Bloomberg's Clarice Couto reported this past Friday that "a surprising tax change in agriculture powerhouse Brazil has the potential to make soy grown in the world’s largest bean exporter less…

Phase One Purchases Behind Schedule, as China Halts Some U.S. Farm Imports

David J. Lynch and Emily Rauhala reported on the front page of Saturday’s Washington Post that, “President Trump on Friday leveled an extraordinary broadside at the Chinese government, accusing it of a comprehensive ‘pattern of misconduct‘ and ordering U.S. officials to begin the process of revoking Hong Kong’s special status under U.S. law.

“The president did not outline a deadline for the historic action. But if carried out, it would mean that the United States would no longer treat Hong Kong and China as separate entities for the purposes of extradition, customs, trade and visa issues, he said. And the announcement could include sanctions on Hong Kong or Chinese officials.”

The Post writers explained that,

The president’s comments were as notable for what he did not say. There was no mention of his irritation with China’s failure to quickly increase purchases of American goods as required by the trade deal he signed in January.

Saturday’s article noted that, “Just four months after Trump celebrated a partial trade deal with China, marking an apparent truce in a two-year diplomatic conflict, relations between the two countries have plummeted. The president has been openly displeased with China’s failure to quickly fulfill the trade deal’s terms, including massive additional purchases of American crops, energy products and manufactured goods.”

Writing on the front page of Saturday’s New York Times, Michael Crowley, Edward Wong and Ana Swanson reported that, “After a prolonged negotiation, the United States and China ushered in a truce in January with the signing of a Phase 1 trade deal, an agreement that included a commitment by China to buy more American agricultural and other goods. But the pandemic has led China to fall far behind schedule in the $200 billion of additional purchases it promised to make before the end of 2021.

“Through March, China imported just $19.8 billion of the promised American goods, well below a target of $43.2 billion, according to tracking by Chad Bown, a senior fellow at the Peterson Institute for International Economics.”

The Times article added that, “Mr. Trump and his advisers have grown increasingly dissatisfied with that arrangement. But they face a difficult choice: stick with the deal and risk looking feckless in an election year, or walk away from a pact they counted as Mr. Trump’s signature achievement with China and risk inflicting more pain on farmers who were expected to benefit from it.

“For the moment, they are hoping that tougher statements will goad the Chinese into action.”

#Brazil supplied 89% of #China's imports of #soybeans in April, up from 76% a year ago and 77% in April 2017, before the U.S.-China trade war began. Just 10% from USA in April 2020 compared with 23% a year earlier. pic.twitter.com/0UtMi9nGbL

— Karen Braun (@kannbwx) May 26, 2020

On Friday, Bloomberg writers Isis Almeida and Elizabeth Rembert reported that,

China bought just $3.35 billion in American agricultural products in the first three months of the year, the lowest for that period since 2007, according to data from the U.S. Department of Agriculture. That’s a fraction of the $36.5 billion it promised for 2020 under the partial trade deal reached in January.

“The spread of the novel coronavirus has put China well behind the necessary pace to meet its phase one pledges. And while purchases of everything from pork to soybeans have picked up in the past two months, it’s ‘highly unlikely’ the nation will reach the target given low commodity prices, according to Rabobank, one of the largest lenders to the agriculture industry.

“‘The commitments are not in volume, they’re in dollar value,” Stephen Nicholson, a senior analyst for grains and oilseeds at the Dutch bank, said in a telephone interview. ‘When commodities are so cheap, you can buy a lot and not get close to that number. That’s the concern.'”

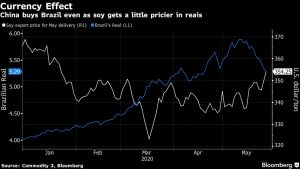

Meanwhile, Bloomberg writer Isis Almeida reported last week that, “China is buying Brazilian soybeans in a sign the Asian nation may be looking to secure supplies as trade tensions with the U.S. rise.”

The Bloomberg article noted that, “‘Even with Brazilian soybeans being more expensive this autumn, China is securing this origin via what they see as the political risk in U.S. soybean/grain sales,’ said Chicago-based consultants AgResource.”

Ms. Almeida pointed out that, “China pledged to buy $36.5 billion in U.S. agricultural goods this year, an increase of $12.5 billion over 2017 levels, before the start of the trade war. Purchases are running well behind and while virus disruptions in China earlier this year hindered buying, a weak currency has also made Brazilian products more attractive. The real is the worst performing major currency this year, although it has recovered some ground in the past two weeks.”

And on Monday, Bloomberg News reported that,

Chinese government officials told major state-run agricultural companies to pause purchases of some American farm goods including soybeans as Beijing evaluates the ongoing escalation of tensions with the U.S. over Hong Kong, according to people familiar with the situation.

“State-owned traders Cofco and Sinograin were ordered to suspend purchases, according to one of the people, who asked not to be identified discussing a private matter. Chinese buyers have also canceled an unspecified number of U.S. pork orders, one of the people said. Private companies haven’t been told to halt imports, according to one of the people.

“The halt is the latest sign that the hard won phase-one trade deal between the world’s two biggest economies is in jeopardy. While Chinese Premier Li Keqiang last month reiterated a pledge to implement the agreement that was inked in January, tensions have continued to escalate since then amid a standoff over Beijing’s move to tighten its grip on Hong Kong.”

The Bloomberg article added that, “The measures to halt imports come after President Donald Trump on Friday lobbed a barrage of criticism at Beijing after it moved to impose controversial new national security legislation on Hong Kong. Critics say it will crack down on dissent and undermine the ‘one country, two systems’ principle that has kept Hong Kong autonomous of the mainland since the 1997 handover from the British.”

Later on Monday, Reuters writers Karl Plume, Hallie Gu, and Keith Zhai reported that, “State-owned Chinese firms bought at least three cargoes of U.S. soybeans on Monday, even as sources in China said the government had told them to halt purchases after Washington said it would eliminate special treatment for Hong Kong to punish Beijing.

“The purchases, totaling at least 180,000 tonnes of the oilseed, were for shipment in October or November, the peak U.S. soy export season when American soybeans are usually the cheapest in the world, three U.S. traders with knowledge of the deals said.

“It was not immediately clear why buying continued after Beijing’s message to state-owned firms, but U.S. traders said Chinese importers still have not covered a large share of October and November soybean needs.”