As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Federal Reserve: Observations on the Ag Economy- August 2020

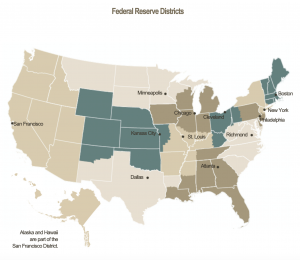

On Wednesday, the Federal Reserve Board released its August 2020 Beige Book update, a summary of commentary on current economic conditions by Federal Reserve District. The report included several observations pertaining to the U.S. agricultural economy.

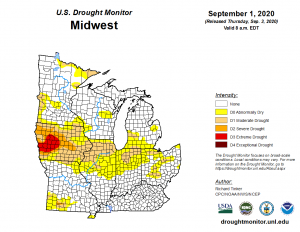

* Sixth District- Atlanta– “Agricultural conditions remained weak. Drought-free conditions prevailed in most parts of the District except in Georgia, where much of the state experienced abnormally dry conditions. On a month-over-month basis, July’s production forecast for Florida’s orange crop was unchanged from the previous month and remained below last year’s production, while Florida’s grapefruit production forecast was down from the previous month but remained ahead of last year. The USDA reported that in June, year-over-year prices paid to farmers were up for rice and soybeans but down for corn, cotton, cattle, broilers, eggs, and milk. On a month-over-month basis, prices increased for cotton, rice, soybeans, broilers, and milk but decreased for corn and eggs while cattle prices were unchanged.”

* Seventh District- Chicago– “The agriculture sector continued to deal with lost income due to COVID-19 related factors, though CARES Act payments provided some support. In addition, a derecho windstorm caused damage to crops (especially corn), storage facilities, and livestock facilities in a number of areas within the District. Parts of the District were also experiencing drought.

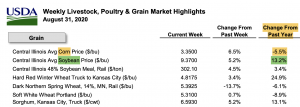

“Still, contacts expected the corn and soybean harvests to be near record levels for the District as a whole. Corn prices were little changed at levels below where they were a year ago, while soybean prices rose and were above year-ago levels.

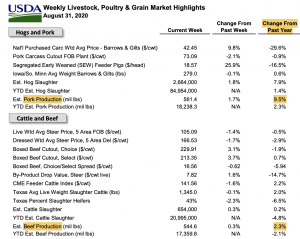

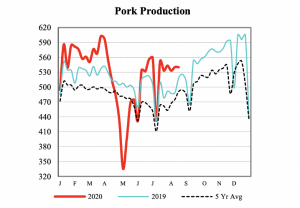

“Beef and pork production was catching up from pandemic-related reductions, and the backlog of cattle and hogs ready for slaughter fell.

“One contact reported that a gap in the supply of hogs was forming due to earlier euthanizations of many baby pigs.

“Cattle and hog prices rose, but not above year-ago prices. Beef and cheese prices moved lower as supplies normalized.”

* Eighth District- St. Louis– “Agriculture conditions have improved slightly from the previous reporting period. Relative to early July, the percentage of District corn, rice, and soybeans rated fair or better has increased slightly while the percentage of cotton decreased slightly. Contacts indicated that, while crop conditions look promising, low crop prices will reduce profitability and there is still concern over trade disputes with China and the effects on commodity pricing.”

* Ninth District- Minneapolis– “District agricultural conditions were mixed.

Lenders responding to the Minneapolis Fed’s second-quarter (July) survey of agricultural credit conditions overwhelmingly reported decreased farm incomes in their area relative to a year earlier, with a similar share reporting decreased capital spending.

“Crops as of early August were in strong condition in most areas of the District, with some states on track for record or near- record production, but prices for most commodities remained low.”

* Tenth District- Kansas City– “Weak conditions in the Tenth District agricultural econo-my persisted, and farm income deteriorated further.

The effects of the COVID-19 pandemic continued to constrain prices of key agricultural commodities, and profit opportunities remained limited.

“Prices for major crops and livestock increased slightly from the prior reporting period, but remained below pre-pandemic levels. Drought in the western portion of the District could further reduce revenues for some producers. Dry conditions were most prevalent in Colorado, where nearly 30 percent of corn acres had poor or very poor quality through mid-August. Alongside lower revenues, farm income across all states in the District declined at a noticeably faster pace than the prior survey period.”

* Eleventh District- Dallas– “Soil moisture conditions deteriorated across the western part of the district, where drought conditions intensified. Grain harvesting progressed and yields were fairly normal, though prices remained unprofitably low. Cotton prices inched higher over the past six weeks as demand exceeded expectations, though prices were still below break-even levels without government price supports. Cattle and dairy prices trended higher.”

* Twelfth District- San Francisco– “Conditions in the agriculture sector remained weak overall. Yields and quality of grain, fruit, and nut crops were high. In the Mountain West, bumper wheat crops contrib- uted to already bulging inventories from previous harvests. General production and distribution were constrained by COVID-19-related supply chain disruptions and additional expenses incurred to adhere to social- distancing guidelines at farms and processing centers. Domestic demand remained mixed overall, but sales of grapes, apples, and cherries to grocery stores and lumber to retailers and contractors increased notably over the reporting period. Export demand was weak, with producers in California and the Pacific Northwest highlighting poor sales to Asian markets across a variety of products, including nuts and lumber.”