A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

As Germany Battles African Swine Fever, Inventory of U.S. Hogs Reaches Record for September

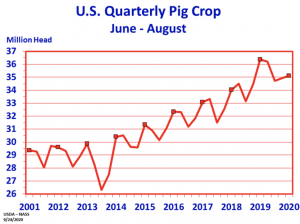

Bloomberg writer Michael Hirtzer reported late last week that, “American hog producers have been cutting back on the herd for several months, but there are signs they haven’t been moving fast enough to keep the market under control.

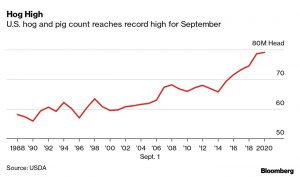

“The pig and hog herd stands at about 79.1 million animals, the USDA said Thursday. That’s down about 0.7% from June 1, but it’s still record large for this time of year and about 1% bigger than 2019.

“The robust supply is good news for bacon eaters but may be less welcomed by hog farmers who have been battered by the pandemic.”

The Bloomberg article pointed out that, “Things could start to turn around. Hogs kept for breeding totaled 6.3 million, down about 2% and a signal that adverse market conditions are slowing expansion.

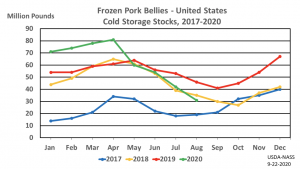

“There have also been some positives for hogs on the demand side. Supplies of pork bellies that are sliced into bacon were down 33% in August from a year ago, according to USDA data.

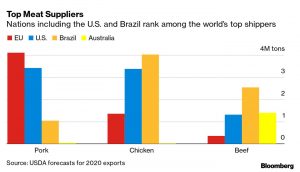

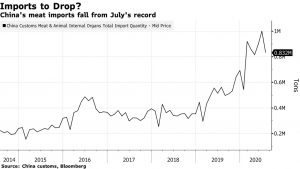

“Meanwhile, China has been buying record amounts of American pork after supplies in Asia fell due to the African swine fever virus.”

Nonetheless, a separate Bloomberg News article on Monday reported that, “China, the top pork consumer, has set a long-term goal to be almost completely self-sufficient in the staple, with big hog farms dominating the industry, as the nation seeks to reduce its dependency on food imports.”

China is targeting 95% self-sufficiency in pork, according to a State Council document on developing the livestock industry. The nation will also expand imports of safe meat products from more countries to supplement output.

“The growth in hog herds will boost overseas purchases of soybeans and feed grains needed to fatten the hogs. This comes at a time when the country is already the largest soybean buyer, and is on track to become the top corn importer.”

Monday’s article added that, “A country with millions of small pig farms breeding less than 500 pigs a year, China has now set a target that 70% of all hog farms should be large scale by 2025, rising to 85% by 2030, while treatment and usage of animal waste are to reach goals of 80% and 85% respectively, according to the plan.

“Hog inventories are already expanding, with herds rising for a seventh straight month in August, signaling growing confidence among breeders.”

Recall that China’s ban on German pork, due to the discovery of African Swine Fever in wild boars, is a separate market variable impacting pork markets.

Reuters News reported last week that,

The cost of China’s much-loved pork rib dishes is soaring after Beijing suspended imports of pigmeat from major supplier Germany, hurting restaurants still recovering from the coronavirus hit earlier this year.

“Pork ribs are one of China’s best-selling menu items but many restaurants specialising in the cut rely on imports, which can be up to 10 times cheaper than local supplies.

“Germany was among the biggest suppliers of ribs to China until it confirmed its first case of African swine fever, an incurable hog disease, earlier this month.”

With respect to the status of African Swine Fever in Germany, Bloomberg writer Megan Durisin reported on Saturday that, “Germany is going to extreme lengths to stop a deadly pig virus from wrecking Europe’s biggest pork industry.

“After discovering its first-ever cases of African swine fever this month, the country is trying to keep the outbreak contained to wild boar near the Polish border and away from livestock farms further west. To do that, it’s building miles of fences, using search dogs, drones and helicopters with thermal-imaging tech to scour the land and offering 110-euro ($128) rewards for carcasses.”

The Bloomberg article stated that, “While there have been just 34 cases so far within a small radius, the stakes are huge. German pork exports outside the European Union — a $2.4 billion industry — have already been hit, including a ban on sales to top customer China. Prices have slumped to a four-year low, and losses could mount if the outbreak isn’t controlled.”

Also last week, Reuters News reported that, “The German government is considering aid to farmers after prices fell following the discovery of African swine fever (ASF) in wild animals the country, Germany’s agriculture minister Julia Kloeckner said on Friday.

“State aid could come in the form of subsidized storage of unsold pork or financial support for farms, Kloeckner told an online press conference after a meeting regional agriculture ministers.”

More broadly, Reuters News reported late last week that, “The Philippines’ Department of Agriculture said on Thursday it had detected new African swine fever outbreaks in six provinces, raising the possibility that the domestic pork shortfall anticipated by year-end will be bigger than initially expected.

“A fresh wave of hog infections has hit the world’s 10th-largest pork consumer and seventh-biggest pork importer, where more than 300,000 pigs have been culled since last year, Agriculture Secretary William Dar said.”