As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Robust Soybean Export Forecast, While Countries “Bulk Up” Their Food Supplies

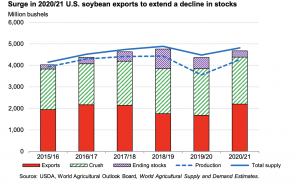

Mark Ash and Dana Golden explained in this month’s Oil Crops Outlook, from USDA’s Economic Research Service (ERS), that, “Despite an unchanged yield, USDA pegs the 2020/21 U.S. soybean crop down by 45 million bushels this month to 4.268 billion as the sown acreage is revised down by 731,000 acres to 83.1 million.

With strong sales to China, USDA raises its forecast of 2020/21 soybean exports by 75 million bushels this month to a record 2.2 billion. The lower supply and higher export demand are forecast to reduce season-ending soybean stocks for 2020/21 by 170 million bushels to 290 million.

“The tighter outlook prompts USDA to boost its forecast of the 2020/21 U.S. average farm price to $9.80 per bushel from $9.25 last month.”

The ERS update added that, “U.S. export inspections of soybeans in September—at 242 million bushels—represent an all- time high for the month. The brisk pace of early shipments reflects unimpeded harvesting and a record volume of new-crop sales. The latter is due largely to a sharp increase for export sales to China that now account for 54 percent of total sales commitments. Sales to unknown destinations are also up sharply, although many could also be for China.”

Export inspections for U.S. #soybeans last week topped 2 mmt for the second consecutive week - some 75% of those were to #China. #Wheat inspections were somewhat strong for the week (relative to same week in prior years), but #corn was so-so. 20/21 crushing 19/20 so far. pic.twitter.com/cWfU7Plg7G

— Karen Braun (@kannbwx) October 13, 2020

Ash and Golden also pointed out that, “A downsized U.S. crop and an increase for foreign use of soybeans in 2020/21 may continue to tighten global stocks to 88.7 million metric tons (versus 93.8 million in 2019/20). For China, 2020/21 soybean imports are forecast 1 million tons higher this month to 100 million on account of strengthening demand.”

With respect to Brazil, the Outlook noted that, “In Brazil, soybean planting has begun for the 2020/21 soybean crop. Progress in the center- west region is slow, however, due to a lack of rainfall in September. Dryness is unlikely to affect the soybean area sown in Brazil for 2020/21, but could delay the arrival of new-crop deliveries next year. A likely extension of the country’s tight old-crop supply has swelled Brazilian price quotes (relative to Chicago futures) for February 2021 shipments. This signals that U.S. exporters may shoulder the burden of supplying China with soybean imports well into next year.”

And on Friday, Bloomberg writers Catarina Saraiva and Millie Munshi reported that,

Across the globe, nations are racing to bulk up their food supplies with hunger on the rise and supply chains vulnerable to more coronavirus lockdowns.

“Jordan has built up record wheat reserves while Egypt, the world’s top buyer of the grain, took the unusual step of tapping international markets during its local harvest and has boosted purchases by more than 50% since April. Taiwan said it will increase strategic food stockpiles, and China has been buying to feed its growing hog herd.”

China's corn futures prices hit all-time highs today despite the ongoing harvest, as concerns mount about quantity & quality of the fresh crop following late-season weather damage. pic.twitter.com/1vb7Z3SyWq

— Gavin Maguire (@GavinJMaguire) October 14, 2020

Traders expect additional import purchases to emerge in the coming days, especially from the US where harvest is approaching the 50% point and where prices are relatively weak compared to China. pic.twitter.com/dFzbWPg9wd

— Gavin Maguire (@GavinJMaguire) October 14, 2020

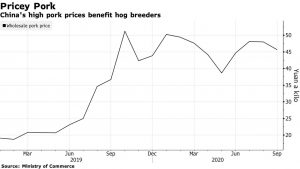

Meanwhile, Bloomberg News reported on Thursday that, “Investing in Chinese hog farms may never have been so profitable, and that’s spurred fears that the boom may soon turn into a bust.

“Record pork prices mean that breeders are potentially enjoying their highest returns ever, and that’s attracted many different kinds of investors to the industry, from a cement maker to state funds and banks, in addition to the ongoing expansion by traditional hog-farming companies.”

The article stated that, “The agriculture ministry has said hog herds have already recovered to 80% of their normal level and the country will boost its frozen pork reserves to ensure protein supplies. The recovery of the herds, and frequent release of state pork stockpiles, have also helped cool prices of the staple meat, a major driver of food inflation, according to the National Bureau of Statistics.”

And Reuters News reported last week that, “China imported 834,000 tonnes of meat in September, customs data showed on Tuesday, slightly higher than last month, as the world’s biggest meat consumer continues to stock up on proteins after a plunge in its pork output.”

The Reuters article noted that, “China’s pork output fell 19% in the first half of the year after the fatal hog disease African swine fever ravaged its huge hog herd over the last two years.

“In a separate statement customs said that pork imports for the first nine months reached 3.29 million tonnes, up 132.2% year on year.”