Bloomberg's Clarice Couto reported this past Friday that "a surprising tax change in agriculture powerhouse Brazil has the potential to make soy grown in the world’s largest bean exporter less…

A Closer Look at Phase 1 Commitments, as Coronavirus “Has Scrambled” the Outlook

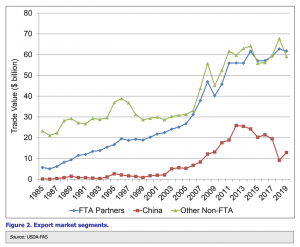

Writing recently at the CARD (Center for Agricultural and Rural Development) Agricultural Policy Review, from Iowa State University (“The Phase One Trade Deal: Projections and Implications“), Chad Hart and Lee Schulz stated that, “The Phase One deal alters the agricultural trade landscape—China has agreed to specific targets for agricultural purchases for this year and next year. The deal uses 2017 as the base year for trade, and, as figures 2 and 3 show [below], Chinese agricultural purchases totaled roughly $19.5 billion that year.

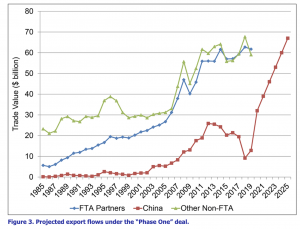

“For 2020, China agreed to purchase $12.5 billion more in agricultural products than it did in the base year, which puts 2020 US agricultural exports to China at $32 billion (other publications report higher amounts, but they are including forestry and ag-related products, such as infant formula and pet food). For 2021, the agreement is $19.5 billion more than the base year—$39 billion in agricultural sales to China. These two targets alone guarantee a significant surge in sales to China, far eclipsing the record sales from 2012. The text of the deal also includes a statement indicating that the growth in US agricultural exports to China set in these two years is projected to continue through 2025. Figure 3 [above] outlines those projections. If projections from the deal are accurate, agricultural trade with China will grow to exceed what the United States currently ships to its free trade partners or to the rest of the world.”

Hart and Schulz noted that, “Traders are sorting through three big questions right now. One, will China follow through on these commitments over the next two years and what mix of products will they choose? Two, how secure are those projections for continued agricultural trade growth beyond 2021? Three, what happens to our other markets as this agreement is fulfilled?

We feel that it is likely that China will meet the value targets for the next two years as the African Swine Fever outbreak there has created a significant protein gap for China.

“The deal contains language easing trade rules for meats between the two countries, so it makes sense that China would expand meat purchases from the United States, fulfilling two objectives at once—filling in the protein gap and meeting trade targets. While soybeans were the largest portion of previous agricultural sales to China, we expect meat, especially pork, to take the leading spots in our future sales to China. Thus, the product mix will shift, moving to more value-added products, which helps China hit the dollar value targets.”

The CARD article added that, “Sales beyond 2021 are not locked in place. The agreement only states that both countries currently think the trade flows would continue to develop at the same pace as the first two years, implying gains of $7 billion per year. If the projections hold, they imply significant shifts in global trade flows—US agriculture will become even more reliant on Chinese demand. A large concern is what will happen to our other markets—this deal will likely crowd some of them out. China has agreed to buy more agricultural products, but that does not mean we can add that value to total exports. In fact, we are currently already seeing the potential for crowding out. Over the past few months China has re-established itself as the top market for US soybeans. As China has moved back in, however, numerous other markets have reduced US soybean imports. Sales to the European Union, Mexico, Japan, Indonesia, South Korea, and Canada have fallen. With trade, there can be significant slippage—gains in one area are often offset by losses elsewhere. In this case, forcing sales to China will likely cost us open sales to the rest of the world.”

However, with respect to U.S. protein exports, Wall Street Journal writer Jacob Bunge reported on Monday that, “The coronavirus epidemic is exacerbating a meat glut in the U.S., filling cold-storage facilities with pork, chicken and beef intended for export to markets hit by the outbreak.”

The Journal article stated that, “U.S. meatpackers including Sanderson, Tyson Foods Inc. and Pilgrim’s Pride Corp. have been counting on big orders from Chinese buyers, as trade tensions ease and China struggles to fill a pork shortfall after losing hundreds of millions of hogs to a swine disease. U.S. hog farmers have ramped up production, and chicken companies have been raising fatter birds. U.S. meat exports to China surged in late 2019, with more U.S. pork shipped to the country in November and December than in all of 2018, according to the USDA.

The new coronavirus has scrambled that outlook. Huge numbers of people staying home rather than eating out slowed meat consumption in China, which hurt orders from the U.S. Government-mandated quarantines in China created logistical snarls.

