A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

Federal Reserve Ag Credit Surveys- 2020 Second Quarter Farm Economy Conditions

On Thursday, the Federal Reserve Banks of Chicago and Kansas City released updates regarding farm income, farmland values and agricultural credit conditions from the second quarter of 2020.

Federal Reserve Bank of Chicago

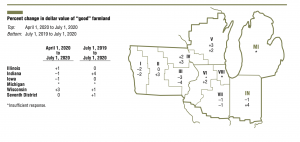

David Oppedahl, a Senior Business Economist at the Chicago Fed, explained in The AgLetter that, “All in all, District farmland values were the same in the second quarter of 2020 as in the first quarter. Yet, there was a year-over-year increase of 1 percent in District agricultural land values. Indiana and Wisconsin had year-over- year increases in their farmland values, while Illinois and Iowa farmland values held steady (see map and table below).”

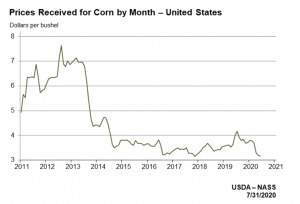

The Ag Letter stated that, “The U.S. Department of Agriculture’s (USDA) June index of prices received by farmers was down 5 percent from a year earlier .

Especially hard hit, corn prices were down 21 percent from a year ago in June, following a plunge in ethanol usage; similarly, hog prices were down 30 percent from a year earlier.

“Despite some categories (such as dairy) seeing gains in exports, cumulative exports of agricultural products were down over the past 12 months (including in June) compared with the 12 months that preceded them, given that trade slowed because of the pandemic and lingering disputes.”

The Chicago Fed pointed out that, “The USDA estimated prices for the 2020–21 crop year of $3.35 per bushel for corn and $8.50 per bushel for soybeans. When calculated with these prices, the projected revenues from the 2020 U.S. harvests relative to revenues from the previous year’s would be 2.5 percent larger for corn and 15.7 percent larger for soybeans. So, even with lower expected crop prices, corn and soybean revenues in 2020 should bounce back from their levels in 2019, when they struggled. Farmland values seemed to benefit not only from the rebound in crop revenues and higher government payments, but also from lower nominal interest rates and a ‘flight to safety’ mentality spurred by the pandemic.”

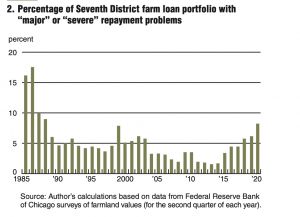

Mr. Oppedahl added that, “At 8.3 percent of the District loan portfolio, the share of farm loans with ‘major’ or ‘severe’ repayment problems (as measured in the second quarter of every year) was last higher in 1988 (see chart 2).

“Furthermore, renewals and extensions of non-real-estate farm loans during the April through June period of 2020 were higher than during the same period of a year ago, as 49 percent of survey respondents reported more of them and just 1 percent reported fewer of them.”

Federal Reserve Bank of Kansas City

and

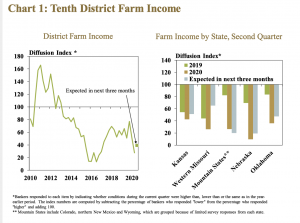

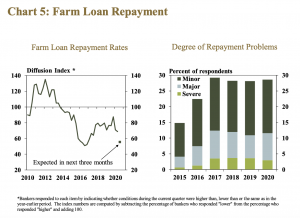

Thursday’s update stated that, “Lower farm income and liquidity contributed to weaker credit conditions, but repayment problems remained stable. Although the pace of decline in repayment rates in the second quarter remained similar to the first quarter, bankers expected farm borrowers to have more difficulty making loan payments in the next three months.”

and

The Kansas City Fed noted that,

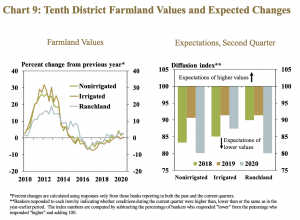

In addition to government programs, farmland values continued to provide stability amid a weak financial environment.

“Nonirrigated cropland and ranchland values increased 2.5% and irrigated cropland values remained stable.”

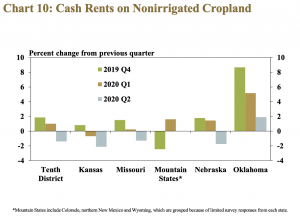

“Contrary to recent trends in farmland values, cash rents decreased slightly. Cash rents across the District declined almost 2%, driven by notable decreases in Kansas, Missouri and Nebraska.”

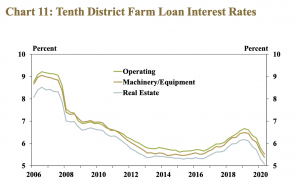

And with respect to interest rates, Thursday’s update pointed out that, “Interest rates on all types of loans reached historically low levels in the second quarter. Following reductions in benchmark rates, interest rates on operating loans fell to 5.5%.”

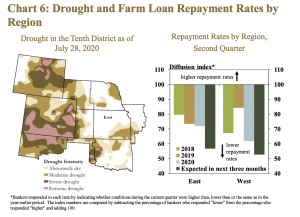

In summary, the Kansas City Fed stated that, “Farm income and credit conditions in the Tenth District deteriorated further in the second quarter. Low commodity prices and concerns about the effects of the pandemic on demand for agricultural products weighed on farm income and expectations about repayment rates on farm loans. Most bankers reported that direct government support programs were expected to provide relief for lower revenues, and credit programs could supplement the borrowing needs of some producers. However, continued uncertainty, low commodity prices, and emerging drought in the western portion of the District could put additional pressure on agricultural economic conditions moving forward.”