House Agriculture Chair G.T. Thompson has tentatively scheduled a farm bill markup for the week of Feb. 23, according to three people familiar with the plans.

Biofuel Issues Abound: Blending Quotas, RFS Waivers, COVID-19 Relief for Ethanol, and Gasoline Demand

Earlier this week, Bloomberg writer Jennifer A Dlouhy reported that, “The Environmental Protection Agency has drafted a plan to slightly lift biofuel-blending targets next year, while so far skirting potentially controversial decisions about exempting refineries from U.S. mandates to use plant-based fuels, according to three people familiar with the matter.

“Under a proposed rule now undergoing White House review, the EPA would require refiners to use 5.17 billion gallons of advanced biofuels in 2021, up from 5.09 billion gallons this year, according to two of the people. That would include 670 million gallons of cellulosic renewable fuels, such as those made from crop residue, switchgrass and biogas harvested at landfills, up from 590 million gallons required this year.”

The Bloomberg article noted that, “The EPA is expected to propose the quotas in coming months, and under federal law faces a Nov. 30 deadline to finalize the targets. Representatives of the EPA did not immediately respond to requests for comment.”

Ms. Dlouhy added that, “Refiners would be able to use as much as 15 billion gallons of conventional renewable fuels, including corn-based ethanol, to satisfy the mandate in 2020. And under the EPA’s draft plan, in 2022, the government would require refiners to use 2.76 billion gallons of biodiesel, typically made from soybeans and waste cooking oil, up from 2.43 billion gallons in 2021, according to two of the people.”

And on Wednesday, Reuters writers Stephanie Kelly and Laura Sanicola reported that, “The U.S. Environmental Protection Agency has proposed lifting the amount of biofuels that refiners must blend into their fuel next year to 20.17 billion gallons, from 20.09 billion this year, according to two sources familiar with the details of an agency draft proposal.”

The Reuters writers explained that, “The EPA is charged with setting biofuel and biodiesel blending requirements for the refining industry as part of the Renewable Fuel Standard, a regulation aimed to help farmers and reduce U.S. dependence on oil.

Under the RFS, refiners must blend billions of gallons of biofuels into the nation’s fuel pool or buy credits from those that do. Refiners say the obligations are too costly, while farmers benefit from an expanded market for their crops.

More specifically with respect to the blending requirements, DTN writer Todd Neeley reported earlier this week that, “Pressure continues to mount on the Trump administration to waive the Renewable Fuel Standard for oil-producing states, as a group of 15 Republicans in the United States Senate asked EPA Administrator Andrew Wheeler for a waiver.

“In recent weeks 24 members of the U.S. House of Representatives as well as attorneys generals and governors from several states have asked for waivers, alleging economic hardship caused by the COVID-19 crisis warrants an exemption.”

Mr. Neeley reminded readers that, “The ethanol industry scored a victory in the 10th Circuit in Denver. The court ruled the agency mishandled three such waivers in 2017 and 2018, meaning the EPA would need to make changes to the program. To this point, the agency has not done so.”

Per @EIAgov data, average #ethanol production for the week ending 5/15 accelerated by 7.5% (46,000 b/d) to 663,000 b/d (10.16 bg annualized). Stocks shrank 2.3% to 23.6 million barrels—the lowest volume since January. pic.twitter.com/JWyrSRPm4u

— Renewable Fuels Association (@EthanolRFA) May 20, 2020

Also on the waiver issue, Senator Dick Durbin (D., Il.) indicated in a news release this week that, “President Trump’s EPA has handed out 85 waivers to stop blending ethanol into gasoline, helping large oil companies that already had huge profits. Now with the COVID-19 pandemic, half of the nation’s ethanol plants have shutdown, yet these same oil companies want more waivers. Under this President, the farming sector now finds itself relying more on government aid than free markets. I will be joining my colleagues in Congress to help the ethanol and farm sector and keep it moving forward until this crisis is over.”

Regarding potential decisions on the waiver requests, Reuters writer Valerie Volcovici reported yesterday that,

The U.S. Environmental Protection Agency has not yet decided whether to grant requests from the oil refining industry to reduce biofuel blending mandates this year, agency chief Andrew Wheeler told lawmakers in a hearing on Wednesday.

“Asked if the agency had decided on how to handle the requests, Wheeler said: ‘No we have not yet.'”

“We need help in the ag industry; we need help for our family farmers.”

