As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

La Niña in Brazil Could Impact Chinese Demand for U.S. Soybeans and Support Prices

Soybean prices rose recently on the Chicago Mercantile Exchange, driven by the delay in planting the Brazilian crop, among other factors. This situation should prolong Chinese demand for U.S. production and puts pressure on American stocks. Last Friday (October 23), soybean prices reached the highest level since January 2017 ($10.81 per bushel).

Agência Estado Letícia Pakulski writer reported that China’s demand for U.S. soybeans, and the perception that the Asian country will need the U.S. to produce for longer after the delays in planting in Brazil, have supported futures prices. The article added that there is a chance that prices will rise further since the world supply depends on what happens in South America, in a year with the presence of La Niña.

A demanda da China pela soja dos EUA e a percepção de que o país asiático terá de recorrer por mais tempo ao produto norte-americano após os atrasos no plantio no Brasil têm dado sustentação aos preços futuros na Bolsa de Chicago (CBOT). Confira: https://t.co/eny0i2587A pic.twitter.com/Msgo8oUHRu

— BroadcastAgro (@BroadcastAgro) October 22, 2020

Valor Econônico writers Naiara Albuquerque and Fernanda Pressinott pointed out that the delay in planting the summer crop in South America has supported prices in Chicago. The firm Chinese demand for American grain also continues to influence the highs.

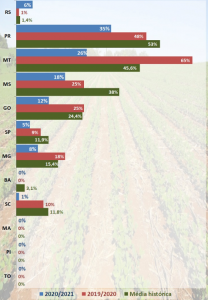

Despite the initial delay due to the lack of rain, Reuters writer Roberto Samora pointed to an estimate on Monday by AgRural that indicated soybean planting in Brazil advanced 15 percentage points in one week, to 23% of the projected area for the country in 2020/2021. The article noted that the rains that arrived in Brazil recently gave a boost to the planting, but even so, there is a delay compared to last year, and the five-year average.

Canal Rural Daniel Popov writer stated that soybean planting reached 16.3% in Brazil, according to consultancy Safras e Mercado. In the same period last year, planting was at 30%.

Meanwhile, Notícias Agrícolas Virgínia Alves writer reported that the National Meteorological Institute forecasts a lot of rain for Mato Grosso do Sul this week, with a tropical storm operating in the Southeast. In addition, the advance of a cold front increases instability in Rio Grande do Sul, giving the region a lot of rain.

Meteorologia emite dois alertas; temporal entrando pelo Sul e ciclone formado no litoral do Sudeste.

— Notícias Agrícolas (@NotiAgri) October 26, 2020

Saiba mais em https://t.co/2B3dbCtnlV

⠀#clima #previsaosotempo #chuva #temporal #temperatura #calor #agro #noticiasagricolas pic.twitter.com/dsqZGurc55

In interview with Agência Estado, AgRural analyst Daniele Siqueira said that even if Brazilian farmers begin planting at full speed going forward, the initial delay reduces the volume that should be gleaned in the first months of 2021:

“So, what is expected is that China continues to buy in the USA for shipment by February 2021,” said Daniele.

In Rio Grande do Sul, in southern Brazil, a lack of rain has delayed soybean planting and corn development, according information from Emater. Globo Rural magazine pointed out that the areas planted with soybeans are only 5%, and in some regions the work was interrupted due to the lack of humidity.

Plantio da oleaginosa chegou a apenas 5% da área reservada para a cultura no Estado, de acordo com a Ematerhttps://t.co/x1vqyWeHgL

— Globo Rural (@Globo_Rural) October 25, 2020

Zero Hora columnist Gisele Loeblein reported that La Niña’s influence projections have increased tensions in the Rio Grande do Sul. The state faced a severe drought last season, in the beginning of this year.

Canal Rural noted that soybean and corn crops in southern Brazil are expected to lose 3.5m tons due to La Niña. According to Mateus Pereira, director of Pátria Agronegócios, the forecasts for the 2020/2021 harvest bring more serious climate problems to producers than the last two seasons.

La Niña: safras de soja e milho do Sul devem registrar perdas de 3,5 mi de toneladas https://t.co/JOHZ4zmsct

— Canal Rural (@canalrural) October 23, 2020

The article added that these problems should also have an impact on the market, as more than 55% of the 2020/2021 harvest has already been sold on the futures market, more than double the average of sales in the last five years. According to Pereira, with the troubled scenario for the Brazilian climate, the only indication that can be clearly observed is an upward trend in prices.