The world's farmers face soaring fertilizer and fuel prices as the war in the Middle East escalates, leaving some scrambling for supplies as the spring planting season approaches and causing…

Brazil in “Advanced” Talks with China to Boost Corn Sales as China’s Hog Herd Rebuilds

Last week, Bloomberg writers Isis Almeida, Samy Adghirni, and Tatiana Freitas reported that, “Brazil is close to an agreement that would allow the world’s second-largest corn exporter to boost sales of the grain to China, a move that could threaten the U.S.’s dominance, according to people familiar with the matter.

“Talks between the governments of Brazil and China are in advanced stages, with many of the technical barriers and issues relating to preventing the spread of pests or crop diseases in the process of being resolved, said the people, who asked not to be identified because the negotiations are ongoing. Traders also recently met members of Brazilian grain exporter group Anec to discuss the issue, the people said.

“The move comes as China, the world’s top commodities buyer, needs to boost grain purchases to feed a hog herd that’s recovering faster than expected from a deadly pig disease.

It could also pose a threat to the U.S., which has sold the most corn on record to the Asian nation in the current season.

Likewise, Reuters writer Roberto Samora reported last week that, “Brazil and China are in talks to boost corn trade between the two nations, though raising exports to the Asian nation at this time is unfeasible due to inter-harvest supply shortages, Abramilho, a corn producers association, said on Wednesday.

“Only a fraction of Brazil’s corn sales went to China last year, or 68,550 tonnes, according to Brazilian government data. Total exports were 42.7 million tonnes in the period. By comparison, China bought almost 80% of Brazil’s soy, or 58 million tonnes last year.”

The Reuters article explained that, “Abramilho said the measures to facilitate the corn trade with China would be relatively simple to introduce, explaining that the Chinese are concerned about a certain type of weed, which could be eliminated with the use herbicides.

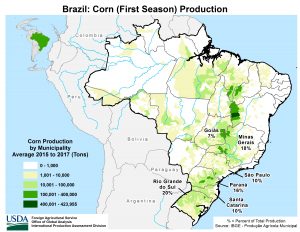

“Brazil plants two large corn crops per year and should collect a total of more than 102 million tonnes this season, according to government estimates.”

Meanwhile, USDA’s Economic Research Service pointed out in in its monthly Feed Outlook report last week that, “China corn imports for 2020/21 are raised 3.0 million MT to 16.0 million, and account for much of the increased grain imports. High domestic corn prices in China have led to increased shipments and sales from several export markets—mainly the United States and Ukraine—and have contributed to steadily rising global grain prices since the summer of 2020. China has also seen additional shipments of soybeans, which are crushed domestically, and the meal used as a major component of livestock feed. The increased demand for feed is at least partially attributed to China’s recovering swine herd, which was severely impacted by African Swine Fever in recent years, that resulted in steep culls of the domestic inventory.”

And Chad Hart, an agricultural economist at Iowa State University, pointed out in this month’s AgDecisionMaker that, “Historically, China has been a small to nonexistent corn market for the US as China is the 2nd largest producer of corn in the world and generally produces enough corn to meet domestic needs.

However, the trade deal and herd rebuilding have created a record-setting opportunity for US corn, as export sales to China have grown to over 400 million bushels, currently placing China as the top destination for US corn.

“But other trade deals are also promoting US corn in international markets.

“The trade agreements with Japan and South Korea have provided substantial support as well, with Japanese purchases more than doubling and South Korean purchases growing by over 3000%. Corn sales to Central and South America are on the rise, with Mexico, Colombia, and Guatemala each purchasing at least 15% more this year. Corn export sales growth outside of the top markets is up 50% as well. It is this broad-based surge in corn sales that prompted USDA to project record corn exports this marketing year.”

Also last week, Reuters columnist Karen Braun noted that, “Some analysts have suggested that annual corn imports within the next couple years could more than double the 16.5 million tonnes that the U.S. Department of Agriculture has predicted for the current year, though others wonder if the demand boom is more temporary in nature.

“Diversifying suppliers has increasingly been on China’s radar since the trade war broke out with the United States in 2018. While this idea does not directly imply that actual imports will increase, it would certainly seem like an acknowledgment that imports are necessary to guarantee food security, at least for now.”