— Rep. Cheri Bustos (@RepCheri) May 20, 2020

Proud to have worked to bring relief to our biofuel producers in the #HeroesAct. Read more from @Reuters ⬇️https://t.co/FimvCZ0RWM

Rhiannon Branch also reported on yesterday’s Senate hearing with Administrator Wheeler in an update at Brownfield News, pointing out that: “Iowa Senator Joni Ernst, speaking to EPA Administrator Andrew Wheeler during a Senate hearing Wednesday, discussed challenges facing the ethanol industry.

“Ernst expressed her frustration with oil companies and politicians who say that, because the petroleum industry is struggling, Renewable Fuels Standard (RFS) blending requirements should be waived.”

As resilient & tenacious as Iowa’s biofuel producers are, they've been hit hard by #COVID19. As a result, jobs have been lost & lives have been upended in Iowa.

— Joni Ernst (@SenJoniErnst) May 20, 2020

Today @EPWGOP hearing I pressed @EPAAWheeler on his commitment to expand biofuel infrastructure and protect the RFS. pic.twitter.com/lEIUQwqPwG

The Brownfield article added that, “Wyoming Senator John Barrasso told Wheeler oil refiners in his state are struggling because of the 10th Circuit Court ruling on RFS small refinery exemptions.

“‘The EPA’s failure to challenge the standing claims of the biofuels producers in the 10th Circuit, to me, is inexcusable. The EPA’s failure to seek a rehearing on the recent 10th Circuit ruling was inexplicable.'”

2day I introd a biofuels assistance bill w Sen Klobuchar Since federal govt is helping big oil by putting surplus oil in strategic petroleum reserve there’s a BIGGER need 2help biofuels w 130 plants shutdown There’s a reason for EQUITY bc every gallon of gas has ethanol in it

— ChuckGrassley (@ChuckGrassley) May 19, 2020

Meanwhile, DTN writer Todd Neeley reported yesterday that, “One way or another, the ethanol industry is hopeful any additional COVID-19 relief package coming from Congress will include some form of financial relief for the industry.

This week, Sens. Chuck Grassley, R-Iowa, and Amy Klobuchar, D-Minn., introduced legislation to provide reimbursements to ethanol producers for feedstock purchases made dating back to the first quarter of 2020.

“Last Friday, the United States House of Representatives passed a COVID-19 bill that includes a proposed 45-cent-per-gallon payment to ethanol producers.”

U.S. ethanol may be inching back up after gasoline demand increases as some lockdowns ease. Insights via @CMEGroup pic.twitter.com/g2bdX8D9OJ

— Bloomberg QuickTake (@QuickTake) May 18, 2020

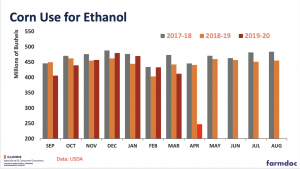

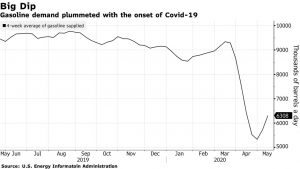

And regarding gasoline and ethanol demand, Wall Street Journal writer Amrith Ramkumar reported this week that, “U.S. motor gasoline supplied by energy companies, a proxy for demand from drivers, rose nearly 40% in the three-week period ended May 8, according to government data. Demand for distillate fuel including diesel—commonly used by trucks, trains and boats—is also climbing, though jet-fuel consumption remains weak.

“Real-time gasoline demand indicators such as daily requests for driving directions on Apple Inc.’s Maps app also show a recent surge.”

CHART OF THE DAY: @Apple mobility trends for U.S. driving point to another increase in gasoline demand last week, potentially surging toward ~8 million b/d (from a low point of ~5.0m b/d in early April, but below the 10-9m b/d pre-virus range) #OOTT pic.twitter.com/z5pCnymCMq

— Javier Blas (@JavierBlas) May 20, 2020

Bloomberg writers Jeffrey Bair and Olivia Raimonde reported this week that, “Gig-economy deliveries for groceries, alcohol and other goods look to be driving a nascent recovery in U.S. gasoline demand after the lowest plunge in almost 30 years.

“Americans’ embrace of those services in the Covid-19 lockdowns may be permanent, experts say, and many consumers may never return to buying their own groceries in a store. That also signals an emerging challenge for fuel markets.”

However, the Bloomberg article noted that, “It’s more difficult to determine if the uptick in deliveries will be a long-term positive or negative on fuel consumption. It could be unchanged, with every trip to the grocery store being replaced by one trip for a delivery driver, and demand staying flat. Or drivers could double or triple deliveries for every pickup at the store, trimming demand. A third scenario could see families using delivery services, freeing up more time to hit the road for other reasons, and therefore, increasing demand.”