President Donald Trump on Friday signed an executive order temporarily expanding the amount of beef the U.S. can import from Argentina, a move the White House says is aimed at…

Recent FAS Reports Highlight Soybean, Meat, and Corn Export Variables

Reports this month from the USDA’s Foreign Agricultural Service (FAS) have provided updated information on market variables impacting soybeans, meat, and corn. Today’s update highlights some of the key findings from these FAS publications.

Soybeans

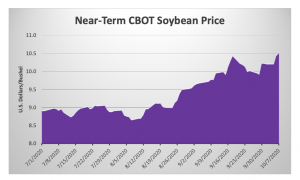

In a report Friday, Oilseeds: World Markets and Trade, FAS stated that, “Soybean prices on the Chicago Exchange topped $10.00/bu in mid-September, eventually peaking at $10.44/bu on September 18 before falling back to just below the $10.00 dollar mark at the end of the month. Subsequently, prices rallied again to near $10.50/bu following the release of the September Grain Stocks report and further export sales strength.

This is the first time near-term soybean futures have reached the $10.00 mark since early June 2018.

“Current prices are roughly 27 percent above levels observed in early August prior to the first NASS 2020 soybean yield estimate.”

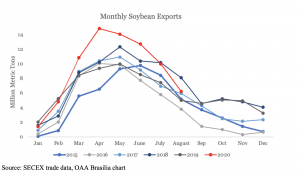

The report explained that, “The dynamics behind the mid-August to mid-September price surge are complex but basically reflect a rebound in China purchases of U.S. soybeans and limited availability of exportable supplies in South America. Recovery of China’s pork industry from African Swine Fever has spurred imports in 2020 with volume up 8.4 million tons (15 percent) for the first 8 months of 2020 compared to a year earlier. Most of these purchases were from Brazil, where exports to all markets (January-September) were up 30 percent year-over-year to a record 79.2 million tons. The strong pace of 2020 exports, driven by strong China demand and a record low exchange rate, has depleted exportable supplies and is forecast to drive Brazil imports to their highest level since 2003.

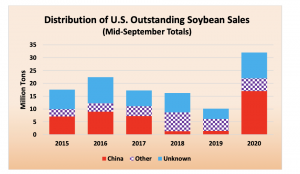

“Consequently, China buyers have turned agressively to securing U.S. soybeans in recent months. Outstanding sales to China in mid-September totaled nearly 17.0 million tons, nearly equal to the record set in 2013. Total outstanding sales for all markets in mid-September, including unknown destinations, is at a record 32.0 million tons, a three-fold increase compared to 2019.”

With respect to soybean production in Brazil, FAS stated in a report earlier this month, Brazil: Oilseeds and Products Update, that, “Post maintains its forecast for soybean planted area at 38.5 million hectares (ha) for 2020/21, up from 36.9 million ha in 2019/20. Despite a drier than average start to planting, Post forecasts a record harvest at 131 million metric tons (MMT). Area expansion is expected based on unprecedented domestic soybean prices.”

Meat

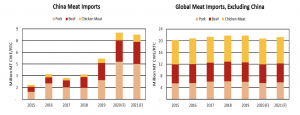

In a separate report Friday, Livestock and Poultry: World Markets and Trade, FAS stated that, “Global meat imports will decline marginally in 2021 as softening demand from China offsets gains elsewhere. China meat imports are forecast to set records in 2020 due to a sharp decline in pork production from African swine fever (ASF). Next year, imports are expected to fall as producers rebuild swine herds and production rebounds. Outside of China, global meat imports are largely rebounding as economies bounce back from COVID-19 and as food service demand improves.”

The report added that, “China pork imports are forecast 6 percent lower at 4.5 million tons. Imports will remain near record highs but are unlikely to exceed 2020 levels due to growing domestic production. Elsewhere, demand for pork is improving from last year when imports hit the lowest level since 2016 due to both COVID-19 and robust demand from China. Lower expected global pork prices will buoy shipments to price-sensitive markets.

