Bloomberg's Clarice Couto reported this past Friday that "a surprising tax change in agriculture powerhouse Brazil has the potential to make soy grown in the world’s largest bean exporter less…

China’s Restrictions on Food Imports Meet Resistance from Exporters

Last week, Bloomberg’s Mike Dorning reported that, “U.S. health and agricultural authorities issued thinly veiled criticism of new demands from China for food-exporting companies to sign documents stating that they comply with safety standards to prevent transmission of Covid-19.

“‘Efforts by some countries to restrict global food exports related to Covid-19 transmission are not consistent with the known science of transmission,’ U.S. Agriculture Secretary Sonny Perdue and FDA Commissioner Stephen Hahn said in a joint statement Wednesday.

“That’s in line with advice from experts, who have continued to say that food poses little risk of spreading the coronavirus.”

The Bloomberg article stated that, “The Chinese request isn’t aimed at imposing trade restrictions, according to people familiar with the matter. The requests are informal, and is to ease Chinese consumer concerns over the safety of imported products such as meat, one of the people said.

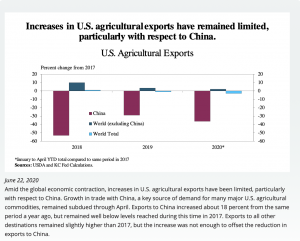

But whether or not it was meant to target trade flows, the new demand could still end up being an impediment to shipments. That would further delay the $36.5 billion in farm purchases the Asian nation pledged under Beijing and Washington’s phase one trade deal.

On Thursday, Wall Street Journal writers Lucy Craymer and Jacob Bunge reported that, “China is tightening restrictions on food imports as it seeks to stave off a resurgence of the coronavirus, but its efforts are meeting resistance from government agencies of major food exporters.

“China’s customs authority requested last week that companies sending meat, dairy and other food products to the country sign documents declaring that their food hasn’t been contaminated by the virus and that they are in compliance with Chinese laws and international guidelines for food safety during the Covid-19 pandemic.”

The Journal article noted that, “China, the world’s top consumer of pork, is dealing with a shortage of protein after an African swine fever epidemic drastically reduced the country’s hog herd. Chinese meat imports in the first five months of 2020 have jumped from a year ago as it tries to meet consumer demand and stop domestic prices from rising. Its customs officials have begun testing imports arriving in the country to check that they aren’t contaminated by the virus.

“Darin Friedrichs, senior Asia commodity analyst at StoneX Group, said China’s efforts to test produce and seek assurance from exporters might appear extreme given that the virus is unlikely to be transmitted through imported food. ‘They’re being overly cautious at this point,’ he said.”

Might we see Chinese #pork imports double this year? We're certainly on that path. #oatt pic.twitter.com/VgJBu6Ghq7

— Arlan Suderman (@ArlanFF101) June 26, 2020

Meanwhile, Reuters writer Ana Mano reported last week that, “Brazilian grain exporters should not give China the guarantees it requested that their cargoes are free of the novel coronavirus, as that would require extensive testing, according to ANEC, an association representing local grain traders.

“The exporters’ response to the Chinese request will emphasize that there is no evidence the coronavirus can be transmitted by food, Marcos Amorim, director of ANEC’s contract committee, said during a webinar hosted by law firm Mattos Engelberg on Thursday.”

On Friday, Bloomberg’s Millie Munshi explained that, “In any case, just the suggestion from China that the country could make it harder for imported food to flow freely can spook markets. Hog futures traded in Chicago are on pace for a weekly loss, as are soybeans. Pork and soy are two of the biggest U.S. farm exports to China.

“Of course, all this is happening set against the backdrop of the U.S.-China trade deal, with Beijing pledging to buy more than $30 billion worth of American agriculture goods this year.

So far the Asian country has fallen way behind the purchasing pace that would be needed to meet that promise. And traders fear that this latest turn will only be a further impediment.

And Reuters writer Tom Polansek reported last week that, “Global meat exporters like JBS SA along with some U.S. produce suppliers, have agreed to sign declarations ensuring the safety of their shipments. Others that export produce and soybeans have scoffed.”

Reuters writer Karl Plume reported last week that, “U.S. food and feed exporters are shipping goods to China with letters assuring the safety of their cargo in lieu of official declarations requested by Chinese authorities that guarantee coronavirus-free shipments, a U.S. agricultural export group said on Friday.

“The commitment statements, drafted by the Agriculture Transportation Coalition (AgTC), are meant only to assure importers that shipments have been harvested, processed and handled consistent with industry safety standards and guidelines from medical experts.

“The move comes after China’s customs authority last week asked food exporters to the country to sign official declarations their produce is not contaminated by the novel coronavirus.”

More broadly on U.S., China relations, Lingling Wei and Bob Davis reported on the front page of Saturday’s Wall Street Journal that,

Beijing has begun quietly delivering a message to Washington: U.S. pressure over matters China considers off limits could jeopardize Chinese purchases of farm goods and other U.S. exports under the ‘Phase One’ trade deal.

“Chinese leaders have accused Washington of meddling in areas such as Hong Kong, where China is imposing a sweeping national-security law, and Taiwan, which Beijing considers as part of China. On Thursday, the U.S. Senate passed by unanimous consent a bill that would put sanctions on Chinese officials, businesses and banks that undermine Hong Kong’s limited autonomy from Beijing.”

The Journal writers pointed out that, “But Beijing still runs the risk of overplaying its hand, as happened many times during the trade negotiations in the past two years. For example, from the start, Chinese negotiators recognized that farm purchases—especially soybeans—had been at the heart of Mr. Trump’s demands on China, and sought to use that to its advantage. But repeated failures to follow through with promised purchases led to tariffs upon tariffs from the Trump administration.

“And the administration has worked before with China to keep the deal alive when endangered.”

With respect to soybean exports to China, Reuters writers Hallie Gu in Beijing and Chen Aizhu reported last week that, “China’s soybean imports from top supplier Brazil soared in May to their highest in two years, according to customs data released late on Thursday, as backed-up cargoes that were delayed by bad weather in Brazil cleared customs.

Brazil is expected to remain the world’s largest #soybean exporter in 2020/21 (Oct/Sep), albeit with a slightly lower global market share on expectations that US shipments to China will expand y/y. pic.twitter.com/j8YAgEQt6o

— International Grains Council (@IGCgrains) June 26, 2020

“China, the world’s top soybean importer, brought in 8.86 tonnes of Brazilian soybeans in May, the highest since May 2018 and up 41% from last year’s 6.3 million tonnes, data from the General Administration of Customs showed.

Brazil’s MY2020/21 (Feb/Jan) #soybean exports reached record levels in the early part of the season on strong demand from China. However, the pace of shipments is expected to slow in the coming months as availabilities tighten and buyers switch to US supplies. pic.twitter.com/o6t8A1qhFN

— International Grains Council (@IGCgrains) June 25, 2020

“Brazil imports were also up 49% from 5.939 million tonnes in April.”