A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

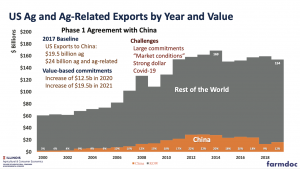

China “Very, Very Committed” to Phase 1, But Skepticism Remains as COVID-19 Repercussions Cloud Outlook

Reuters News reported last week that, “China remains ‘very, very committed‘ to meeting its commitments under a Phase 1 trade deal with the United States, despite the unprecedented economic and health impacts of the new coronavirus pandemic, a senior U.S. trade official said on Wednesday.

“The official told reporters that U.S. officials were talking regularly, and often daily, about implementation of the trade deal and to make sure that China fulfilled its extensive agreements to buy U.S. goods and services.”

Likewise, Wall Street Journal writer William Mauldin reported last week that, “A senior U.S. trade official expressed confidence Wednesday that Beijing will meet its obligations under the trade deal with Washington, despite fallout from the coronavirus pandemic and doubts by experts about China’s ability to meet purchase targets.

“‘There have been certain challenges presented by the coronavirus, but overall the experience that we’ve had is that the Chinese are very, very committed to implementing their commitments,’ the senior official said during a briefing with reporters.”

However, the Journal article noted that,

‘Looking at the supply-and-demand trends, and looking at how ambitious those targets were to begin with, in my view it’s inconceivable that we’re going to hit those targets this year,’ said Wendy Cutler, a former senior U.S. trade official and current vice president at the Asia Society Policy Institute.

Mr. Mauldin added that, “A spokesman for the Chinese embassy in Washington said Beijing has ‘overcome various difficulties’ to implement the agreement during the coronavirus pandemic. ‘China will continue to enforce the agreement and hopes that the U.S. side will also create favorable conditions for its implementation,’ the spokesman said.

“The China deal, signed in January, has a clause that allows Beijing to consult with Washington on the purchase agreements in case of a sudden economic setback.”

Meanwhile, Wall Street Journal columnist Nathaniel Taplin indicated last week that, “China was essentially shut for most of February, its domestic transport networks ground to a halt. It is slowly clawing back to normalcy, but Western economies—and global logistics networks—remain in disarray. U.S. food-processing plants are struggling with rising infection counts and labor problems, while crops rot in the fields.

“The impact is already painfully evident in first-quarter trade data. Chinese imports of U.S. farm goods—a major element of the trade deal—did rise sharply. But most of the increase appears to have been before the virus hit: U.S. exports of farm goods to China were up 72% from a year earlier in January, according to the USDA, then down 27% in February.

“In March, according to Chinese data, imports of U.S. livestock, animal and vegetable products rebounded, up 37% from a year earlier. But with U.S. food processing and logistics disrupted, April’s number is likely to be weak. And to hit trade-deal targets, U.S. farm exports to China need to more than double this year.”

WATCH: Trump Adviser Peter Navarro explains how the coronavirus crisis is affecting trade between the U.S. and China #nine2noon pic.twitter.com/tGtbhHerCJ

— America's Newsroom (@AmericaNewsroom) May 4, 2020

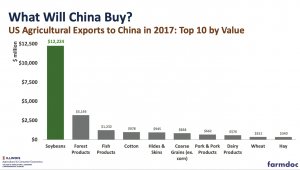

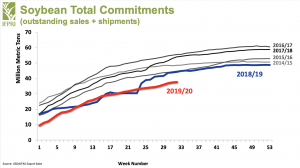

And Reuters columnist Karen Braun noted on Friday that, “China does not typically make large purchases of U.S. soybeans at this time of year when Brazil is the main supplier. But in the week ended April 23, the Asian country booked 618,099 tonnes of old-crop U.S. soybeans, its largest weekly purchase since December and its largest on record for the month of April.

“Chinese buyers were at it again on Thursday as traders reported that at least five U.S. bean cargoes, totaling at least 300,000 tonnes, were booked for shipment in August and September. The total may have been higher since traders said buyers were seeking at least eight to 10 cargoes on Thursday.