Mr. Bunge added that, “Meat industry officials hope the epidemic represents a temporary delay to the long-anticipated surge in exports to China. They will have more meat to market this year: the USDA projects red meat production will rise 2.9% this year, while poultry production is estimated to grow 3.9%.”

"#Meat Stockpiles Surge as #Coronavirus Epidemic Curbs #Exports," https://t.co/VurymvGMaW by @jacobbunge

— Farm Policy (@FarmPolicy) March 3, 2020

The #coronavirus epidemic is exacerbating a meat glut in the US, filling cold-storage facilities w #pork, #chicken & #beef intended for export to markets hit by the outbreak. pic.twitter.com/r6QNG30VbK

Meanwhile, Reuters columnist Karen Braun stated last week that, “It is no secret that most agriculture market participants have had concerns since Day 1 about the Phase 1 trade agreement between the United States and China, and top U.S. trade officials did not offer much additional clarity last week [Feb. 21st] at USDA’s outlook forum.

“That trade deal, signed Jan. 15, implies that China in 2020 will purchase and import some 50% more U.S. agricultural products than it did in 2017, before the trade war began. This year’s purchase target is also 25% above 2013′s record.”

Ms. Braun indicated that, “I specifically asked how those numbers were formulated, whether it was based on a trend or something else. I have long been curious over these figures because of how large they are relative to the previous annual record of American farm exports to China, and what the market prices were when those highs were made.

“I was told by both officials [Gregg Doud, the Chief Agricultural Negotiator in the Office of the United States Trade Representative, and Ted McKinney, Under Secretary of Agriculture for Trade and Foreign Agricultural Affairs] simply that it was part of the negotiations. I tried to ask again and even suggested the idea of just trying to get China to agree to the largest numbers possible, but I got the same answer.

I feel as if my question was answered at the forum, in a way. I have done the math countless times as have many other analysts, and at globally competitive prices, it is hard to make the numbers work. I already wondered if the targets were perhaps arbitrary, and after Friday [Feb. 21], I fear that is the more likely scenario.

Also last week, Bloomberg writers Isis Almeida and Megan Durisin reported that, “American sorghum sales soared to a five-year high as the grain proves to be one of the few big crop winners seeing a significant demand boost from the newly-enacted U.S.-China trade pact.

“Net export sales climbed to 444,500 metric tons in the week ended Feb. 20, government data show. It’s the first week of reporting since the phase-one deal between Washington and Beijing went into force. The figure was the highest since December 2014 — led by purchases by so-called ‘unknown destinations,’ and China accounted for 119,000 tons.”

“Pork purchases of 7,200 tons also remain well below levels seen in late 2019. Thousands of containers of meat have been piling up at Chinese ports as the coronavirus outbreak disrupts transportation and spurs labor shortages,” the Bloomberg article said.

Following a downward revision to Australia’s 2019/20 #sorghum output, where output was curtailed by an extremely dry December, world production is expected to fall y/y. pic.twitter.com/WzL8JPur8g

— International Grains Council (@IGCgrains) February 27, 2020

And DTN writer Katie Dehlinger reported on Friday that, “There was an important two-letter word in President Donald Trump’s tweet last week suggesting there could be a third round of trade assistance payments.

IF OUR FORMALLY TARGETED FARMERS NEED ADDITIONAL AID UNTIL SUCH TIME AS THE TRADE DEALS WITH CHINA, MEXICO, CANADA AND OTHERS FULLY KICK IN, THAT AID WILL BE PROVIDED BY THE FEDERAL GOVERNMENT, PAID FOR OUT OF THE MASSIVE TARIFF MONEY COMING INTO THE USA!

— Donald J. Trump (@realDonaldTrump) February 21, 2020

“‘It said ‘if,’ Agriculture Secretary Sonny Perdue told farmers at Commodity Classic here [San Antonio] on Friday. ‘Let me clarify: My advice and counsel to him is the MFP payments were a trade-damage mechanism, and we used the CCC to make up for lost income based on the inability to trade. It was never designed as a price support program.’

He said the agency isn’t crafting a third round of Market Facilitation Program payments and advises farmers to plant for market.

“‘We believe we will see prices rise as these commodities start to flow again,’ he said.”

@SecretarySonny says to #NFU2020 much of what he said Friday at Commodity Classic. He doesn't see an MFP payment for 2020. "Since it is not a price support program, my answer is no."

— Chris Clayton (@ChrisClaytonDTN) March 2, 2020

"If" trade with China doesn't materialize, that could change later this year, he said.