Bloomberg's Tarso Veloso and Kim Chipman reported Monday that "agriculture giants including Cargill Inc. and Bunge Global SA are slowing their buying of soybeans due to uncertainty over US biofuels…

Chinese Demand, Dry Weather Help Spur Crop Prices

Wall Street Journal writers Ryan Dezember and Kirk Maltais reported last week that, “Dry weather, China’s push to fatten its pigs and the lockdown-induced baking bonanza are lifting prices for U.S. row crops.

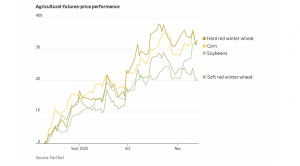

“Futures prices for soybeans, corn and hard red winter wheat—the kind used for baking bread—have risen by about a third since a rally began Aug. 10. Soft red winter wheat, found in animal feed and processed foods, is up 22%.

The Journal writers explained that, “Dry weather in the U.S. Great Plains, Argentina, Russia, Ukraine and Brazil have reduced yields and expectations for what were forecast to be bumper crops.

“Meanwhile, China has been restocking its grain bins and rebuilding its hog herds after culling millions of pigs last year to combat an outbreak of African swine fever.

The U.S. Agriculture Department predicts that China this season will import record volumes of coarse grains, which are mostly corn, and buy more foreign wheat than it has in a quarter-century.

Dezember and Maltais added that, “Farmers and traders are watching the weather in Argentina and Brazil, where a lack of rain threatens harvests.”

"Beans in the pre-teens"

— Karen Braun (@kannbwx) November 23, 2020

Nov. 22/23: Most-active CBOT #soybeans hit $12/bushel in overnight trade, the first time since June 10, 2016.

If futures move past $12.08-1/2, would be the highest since June 30, 2014. Beans haven't truly been in the "teens" since a week before that. pic.twitter.com/Dq5HG4IAQg

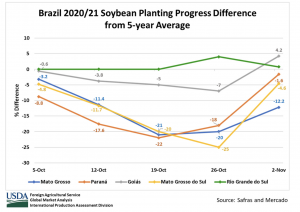

More narrowly on South American crop prospects, Bloomberg writer Tatiana Freitas reported late last week that, “Despite drought made worse by a La Nina weather system, Brazil’s next soybean harvest may still be a record as farmers have planted crops more widely.”

The Bloomberg article stated that, “While the season’s start has been ‘very unusual,’ Brazil still may see a bigger crop than in 2019-20, when the world’s top exporter reaped 125 million metric tons, according to Daniele Siqueira, an analyst at AgRural.

“The firm sees the crop at 132.2 million tons based on trend-line yield projections and an area increase of 3.6%, and it will wait to see the weather behavior in the coming weeks to make adjustments. With most of the beans germinating and at vegetative stage, there’s time for a recovery.”

In its World Agricultural Production report this month, the USDA’s Foreign Agricultural Service (FAS) indicated that, “Brazil soybean production for 2020/21 is forecast at a record 133.0 million metric tons (mmt), unchanged despite the delay in planting and larger by 7.0 mmt (6 percent) from last season’s record crop of 126.0 mmt.”

FAS noted that, “Despite the delayed planting, soybean yield prospects remain high, conditional on the weather remaining favorable for the remainder of the season.”

Meanwhile, Reuters writers Ana Mano and Mark Weinraub reported last week that, “U.S. farmers sold freshly harvested soybeans directly off their combines for a profit as prices rose to a four-year high this autumn, a welcome change from the losses suffered during the U.S.-China trade war.

“Strong exports to China as the world’s top soybean importer emerged from lockdown helped push the most-active soybean futures contract at the Chicago Board of Trade up 12.3% between Aug. 1 and mid-September, when harvest kicked into gear across the U.S. Midwest.”

But it's not just the front-month futures contract that has climbed. All soybean futures prices have rallied - especially during the past few weeks - so that the entire soybean forward curve running through 2024 is sharply higher than just a few weeks ago. Bad news for buyers? pic.twitter.com/H4LEG2rOQv

— Gavin Maguire (@GavinJMaguire) November 23, 2020

The Reuters article pointed out that, “After signing a ‘Phase 1’ trade agreement in January, China started ramping up U.S. soybean purchases in the second half of the year, helping spur the largest late summer soybean price rally in 13 years.”

And on Friday, Bloomberg writer Megan Durisin reported that,

The supply crunch in the global grain markets could linger past this year.

“Agricultural markets have roared back in recent months from a first-half plunge, bolstered by strong demand from China and smaller-than-expected harvests that are winding down in some key producers, Soren Schroder, the former CEO of trader and processor Bunge, told the Global Grain Geneva conference this week.”

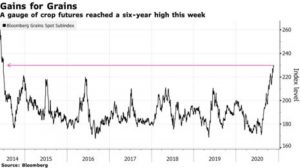

The Bloomberg article stated that, “Soybean prices surged to a six-year high this week in Chicago, and corn futures are near their loftiest since mid-2019. China has been a rampant buyer of both as the country rebuilds hog herds decimated by a deadly swine fever outbreak last year. Coupled with the robust demand have been worries that the La Nina weather phenomenon could curb coming harvests in agricultural powerhouses Brazil and Argentina.”

What's driving China's aggressive purchases of U.S. corn? Insights via @CMEGroup pic.twitter.com/N55fmdRsFP

— Bloomberg Quicktake (@Quicktake) November 18, 2020

Ms. Durisin added that, “There’s no indication that China’s imports will let up soon, given the strong yuan and domestic corn prices at multi-year highs, Mark Jekanowski, chairman of the U.S. Department of Agriculture’s World Agricultural Outlook Board, said at the Geneva conference.

“The pace of corn and feed-grain purchases in recent months has caught many people by surprise, he said. And China’s level of imports may stay a longer-term fixture of the market, according to Schroder.”