/20 soybean imports this month by 3 million tons to 88 million. A primary factor behind the altered outlook is an expectation for higher agricultural trade with the United States. Declining freight rates to China are also more favorable for trade overall.”

Sales of U.S. #soybeans to China have slowed significantly, as only ~1 mmt have been sold since Jan. 1. The recent pace is much slower than in past years, including last year. 2019/20 sales to #China were 12.1 mmt thru Feb. 6, valued in the vicinity of $4.4 billion. pic.twitter.com/bjiY3HzAZN

— Karen Braun (@kannbwx) February 13, 2020

Mr. Ash also noted in the Oil Crops Outlook that, “Soybean use in China may see only gradual gains this year. While the 2019/20 soybean crush is forecast up 1 million tons this month to 86 million, this still represents a modest 1-percent increase over the 2018/19 level. The country’s hog herd is in the early stages of a recovery from last year’s massive losses due to African swine fever. At the same time, some areas have recently seen an outbreak of avian influenza, which could affect the demand for poultry feed.

“Recovery from both situations may be complicated by trade disruptions both within and outside China. Even more turmoil is threatened by a new outbreak of a coronavirus—a potentially deadly disease for humans. Until the current quarantines and travel restrictions are lifted, the situation could restrict the public movements of workers. The production and commerce of soybean meal in China could be inhibited.”