House Agriculture Chair G.T. Thompson has tentatively scheduled a farm bill markup for the week of Feb. 23, according to three people familiar with the plans.

Appellate Court Denies Rehearing in RFS Case, While Decreased Fuel Consumption Results in Idling of Some Ethanol Plants

DTN writer Todd Neeley reported this week that, “Small refiners will not receive a rehearing before the entire U.S. Court of Appeals for the 10th Circuit in Denver on a case alleging EPA improperly granted small-refinery exemptions to the Renewable Fuel Standard in 2017 and 2018, the court announced in an order on Tuesday.

The ball is now in the EPA’s court to decide how it will apply the original ruling by the 10th Circuit.

“In the Jan. 24 ruling, a three-judge panel ruled EPA didn’t have the authority to issue exemption extensions to three companies that were not originally granted waivers. It also found EPA ‘abused its discretion’ by not explaining its conclusion that a small refinery could suffer disproportionate economic hardship while also maintaining refiners passed RFS compliance costs on to consumers at the pump.

“On March 27, EPA announced its next steps on SREs following the Trump administration’s decision not to appeal the ruling. The agency said it would wait for the court case to play out before taking action.”

Mr. Neeley indicated that, “The court’s decision Tuesday now starts a 90-day clock for the refiners to petition the U.S. Supreme Court.”

And Reuters writer Stephanie Kelly reported this week that, “A U.S. federal court on Tuesday rejected a challenge from two oil refining companies to its January ruling that the Environmental Protection Agency had been handing out biofuel waivers inappropriately.

In a major blow to the refining industry, the ruling effectively forces the EPA to reduce the number of waivers it can grant to refiners exempting them from their obligations under the U.S. Renewable Fuel Standard.

The Reuters article added that, “The EPA said it was holding off on deciding on pending waiver requests until the court case is ended.

“The agency is expected to apply the court’s ruling nationally, effectively gutting the exemption program, but is also considering other measures to ease the regulatory burden on refiners like limiting prices for blending credits.”

4. So, my conclusion is that there is a very high probability that the #SRE program as implemented by the Trump EPA is deader than a doornail. Who would have thought it could end so abruptly? I thought there was always more legal risk than many, but it still surprised me.

— Scott Irwin (@ScottIrwinUI) April 8, 2020

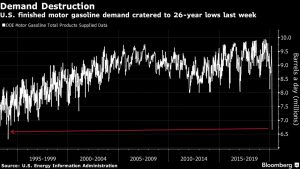

Meanwhile, Bloomberg writer Jeffrey Bair reported this week that, “U.S. gasoline demand has collapsed as stay-at-home orders keep drivers off the road, following the pattern seen in the hardest-hit parts of Europe.

“Sales at retail stations were down 46.6% from a year earlier in the week ending March 28, according to a report from OPIS by IHS Markit. The average station sold about 11,000 gallons — less than two tanker trucks’ worth.

“The gasoline demand plunge accelerated as government orders on staying home became more widespread, dropping 30% in a week.”

The decrease in fuel consumption due to social distancing has left some of Iowa’s biofuel facilities little choice but to idle production or close completely. I’m urging @USDA to support our biofuel producers and workers during this crisis. pic.twitter.com/7pVZeTL9Vl

— Joni Ernst (@SenJoniErnst) April 7, 2020

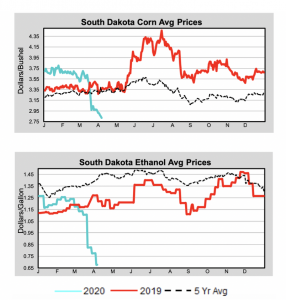

With respect to the impacts of reduced fuel demand, DTN writer Todd Neeley reported this week that, “POET Inc. is idling ethanol plants in South Dakota and Iowa and delaying startup of a new plant in Indiana. The company is one of many trying to navigate the fallout of an oversupplied ethanol market from the COVID-19 pandemic.

“The company announced on Tuesday it will idle plants in Ashton and Coon Rapids, Iowa, and in Chancellor, South Dakota. In addition, POET said in a news release it will delay startup at a plant in Shelbyville, Indiana.

“Combined, the plants produce about 330 million gallons annually and use about 110 million bushels of corn. POET is furloughing about 130 employees as part of the action.”

Mr. Neeley stated that, “Sen. Charles Grassley, R-Iowa, during his weekly news conference with agriculture journalists, said he sent a letter to U.S. Secretary of Agriculture Sonny Perdue requesting money for the ethanol industry through the Commodity Credit Corporation in the CARES Act.

“‘The loss of fuel demand has drastically hurt the biofuels industry, and corn prices have plummeted almost every day for the last two weeks,’ he said. ‘The decrease in fuel consumption has left production facilities little choice but to idle production and in some cases close completely. Since March 1, more than 4 billion gallons of ethanol production has ceased production.'”