“China beef imports are forecast 4 percent higher at 2.9 million tons in 2021– another record high. Evolving tastes and relatively modest production growth are expected to support beef imports next year. However, rebounding pork production will slow growth in beef imports to the slowest pace in more than 5 years.”

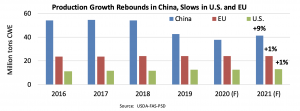

In greater detail regarding pork production, FAS pointed out that, “Global production is forecast 4 percent higher in 2021 due to rebounding output in countries affected by African swine fever (ASF) and to a lesser extent recovery from COVID-19 impacts. Production is forecast 9 percent higher in China as producers aggressively rebuild their herds and take advantage of high hog prices. However, at 41.5 million tons, production is still nearly 25 percent lower than pre- disease levels.”

“U.S. production is forecast about 1 percent higher in 2021 on modest growth in slaughter,” FAS said.

Corn

Regarding corn, in a report earlier this month, China: Grain and Feed Update, FAS indicated that, “China’s 2020/21 feed and residual use for all coarse grains and feed-quality wheat are estimated to increase 3.2 percent compared to the previous marketing year due to a projected recovery of swine production and strong expansion in the poultry and ruminant sectors.

Though typhoons caused heavy damage and extensive lodging in the major corn producing northeastern provinces, the impact on overall production will be limited as storms hit only weeks before harvest and will not result in a total loss. In addition, Fall Army Worm (FAW) impact is less than anticipated resulting in a total decrease in corn production of only 4 percent.

“While China may rely more on corn imports in the coming marketing year, some of these gains will be mitigated by an increased use of sorghum, barley, and old rice and wheat stocks in feed rations to take the place of record high-priced corn.”

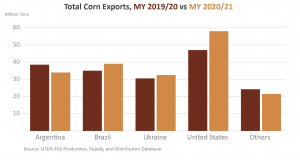

More narrowly on the corn exports, FAS pointed out on Friday (Grain: World Markets and Trade) that, “Ukraine has been China’s primary supplier of corn since 2014/15.

“Perhaps reflecting the high domestic corn prices in China, imports of Ukrainian corn are at their highest in the last 6 years. However, China’s demand for U.S. corn is also robust and Ukraine looks to face increased competition from the United States in the near future. According to U.S. export inspection data, since September 1 corn shipments to China totaled 1.1 million tons, ahead of Mexico at 1.0 million tons, as the largest destination.”

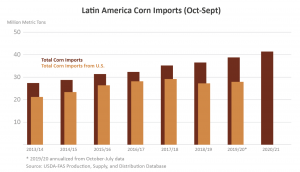

And in a report this month titled, “Prospects for U.S. Corn in Latin America,” FAS stated that, “Latin America accounts for about 25 percent of global corn imports. The region’s corn demand for imported corn has grown steadily over the years supported by expansion in the livestock sector, particularly poultry production. Demand for animal protein has grown with improved economic conditions and greater disposable incomes. Corn trade in the region for the first half of 2020 has been steady with little impact from COVID-19. The United States has been the top supplier benefitting from Latin America’s growth in imports. However, imports of U.S. corn have been trailing off, driven by changes in the key markets of Colombia, Peru, and Mexico.”

The report added that, “U.S. prices hit a 5-year high in the spring of 2019, caused by unprecedented planting delays due to wet weather. Uncertainty over the crop size kept prices elevated into the summer, eroding the competitiveness of U.S. corn in foreign markets. Flooding of the Mississippi River added logistical challenges and limited barge traffic to the Gulf terminals.

“Concerns over quality in the 2019 crop (i.e., low test weight and broken/damaged kernels) may have also contributed to smaller exports. Colombia and Peru turned to Argentina, which had been their major supplier of the past, while Mexico also sought to diversify suppliers.”