But that follows several weeks of relatively dismal sales. Through mid-April, China had bought only about 1 million tonnes of U.S. beans in the three months since the Phase 1 deal was signed. Combined exports to China in February and March may have been the lightest for the period since 1999.

Ms. Braun stated that, “The latest moves are encouraging, but China has a long way to go. Through April 23, it had 13.25 million tonnes of U.S. soybeans on the books for delivery in 2019-20, though some 9.6 million were shipped between September and December.”

With respect to livestock, Ms. Braun noted that, “China has been seeking more U.S. pork for most of the last year due to the African swine fever outbreak sharply reducing Chinese pork production. However, the United States is running into shortages of its own as the coronavirus has recently caused many plants to close or operate at reduced capacity, so it is uncertain how this may affect U.S. exports in the coming weeks or even months.

“But April sales have been big. China bought 35,138 tonnes of U.S. pork in the week ended April 23, its second-largest weekly purchase in 2020 and the fourth-largest in records back to 2013. Through April 23, China had booked 424,301 tonnes of U.S. pork for delivery in 2020.”

In broader reporting on U.S. – China trade relations, Reuters writers Jeff Mason, Matt Spetalnick, and Humeyra Pamuk reported late last week that, “U.S. President Donald Trump said on Thursday his hard-fought trade deal with China was now of secondary importance to the coronavirus pandemic and he threatened new tariffs on Beijing, as his administration crafted retaliatory measures over the outbreak.”

The Reuters article stated that, “Trump made clear, however, that his concerns about China’s role in the origin and spread of the coronavirus were taking priority for now over his efforts to build on an initial trade agreement with Beijing that long dominated his dealings with the world’s second-largest economy.

“‘We signed a trade deal where they’re supposed to buy, and they’ve been buying a lot, actually. But that now becomes secondary to what took place with the virus,’ Trump told reporters. ‘The virus situation is just not acceptable.'”

Why China may not meet its obligations under the phase one trade deal. Insights via @CMEGroup pic.twitter.com/3lI5gOie9h

— Bloomberg QuickTake (@QuickTake) April 29, 2020

And Jeff Stein, Carol D. Leonnig, Josh Dawsey and Gerry Shih reported on the front page of Friday’s Washington Post that, “Senior U.S. officials are beginning to explore proposals for punishing or demanding financial compensation from China for its handling of the coronavirus pandemic, according to four senior administration officials with knowledge of internal planning.

“The move could splinter already strained relations between the two superpowers at a perilous moment for the global economy.”

The Post article added that, “White House officials and multiple congressional lawmakers have become increasingly fixated on China’s response to the outbreak and failure to contain it, asserting Chinese officials concealed key information and refused to cooperate with international health organizations. Chinese officials have repeatedly rejected allegations that they did not act swiftly enough to confront the virus.”

In addition, New York Times writers Edward Wong and Ana Swanson reported on Friday that, “Some top Trump administration officials are moving to take a more aggressive stand against China on economic, diplomatic and scientific issues at the heart of the relationship between the world’s two superpowers, further fraying ties that have reached their lowest point in decades.”

The Times article pointed out that, “The open rivalry between the two nations has taken on a harder and much darker shading in the months since the new coronavirus spread from a metropolis on the Yangtze River across the globe, speeding up efforts by hard-liners in both Washington and Beijing to execute a so-called decoupling of important elements of the relationship.”

On Monday, Bloomberg writers Jenny Leonard and Tyler Pager reported that,

In a Fox News interview on Sunday night, Trump raised concerns of a resumption economic hostilities with China, calling tariffs ‘the ultimate punishment’ for its response to the pandemic and threatening to withdraw from the trade deal if Beijing’s purchase pledges come up short.

The Bloomberg article added that, “The political pressure to do something, however, is mounting within his own party. While Trump denied reports last week that his administration is planning to cancel part of the U.S.’s debt obligations to China, he said he had many other ways to punish the country.

“On Sunday, he called tariffs the ‘greatest negotiating tool’ but didn’t directly answer a question on whether he’d use them now against China for the country’s failure to limit the spread of the virus.”